Stifel cuts Tellurian stock target, maintains sell rating

Stifel lowers Tellurian price target to $0.25, maintains sell rating after deal to sell Haynesville assets for $260 million.

7939 NW 21st St

Miami, Florida

Stifel lowers Tellurian price target to $0.25, maintains sell rating after deal to sell Haynesville assets for $260 million.

Investors alarmed as CVS Health's Medicare division struggles, leading to a steep decline in stock price. Is it a buying opportunity?

BLACKBAUD INC Executive VP sells shares, raising questions on valuation. High P/E ratio and revenue growth concerns prompt investor caution.

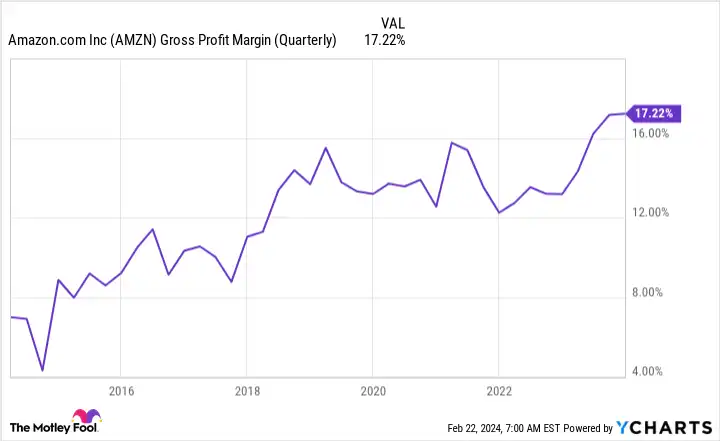

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Palantir Technologies may replace Tesla in the Magnificent Seven, as its stock soars, but it faces potential contract issues.

Microsoft's stock has increased by 21% over the past three months, with a high Return on Equity and expected growth.

S&P 500 lost 1.5% in the first trading week of 2024, ending a nine-week streak. Analysts expect rocky start to 2024.

World equity markets end November with biggest monthly rally in three years. Optimism for 2024 challenged by declining liquidity and inflation.

McDonald's is bringing back the McRib sandwich, using scarcity marketing to create consumer urgency and drive sales. The success of the McRib has even sparked competition in the fast-food industry. McDonald's has a positive financial performance and is an attractive investment for income-focused investors.

Mongolia Growth Group's stock has risen by 14% in the past month. The company's ROE is lower than the industry average, but it has experienced significant net income growth. The company does not pay dividends and reinvests its profits into the business. There are positive factors to consider, but it is important to assess the risks.

Have you ever found yourself scratching your head, trying to untangle what all those financial experts on the news are talking about when they mention "Price-earnings ratio", or P/E ratio for short? Let's demystify this term together! The P/E ratio is kind of like a measuring stick that investors use to gauge how a stock is valued compared to its earnings—in other words, are you getting bang for your buck?

First and foremost, news content regarding the price-earnings ratio often centers around market analysis and investment discussions. It’s where numbers meet narratives. Analysts love dissecting whether a stock’s P/E suggests it’s undervalued (a hidden gem!) or overvalued (too much hype?). High ratios might indicate enthusiastic expectations about future growth while low ones can imply the opposite—or that the stock is simply overlooked.

But beyond just spitting out statistics from recent financial statements, articles will drill down into sector trends — comparing ratios within industries gives context because hey, not all sectors tango at the same tempo. Now here comes a curveball: some avant-garde pundits will debate alternative versions of this metric; enter stage right—forward P/E versus trailing P/E – predicting futures versus studying histories.

Let me paint you a picture with words: imagine being at an art auction. You wouldn’t bid without checking past sales of similar pieces, right? Similarly, knowing historical data supports better decisions! And remember those savvy investors I mentioned earlier? They weave narrative threads by correlating economic conditions or even geopolitical events with erratic movements in these ratios.

So next time you catch wind of this topic amidst the hustle and bustle of finance news sections filled with perplexity and bustiness (and fancy jargon!), think of it as tuning into your favorite detective series—except instead of whodunit mysteries—it's hunt-for-value adventures in Wall Street!