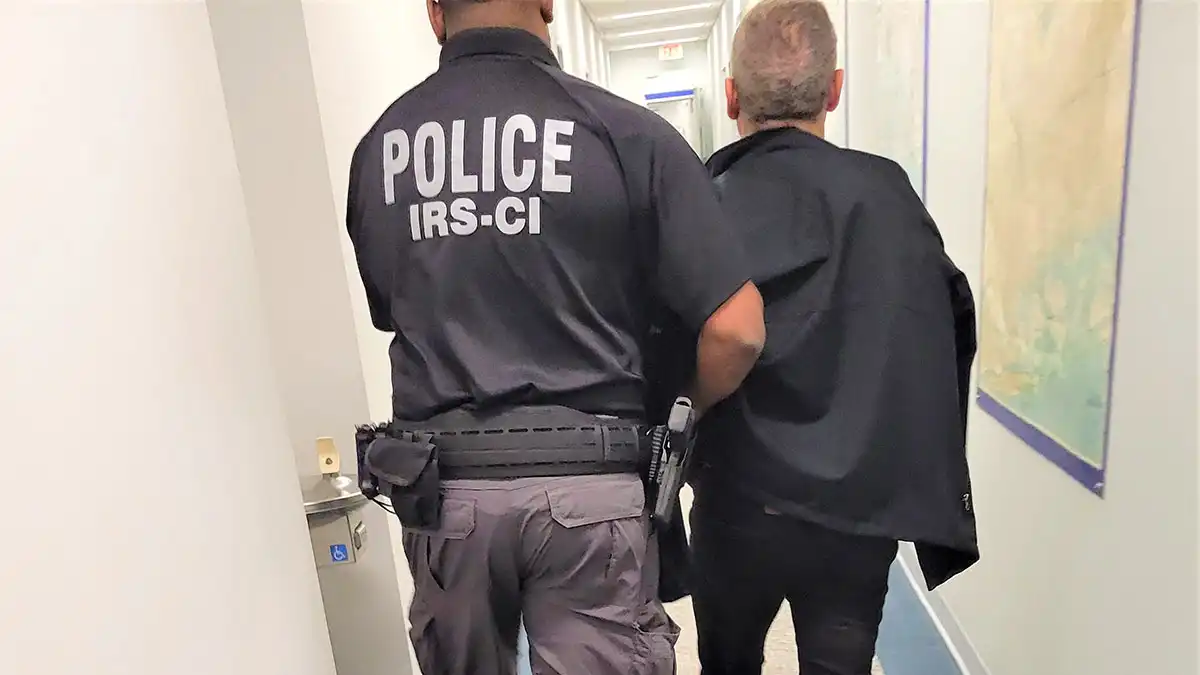

New York tax preparer steals $100 million from IRS GUI

Bronx tax preparer "the Magician" arrested in $100 million tax rip-off scheme, facing federal charges including tax fraud and conspiracy.

7939 NW 21st St

Miami, Florida

Bronx tax preparer "the Magician" arrested in $100 million tax rip-off scheme, facing federal charges including tax fraud and conspiracy.

Tax day is here! File your 2023 returns by 11:59 p.m. to avoid late fees. IRS improves services with new online tools.

Tax Deadline 2024: Canadians are preparing for the April 30 deadline, ensuring they file on time to avoid penalties and delays.

Last-minute tax filers, don't panic! File a free tax extension today to avoid late fees and penalties. Get more money back!

Tax season is ending soon, file your taxes now. Tips on how to file on time and get your refund faster.

The federal pandemic aid is ending, but many states are stepping in with their own permanent child tax credits.

IRS announces January 29 as the official start of 2024 tax season, expects more than 128.7 million filings by April 15.

2024 tax brackets adjusted for inflation, meaning many could see a lower tax bill next year. Here's what you need to know.

Hey there, fellow taxpayer! Are you navigating the labyrinth of Tax Return season in the United States? I feel ya! It's that time when we all become part-time detectives, piecing together the puzzle of deductions and credits. So what kind of juicy news content can you expect to pop up under this topic?

First things first, we're talking about updates on deadlines because who hasn't felt the cold sweat breaking as April 15th looms large, right? But wait, sometimes there are extensions — oh yes! Those little nuggets of relief handed down from Uncle Sam’s generous hands are always worth knowing.

Fancy some insider tips? Let’s be real - everyone loves a good tax hack to save a few bucks. Experts often chime in with advice articles during this period; they’re like financial fairy godmothers guiding us through exemptions or potential refunds lurking in plain sight... if only one knows where to look!

You might also see headlines screaming about changes in laws or policies – thinking about those new forms or rules that decide whether your coffee machine is a business expense (Is it though?). And let's not forget discussions around hot-button issues like tax reforms which get everybody buzzin'. Are we paying more? Less? Shaking things up for freelancers and small businesses perhaps?

The drama doesn’t end there, folks! Come on over to audit lane – it isn't as gloomy as it sounds but definitely something to keep an eye out for since audits can affect loads of taxpayers every year.

To wrap it up (talking taxes could go on forever) remember: amidst announcements on refund statuses and ominous warnings against frauds looking to swindle hard-earned cash back from taxpayers lies crucial information that either makes your life easier or helps keep your wallet fuller at tax time. So stay sharp, enjoy reading through those articles full of fiscal tidbits, and best believe these bytes will benefit you big-time.