S&P 500 Performance Today: Uber Stock Decline on Unexpected Net Loss

Vistra Corp. surges on S&P 500 debut, Arista Networks beats forecasts, Uber Technologies posts unexpected losses, Match Group revenue guidance disappoints.

7939 NW 21st St

Miami, Florida

Vistra Corp. surges on S&P 500 debut, Arista Networks beats forecasts, Uber Technologies posts unexpected losses, Match Group revenue guidance disappoints.

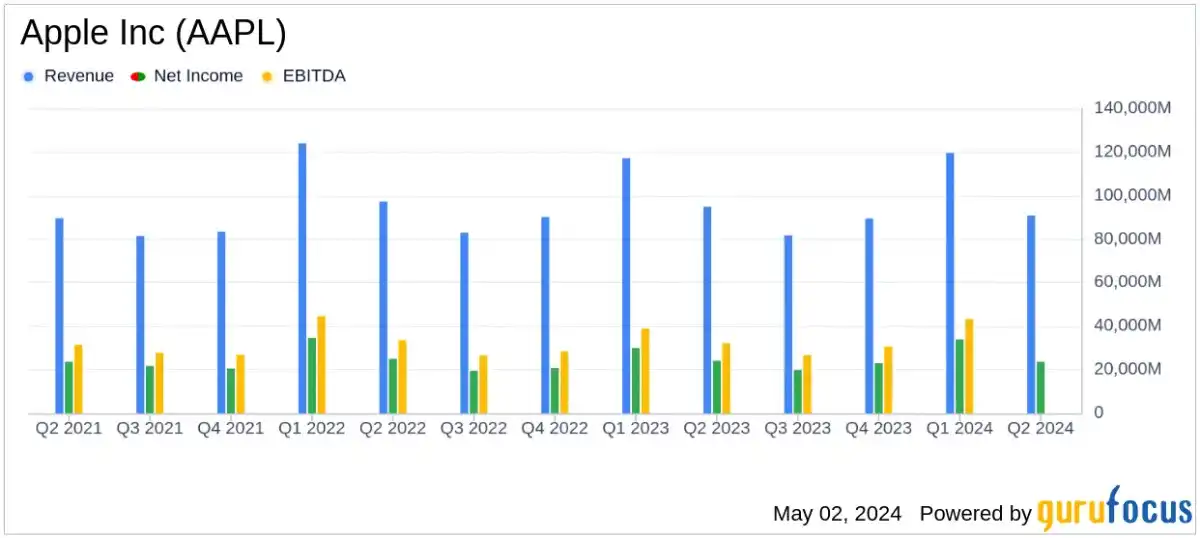

Apple's stock soars despite iPhone sales slump. Company announces dividend increase and stock buyback plan. Pressure to innovate grows.

Apple's Q2 earnings: $90.8 billion revenue, $1.53 EPS. iPhone sales lead at $45.96 billion. Services segment hits all-time high.

Amazon's quarterly report beats projections, boosted by AI interest. Revenue and net income soar, but revenue outlook disappoints. Advertising revenue spikes.

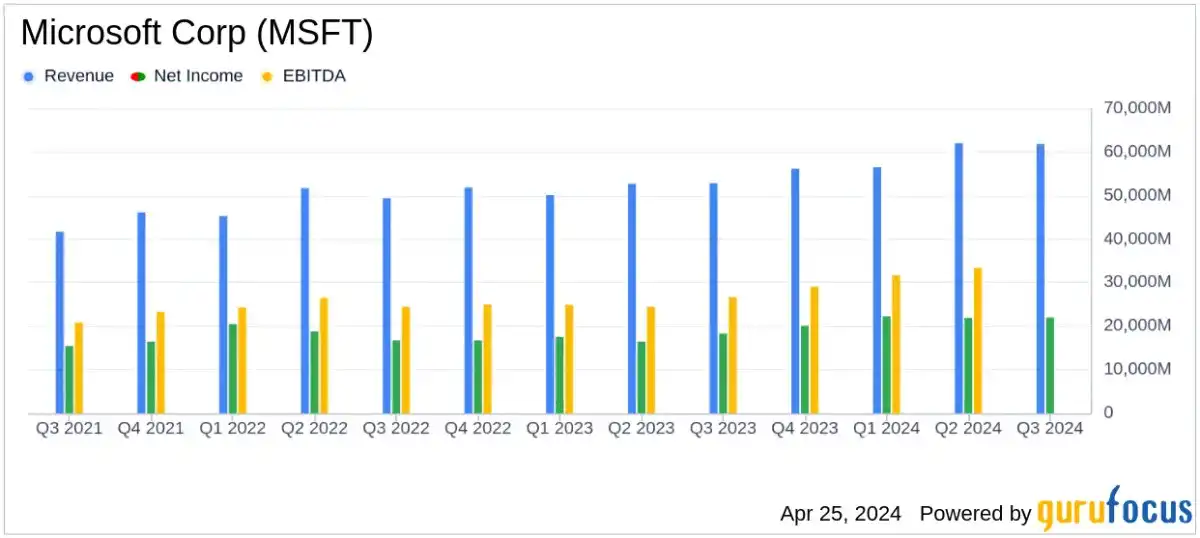

Stocks showed strength with Nasdaq, Dow, and S&P 500 gains. Google and Microsoft boosted market after positive earnings. Snap and Skechers surged.

Microsoft returned $8.4 billion to shareholders in Q3, showing strong growth in revenue and net income, exceeding analyst expectations.

Uber's annual earnings were $1.11 billion, with a 137% increase in EBITDA. Investors were disappointed, causing the stock to drop.

Meta Platforms, Inc. stock surged >20% after announcing a tripling in Q4 profit and its inaugural dividend. It's a long-term 'Buy'.

Billionaire investors are loading up on Apple stock, prompting retail investors to take a closer look. Apple's iPhone ecosystem is strong, and the company continues to share its success with shareholders. While there are concerns about declining sales and a high valuation, many believe Apple is still a good long-term pick.

Hey there, business aficionados! Have you ever wondered how companies give back to their shareholders and signal confidence in their future prospects? It's all about share repurchases, a phenomenon as interesting as it is impactful. So let's dive into the world of finance with some chatty flair and see what this buzz is usually about.

"What exactly are share repurchases?", you might ask while sipping on that morning coffee. Well, when a company starts feeling like Uncle Scrooge but in a good way – overflowing with cash, that is – they may decide to buy back shares from investors. This nifty move can affect their stock price by increasing its value (fewer shares out there means each one becomes more special), and it subtly whispers sweet nothings into investors' ears that the company’s doing pretty well - or so they believe!

This fiscal maneuver is generally considered an alternative to dividends when distributing excess dough amongst stakeholders. And oh boy, does it make headlines! Picture this: "Giant Tech Corp buys back $10 billion of its own stock!". It has quite a ring to it, doesn't it? The news surrounding share buybacks could focus on several angles – from signaling market confidence all the way down Wall Street rumors lane or critiques debating whether companies should reinvest those billions instead.

We often find mixed feelings sprinkled across articles discussing these cash-backed love letters known as buyback programs. Analysts knit their brows pondering "Are these moves always shareholder-friendly?". Companies using surplus funds for repurchasing might sacrifice long-term growth ventures which stirs up quite the controversy.

In conclusion, under 'Share Repurchase', we absorb tales ranging from announcement scoops and financial analyses to broader economic implications and ethical debates—all baked together forming hot-off-the-press pie slices served best fresh and thought-provoking. Isn't financial news just fascinating?