5 Reasons to Buy Amazon Stock - Top Reasons to Invest in Amazon Shares

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

After conducting a thorough analysis of the current stock market, I have come to the conclusion that Amazon (NASDAQ: AMZN) is one of the most promising investment opportunities available. Despite its impressive performance in 2024, with a growth of 11%, I firmly believe that Amazon still has significant upside potential. In fact, I have identified five key factors that make Amazon an exceptionally strong buy at this time, even in light of its already stellar performance this year.

While Amazon is widely recognized for its e-commerce business, it has quietly made a strategic shift towards a service-oriented business model. This shift encompasses various divisions, including third-party seller services, advertising services, subscription services, and its cloud computing business, Amazon Web Services (AWS). The combined revenue generated by these service segments amounted to $92.9 billion, surpassing the revenue from the commerce side, which totaled $75.7 billion.

The significance of this transition cannot be overstated, as these service offerings are essential for numerous businesses, making them more sustainable in the long term. Moreover, while Amazon does not disclose the profitability of each division, it is evident that services generally yield higher profit margins, as evidenced by similar companies such as Shopify for third-party sellers and Alphabet for advertising.

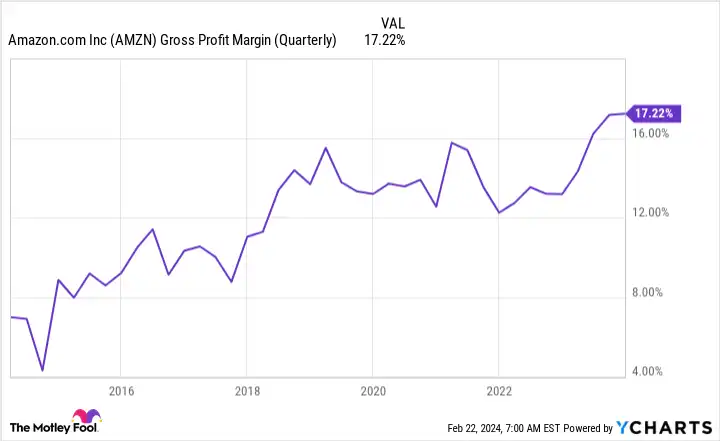

This brings me to the next compelling reason to consider investing in Amazon. Thanks to the rise of its service divisions, the company's gross margins have experienced a remarkable surge over the past decade. A higher gross margin provides Amazon with the potential to achieve better profit margins, which have also shown improvement in recent quarters after being negatively impacted by excessive spending to meet the demand during the pandemic. This will be a critical metric for investors to monitor as Amazon aims to transition into a profit-maximizing company.

A significant contributor to Amazon's profitability is AWS, the cloud computing business. In the fourth quarter, while Amazon's North American commerce business generated $6.5 billion in operating profits, the international business incurred a loss of $419 million. However, AWS more than compensated for this, producing $7.2 billion in operating profits despite having significantly lower sales figures (AWS recorded $24.2 billion in sales in Q4, compared to North American commerce sales of $106 billion).

Although AWS experienced a slight decline in profitability, with its operating margin dropping to 24% in Q4 of 2022, it swiftly rebounded in 2023, achieving an operating profit margin of 30% in Q4.

Another noteworthy aspect that has garnered attention is the growth of AWS. In Q4, its revenue increased by 13%, while competitors such as Google Cloud and Microsoft Azure saw revenue growth in the high 20% range. While there are multiple factors contributing to this, Amazon's management anticipates the emergence of new workloads, which is expected to drive AWS's growth throughout 2024. This is particularly significant as AWS plays a crucial role in Amazon's overall profitability.

Despite Amazon's strong performance in the past year, its stock remains reasonably priced. Utilizing traditional valuation metrics such as the price-to-earnings (P/E) ratio may not be the most suitable approach for evaluating Amazon, as the company is not solely focused on maximizing profits. Instead, the price-to-sales ratio provides a more accurate assessment. At three times sales, Amazon's valuation is comparable to its level in 2018 and still below its valuation during the pandemic-induced sell-off.

Lastly, and perhaps most importantly, Amazon's cash flows have experienced a substantial increase due to the resurgence of AWS, the growth of its service divisions, and improving margins. The company's cash flows in Q4 reached record highs, contributing to a new all-time high for its trailing-12-month total.

With this surplus of cash, Amazon has the ability to pay off debt, repurchase shares, or initiate dividend payments. These actions directly benefit shareholders and are compelling reasons to consider investing in Amazon's stock.

Despite Amazon's impressive performance since the beginning of 2023 and into 2024, it remains an exceptional investment opportunity at this time.

It is worth noting that The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now, and Amazon was not included in their selection. These 10 stocks are anticipated to yield substantial returns in the coming years.

The Stock Advisor service offers investors a straightforward blueprint for success, providing guidance on portfolio construction, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.

In conclusion, the factors outlined above make a compelling case for considering an investment in Amazon's stock. The company's strategic shift towards service-oriented divisions, impressive growth in AWS, reasonable valuation, and robust cash flows all contribute to its appeal as a strong buy in the current market. As always, it is important for investors to conduct their own thorough research and consider their individual financial goals and risk tolerance before making any investment decisions.

Comments on 5 Reasons to Buy Amazon Stock - Top Reasons to Invest in Amazon Shares