Charles Schwab Prepares for New CFO

Charles Schwab hires Citi veteran Mike Verdeschi as deputy CFO, set to take over when current CFO retires. Strong financial results expected.

7939 NW 21st St

Miami, Florida

Charles Schwab hires Citi veteran Mike Verdeschi as deputy CFO, set to take over when current CFO retires. Strong financial results expected.

AMC raises $250 million through equity offering as meme trade boosts GameStop, shares surge 78%. Analysts cautious on long-term outlook.

First Central Savings Bank reports positive earnings despite higher interest rates, with focus on loan growth and asset quality. #Banking #Finance

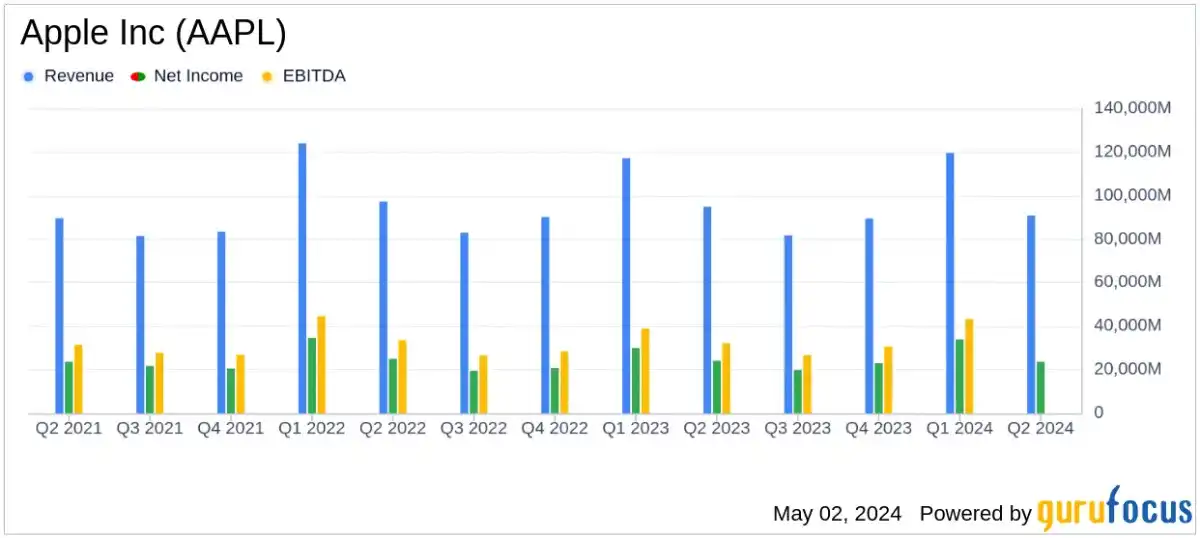

Apple's Q2 earnings: $90.8 billion revenue, $1.53 EPS. iPhone sales lead at $45.96 billion. Services segment hits all-time high.

Fed calms market fears as stocks rise after policy meeting. Interest rates steady, Powell says rate hike unlikely. Inflation remains high.

Join Cash Flow Club for exclusive market tips and guidance. Navigate any climate with expert advice. Learn more for success.

Investors shift focus to tech sector as big tech companies pressure stock market, Nasdaq Composite drops 1%, concerns over Nvidia's earnings.

NYCB faces class-action lawsuit over securities fraud allegations. Bank's shares tumble 60% after Moody's downgrades credit rating to "junk."

Hippo completes 2024 reinsurance renewal, retains more risk, and expands excess-of-loss protection, showing growing confidence in profitability and predictability.

WeWork's potential bankruptcy filing next week comes as no surprise, as the company's shares have plummeted and it has struggled with debt payments.

Chico's FAS, a women's retailer based in Fort Myers, reported a strong second quarter with profits rising to $59.3m.

Ever feel like getting your head around a balance sheet is like trying to solve an ancient riddle? Well, don’t fret! Balance sheets may seem perplexing at first glance, but they're crammed with juicy tidbits that can tell you a whole lot about the financial health of a business. So what sort of news content could we uncover under this typically number-heavy topic?

The thrill of earnings reports, for starters. Businesses often live or die by these statements charged with anticipation and sometimes drama—who doesn't love a good underdog story where profits soar against all odds? Or maybe you've spotted those heavyweight corporations staggering when their balance sheets reveal concerning debt levels. It's not just cold hard numbers; it's a saga.

Economic indicators dance through these financial documents too. Ever wondered how global events tie back to companies' bottom lines? Cash flow trends and asset shifts within balance sheets reflect the broader economic climate changes—akin to reading nature’s signs before stormy weather hits.

And let's talk strategy — oh yes, skeletons in the closet (I’m looking at you, off-balance liabilities) or treasures buried in plain sight (hello there, undervalued assets!). Business strategies are encoded here. Is our protagonist company hoarding cash for troubled times or perhaps plotting an expansion with surplus funds? The plot thickens...

Beyond fiscal plots and subplots lies yet another dimension – sustainability reporting. More than ever before companies are being scrutinized on environmental responsibility right next to their fiscal accountability; their initiatives find room on nowadays more holistic balance sheets.

In essence, whenever you pick up news related to 'Balance Sheet', think Shakespeare meets Wall Street. You'll encounter tales of enterprise endeavors painted across ledgers—a unique blend of narrative artistry coalesced within cells filled with digits!