Stock market today: US indexes decline on concerns of Israel-Iran tensions and rising Treasury yields

US stocks fell on Monday due to concerns over Israel-Iran conflict escalation. Retail sales surged, but Treasury yield hit highest level of 2024.

7939 NW 21st St

Miami, Florida

US stocks fell on Monday due to concerns over Israel-Iran conflict escalation. Retail sales surged, but Treasury yield hit highest level of 2024.

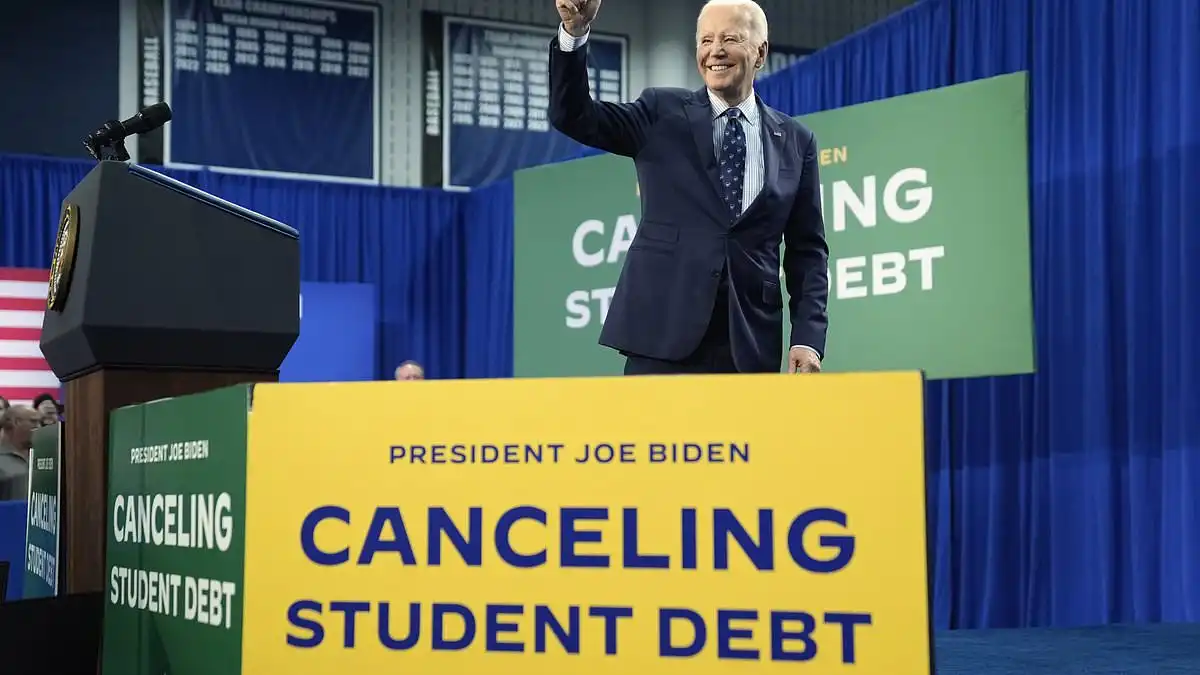

White House cancels $153 billion in student loan debt, GOP criticizes move, experts warn of economic implications and taxpayer costs.

Chicago Bears plan to build a $2 billion domed stadium in Chicago, boosting economy, creating jobs, and generating tax revenue.

"Galentine's Day 2024: Celebrating Female Friendship with Meaningful Gestures, Shared Experiences, and Thoughtful Gifts. Happy Galentine's Day!"

Global equities rise and Treasury yields rebound as hopes of interest rate cuts fade, but uncertainty remains over growth and inflation.

WeWork's potential bankruptcy filing next week comes as no surprise, as the company's shares have plummeted and it has struggled with debt payments.

Bitcoin's price fell by nearly 8% in an hour of frenzied trading, erasing most of its gains since June. The sell-off coincided with news that Elon Musk's SpaceX had written down the value of its bitcoin holdings by $373mn and sold the cryptocurrency. The volatility comes as US regulators crack down on the sector and as expectations of interest rate cuts by the Federal Reserve are reassessed.

Cole eliminated from Claim to Fame, feels betrayed by competitors.

Hello, esteemed reader! Ever thought about dipping your toes into the mammoth world of bond finance and want to know what kind of news landscapes you can tread in this topic? Well, buckle up buddy because we're diving right into that pool.

Bond finance - it has quite the ring to it, doesn't it? Kinda like a secret agent eliminating economic chaos. But instead of gadgets and high-speed chases, bond is armed with a whole lot of numbers and market trends. So what exactly are bonds? Imagine them as IOU notes on a cosmic scale where governments or corporations borrow from investors intending to pay back with interest over time.

Now let's explore some key themes prevalent in the oceanic expanse known as 'bond (finance)’ news content.

Influential rating agencies such as Standard & Poor's make periodic announcements impacting bond holder sentiments dynamically.

This all may seem like spotting specific waves amidst tempestuous seas but stick around long enough & soon enough you would gaze at horizons only seen by sailors intimate with these waters. Ready to chart those charts mate?