Doctors warn capital gains tax reform threatens retirement - Canada News

Canadian Medical Association warns doctors of retirement savings risk due to proposed capital gains tax changes, but financial experts offer solutions.

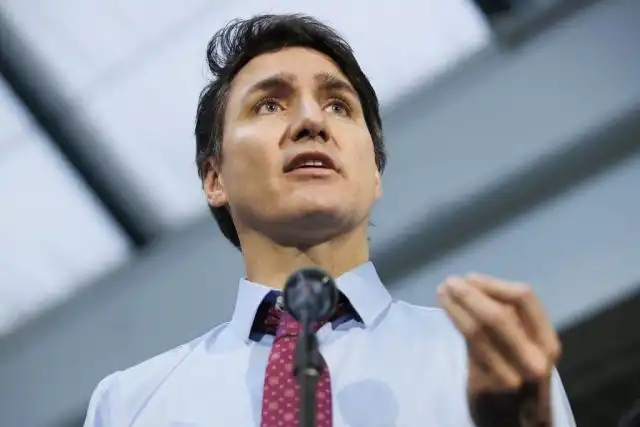

The Canadian Medical Association has raised concerns about the impact of the federal government's proposed changes to capital gains taxation on doctors' retirement savings. Prime Minister Justin Trudeau's government is considering increasing the inclusion rate for capital gains, which could affect doctors who typically incorporate their practices and invest for retirement inside their corporations.

While the association warns that doctors could face higher taxes on all capital gains, including retirement investments, some financial experts believe there are ways for incorporated professionals to protect their savings. Jean-Pierre Laporte suggests that doctors can shield their retirement savings from capital gains taxation by selling off investments and opening a registered pension plan, which would be tax deductible.

Nicole Ewing emphasizes that opening a pension plan may not be suitable for everyone, as there are ongoing compliance and administrative requirements to consider. It is too early to determine the full impact of the proposed changes on doctors' finances, as there are still many variables to consider.

The Liberal government defends the changes to capital gains taxation as a matter of fairness and aims to level the playing field between different sources of income. While doctors have historically benefited from lower tax rates, the government argues that the revenue generated from the tax changes is necessary to fund essential services like housing and healthcare.

Despite the concerns raised by the Canadian Medical Association, the government estimates that only a small percentage of Canadians will be affected by the increased inclusion rate for capital gains. The changes are expected to generate significant revenue over the next five years, which will be used to support important social programs.

Comments on Doctors warn capital gains tax reform threatens retirement - Canada News