NYSE malfunction causes Berkshire Hathaway stock to plunge 99% - ExBulletin

NYSE glitch halts trading in 40 stocks, shows 99% drop in Berkshire Hathaway shares. Reversed trades, reviewing stops. Market adjusts to T+1 settlement.

7939 NW 21st St

Miami, Florida

NYSE glitch halts trading in 40 stocks, shows 99% drop in Berkshire Hathaway shares. Reversed trades, reviewing stops. Market adjusts to T+1 settlement.

Ethereum ETFs finally approved by SEC, sparking industry celebration. Market response lukewarm, but crypto leaders rejoice in historic moment.

Wall Street cautious ahead of Fed meeting and Nvidia earnings. Nasdaq up, small caps down. Solar and clean energy industries surge.

SEC asks leading exchanges to update documents for Ethereum ETFs. Approval could be imminent, with potential positive impact on Ethereum price.

Crypto market surges on Ethereum ETF optimism. SEC potentially approving applications, leading to Ether price surge and positive impact on altcoins.

GameStop and AMC stocks surge after Roaring Kitty returns to social media, sparking retail investor excitement and meme stock rally.

Stocks showed strength with Nasdaq, Dow, and S&P 500 gains. Google and Microsoft boosted market after positive earnings. Snap and Skechers surged.

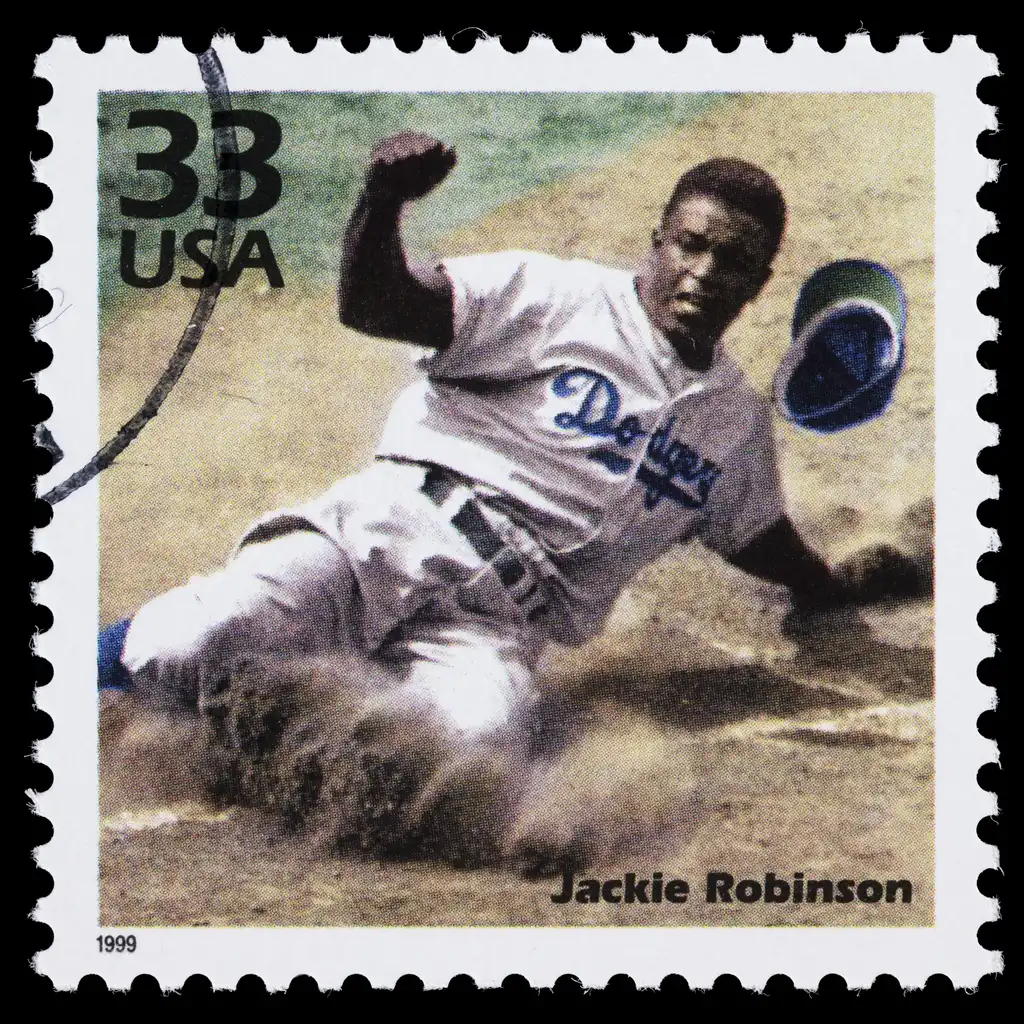

Jackie Robinson Day celebrated in MLB stadiums, players wore #42. ETFs honor causes, like VETZ, PINK, and FLDZ, giving back.

Economist Peter Schiff warns of potential downfall for Bitcoin ETF investors as digital currency's price surge may lead to reversal.

Ark Invest and 21Shares boost Bitcoin ETF transparency with Chainlink integration, setting a new standard for secure, transparent asset management.

Bitcoin price hits new yearly high at $52,545, up 17% in 7 days. Rising institutional interest suggests bullish trend. Potential $55,000 target.

Palantir shares surged over 30% after strong Q4 results, with Ark Invest buying $43 million worth, reflecting faith in the company's potential.

Ethereum hits all-time high, surpassing $25,000 after SEC's approval of Bitcoin ETFs. Analysts predict potential approval of Ethereum spot ETF.

SEC approves first U.S. bitcoin exchange-traded fund (ETF) after years of rejections. Multiple companies file for spot bitcoin ETFs.

Bitcoin consolidates after a surge past $47,000 as US ETF approval looms. Market expects approval, with Bitcoin up 172% in 12 months.

Standard Chartered bank projects Bitcoin to reach $200,000 by 2025 due to ETF inflows, comparing it to the first gold ETF.

Prominent crypto analysts predict Ethereum could surge to over $3,000, citing its unique advantages and strategic partnerships in the market.

Bitcoin reached a 20-month high of $42,000, signaling fading regulatory scrutiny and potential for a bitcoin exchange fund on the stock market.

Get all the latest Bitcoin news and expert analysis in our daily newsletter. Sign up now for a comprehensive market recap!

SEC meeting with Grayscale, BlackRock, and Nasdaq fuels anticipation for bitcoin ETF approval. Bitcoin rallies to highest price in 20 months.

Ark's ARK Autonomous Technology & Robotics ETF purchased over $5 million worth of Advanced Micro Devices (AMD) shares, ahead of the company's upcoming third-quarter results. The fund also bought shares of Taiwan Semiconductor Manufacturing Co. (TSMC).

Bitcoin surges as speculation grows about the approval of a bitcoin exchange-traded fund in the United States.

Bitcoin mining companies have outperformed Bitcoin itself this year, with shares of publicly-traded firms surging over 100%. The rising value of Bitcoin and positive business developments have contributed to the profitability of these companies. Mining companies earn money by mining Bitcoin's next block, and as the value of Bitcoin rises, so does their profit. Additionally, mining companies have made strides in boosting their value proposition to investors through investments in new mining hardware and diversification into other services.

Azure Power announces successful 2023 Annual Meeting of Shareholders, including approval of proposals and re-election of directors.

Meta's Twitter competitor, Threads, has gained 100 million users in a few days, surpassing ChatGPT. Meta's stock has risen over 135% this year, but Fidelity has written down its valuation of Twitter from $44 billion to $15 billion, representing a loss of 65.9%.

Hello, curious minds! Ever wondered what news content we can find under the topic Exchange-traded fund, or more commonly known as ETFs? Let's dive into this financial ocean and see what treasures we can grab from it.

First things first─what is an ETF? Picture it like a basket containing various jewels in form of stocks, commodities, bonds. You buy a share of that basket - cool right? This makes your investment diversified without having to buy each piece individually! What great convenience isn't it?

In news regarding these handy funds you might recently encounter about 'Thematic ETFs'. These are based on emerging trends (remember those rapid rise fall graphs?). Active vs Passive investing strategy debates stirring up quite often too. Imagine high velocity winds (Active) versus calm still air(Passive). Makes sense?

Around the world scene, there have been hot talks about recent surge in popularity for globally focused ETFs. It has become easier now than ever before for investors around the globe to enter international markets. Kinda like playing Monopoly but with real money and real estate─ exciting huh?

Riding along modern technology wave – creation of Crypto based ETFs also shines some light in news hemisphere.

Naturally any booming sector attracts regulatory bodies' attention hence making new laws & regulations part and parcel of "ETF news" category. Think strict school teachers keeping eye on your tests so all goes fair game– Yeah just something similar here framed by SEC for example.

Last drop ─ There is always talk about how to make informed decisions while investing in such funds remembering golden rule – higher potential returns means increased risk sharing stage! Now that sheds some light onto our curiosity bowl about what shimers under 'ETF' topic skyline ─ doesn’t it?. So fasten securities seatbelt and enjoy financial ride into future!