BuzzFeed Expands ATM Program to $150 Million Amid Revenue Dip

BuzzFeed expands stock offering to $150 million, projects revenue decline. Stock volatility and debt burden raise concerns for investors.

7939 NW 21st St

Miami, Florida

BuzzFeed expands stock offering to $150 million, projects revenue decline. Stock volatility and debt burden raise concerns for investors.

GameStop stock soared with Roaring Kitty's return, hitting a 52-week high before dropping 65%. Company raises $933.4 million through offering.

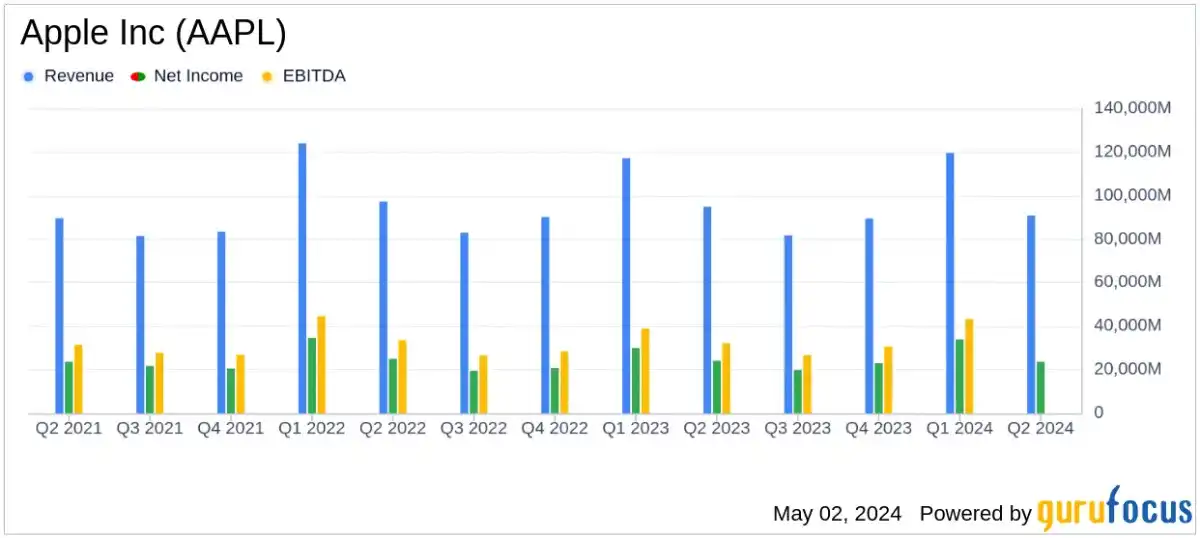

Apple's Q2 earnings: $90.8 billion revenue, $1.53 EPS. iPhone sales lead at $45.96 billion. Services segment hits all-time high.

Fed calms market fears as stocks rise after policy meeting. Interest rates steady, Powell says rate hike unlikely. Inflation remains high.

Bitcoin aims for $70,000 as bullish trend continues. Shiba Inu surges, XRP eyes $0.64 resistance for potential bullish phase.

After a long wait, Starknet Foundation announces the end of a 1.8 billion token airdrop, exciting Turkish cryptocurrency users.

WeWork's potential failure poses a significant threat to the US commercial real estate sector, with experts warning of a "systematic shock."

Ever found yourself in a bustling marketplace, where goods change hands with the ease of a hot knife through butter? That's market liquidity for you—in financial terms, at least. So, what exactly is buzzing under this topic when we peek into the news section?

Ladies and gentlemen, there’s more to 'market liquid' than just something sounding refreshingly drinkable during an economic dry spell. In our conversational stroll today, let’s splash into the sea of information that keeps investors swimming smoothly—or leaves them gasping for air.

First off, have you ever wondered why certain stocks seem to sell faster than tickets at a reunion tour of The Beatles (hypothetical as that might be)? It all comes down to how ‘liquid’ those stocks are—basically, can you buy or sell them quicker than it takes to brew your morning coffee? With high-frequency trading making headlines regularly, we often find discussions on how these rapid-fire transactions affect the ability of markets to absorb large orders without significant price changes—which translates directly into this elusive concept called liquidity.

Diving deeper into market updates discussing movers and shakers in stock prices, bond yields fluctuations, or cryptocurrency waves may actually point us towards fascinating insights about liquidity. News pieces often expose whether there are enough buyers and sellers keeping transactions flowing like a charming mountain stream or if everyone’s trying so hard not to get stuck holding the bag—the proverbial illiquid asset—that they could stall progress worse than rush hour traffic!

In between speculation about interest rates affecting borrowing costs—and thus investment trends—we can also catch wind of global events stirring up things. Policies and geopolitical tensions don't just make buzz; they stir up tsunamis potentially crashing onto shores of market stability or sometimes creating lucrative pockets ideal for surfing by savvy traders capitalizing on shifts in...you guessed it: liquidity!

Last but not least - think hiking isn’t related here? Well consider this final nugget: macroeconomic indicators are akin to trail markers giving clues about terrain ahead—signals such as unemployment rates impacting consumer spending which feeds back into—you’re getting good at this—the dynamic world striving for perfect balance amidst perpetual movement within our friendlier-than-it-sounds topic: Market Liquidity.