Assessing Investment Opportunities in Chile and Argentina: Boots on the Ground

Argentina is making economic reforms to reduce imbalances and control inflation, while Chile is seeing growth driven by copper demand.

7939 NW 21st St

Miami, Florida

Argentina is making economic reforms to reduce imbalances and control inflation, while Chile is seeing growth driven by copper demand.

Former Iowa insurance agent sentenced to 19 years for defrauding elderly clients out of retirement savings, totaling over $1 million.

DOL's fiduciary rule changes impact on advisors' businesses; compliance deadline in September. Industry execs downplay effects, but changes are significant.

Hancock Whitney (NASDAQ:HWC) analyzed by 9 experts with varying views. Ratings, price targets, and financial indicators provide valuable insights. Stay informed!

Zamfara NLC pleads for minimum wage increase as workers receive as low as N7,000 monthly salary, urging Governor Lawal to act.

Canadian Medical Association warns doctors of retirement savings risk due to proposed capital gains tax changes, but financial experts offer solutions.

Bishop Lamor Whitehead found guilty of fraud, extortion, and lying to FBI, defends himself on Instagram, urging followers to research case.

Nancy Pelosi made a big profit from stock options in NVIDIA, sparking concerns about politicians trading individual stocks. #Pelosi #Stocks

Former Chilean President Sebastián Piñera died in a helicopter crash at 74. He led Chile during a pandemic and social unrest.

Yogi Adityanath promises women empowerment and government aid during Gorakhpur visit, addressing needs and providing assistance to citizens during Janata Darshan.

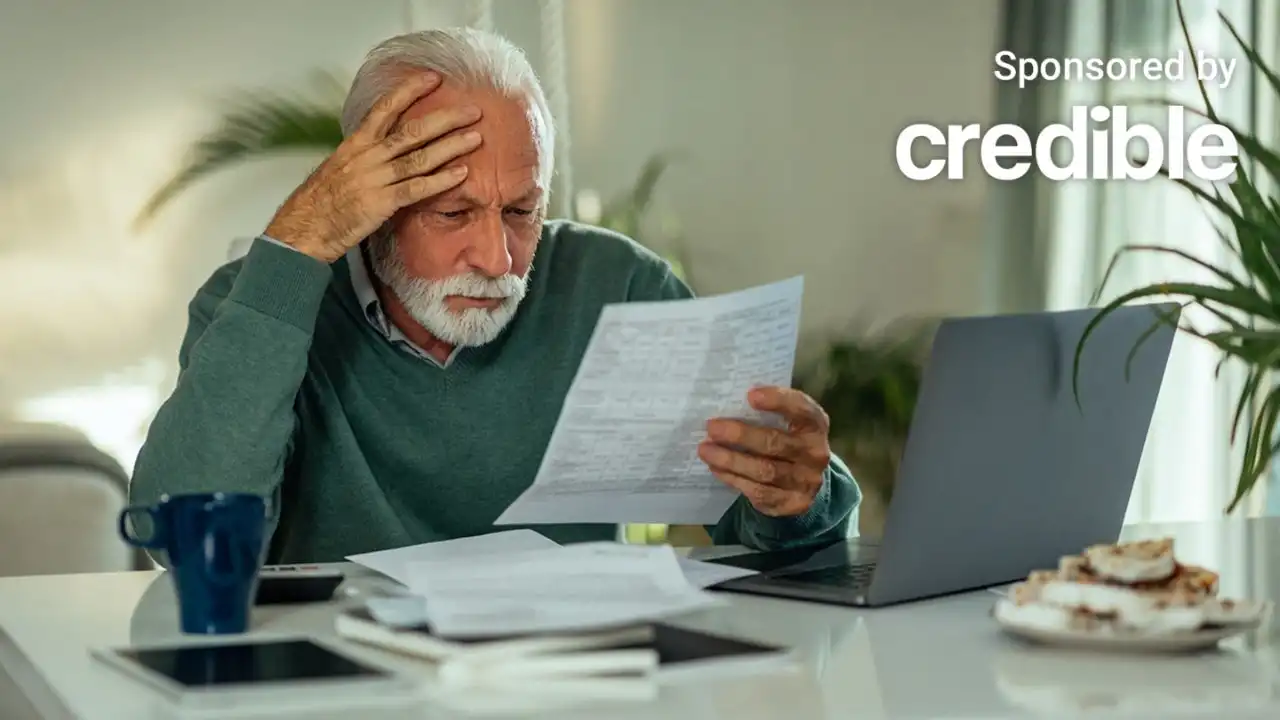

Rising costs prompt seniors to consider returning to work, survey shows. Many say Social Security benefits won't cover expenses.

Members of Value In Corporate Events get exclusive ideas and guidance to navigate the market. Learn More to get ahead!

Senate confirms Martin O'Malley as Social Security Commissioner, marking the first time in 25 years a Democratic nominee is confirmed.

General Motors (GM) has increased its contract offer to a 20% wage hike for US autoworkers in a bid to avoid a strike. Ford Motor has also confirmed it offered a 20% hike and other benefits. The United Auto Workers (UAW) is demanding 40% raises and major improvements in benefits. The UAW has outlined plans for a series of strikes targeting individual auto plants if agreements are not reached. The UAW is asking for 40% raises and major improvements in benefits. A full strike would hit earnings at each affected automaker by about $400 million to $500 million per week.

Social Security benefits may be reduced by 77% in the future due to financial pressures, but changes are likely to be made to prevent cuts.

Greeley residents fear that the proposed merger of Kroger and Albertsons will result in store closures, higher prices, and job losses. Regulators are reviewing the merger, and concerns about previous closures during mergers have been raised. Labor groups argue that the merger puts union jobs at risk, while farmers worry about decreased competition and potential food deserts in rural areas. Colorado Attorney General Phil Weiser is skeptical of the promises made by the companies and plans to meet with executives before deciding whether to challenge the merger. Public comments on the merger can be submitted to coag.gov/grocerymerger.

1976 Election: Debating whether to vote for Jimmy Carter or not.

French cities face widespread destruction and looting amid violent protests.

Retirement might seem like a far-off idea to some of us and a topic we often prefer to take the back seat in our busy lives. So, what's that got to do with pension news anyway? You may ask.

Well, let me tell you - it has everything to do with it! In this sea of ever-changing policies, laws and economic tides; pension news is just like a lighthouse guiding those on their journey through retirement planning. This information hub covers all things 'pension', from detailed analyses on changes in government policies or legislation affecting pensions (wouldn't you want an heads up?), deep dives into private sector initiatives focused on retirement benefits (like new 401k matching strategies) to need-to-know updates about social security adjustments.

Ever heard someone say something along the lines of "Economy is so unpredictable these days!"? No wonder! It's shifting sands beneath our feet – inflation rates go up and down causing alterations in our nest-eggs quite frequently. And here again, turning regular eyes towards pension-related news can work wonders. It not only keeps you informed but also helps realigning plans based on economic trends for optimized budgeting during those golden years!

But wait - there’s more! Ever wondered how world events could impact your future financial resilience? Yes...global happenings right across oceans could influence markets which ultimately impacts investment potential of your hard-earned savings too. Under-the-hood understanding courtesy well-analyzed items under international pension-news coverage aids making foresighted decisions crucial for safeguarded tomorrow.

What's your plan today?, Will you continue sailing blindly without knowing where winds are heading or step aboard observing buoy-markers called ‘Pension News’ mapping prudent paths amidst turbulent waters named ‘retirement planning?’