Roaring Kitty Livestream GameStop Stock Blasts Off - Decrypt

Subscribe to Alpha Reports for exclusive insights on airdrops, NFTs, and more! GameStop (GME) soars as Roaring Kitty plans YouTube livestream.

7939 NW 21st St

Miami, Florida

Subscribe to Alpha Reports for exclusive insights on airdrops, NFTs, and more! GameStop (GME) soars as Roaring Kitty plans YouTube livestream.

Vanguard Group discloses 11.74% stake in International Paper Company. Stock transactions revealed. Stay tuned for more updates. #investment #stocks

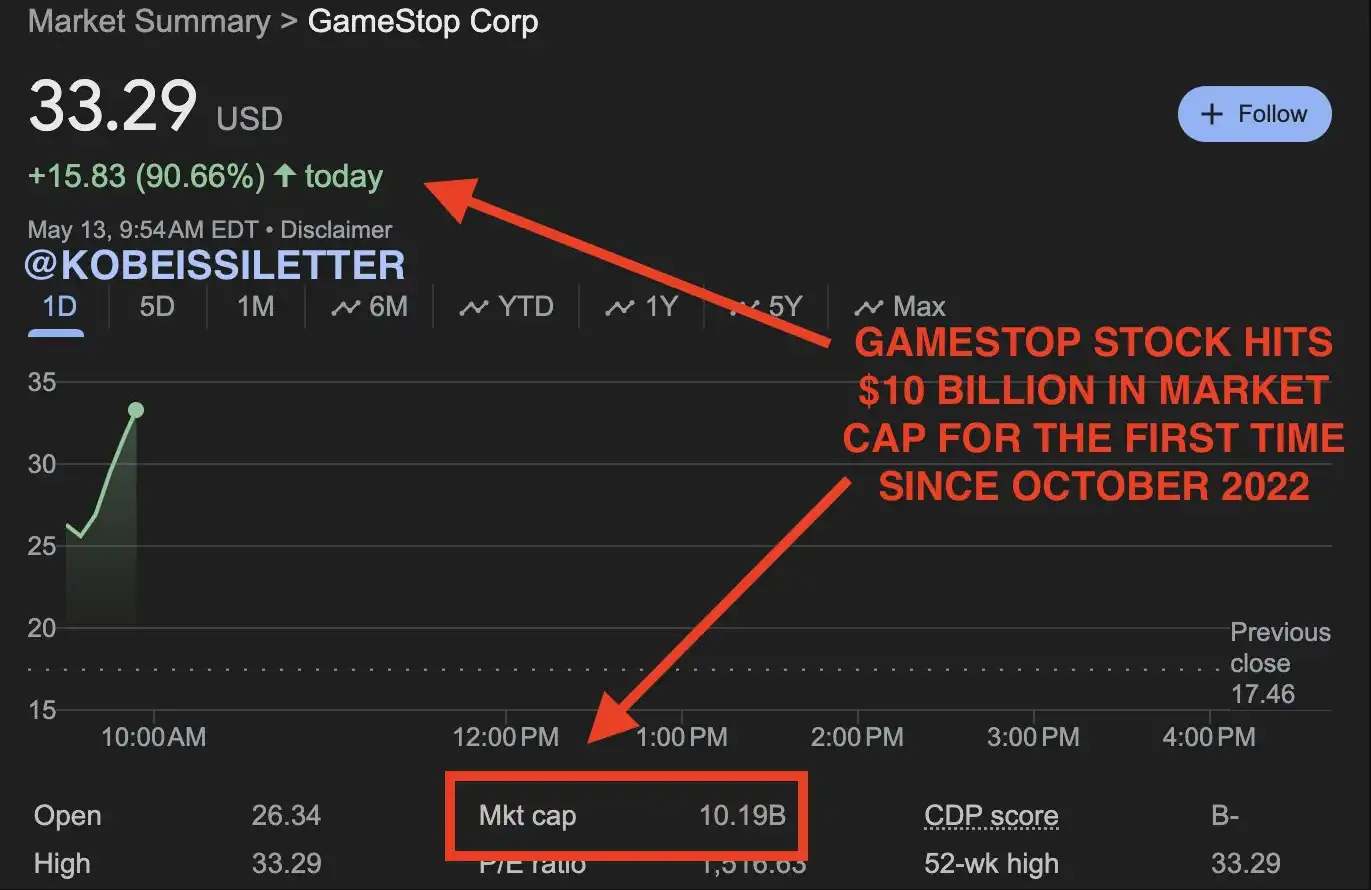

GameStop stock surges 118% in premarket trading, fueled by "Roaring Kitty" and meme stock rally. AMC also sees significant gains.

GameStop and AMC stocks surge, reigniting meme stock frenzy of 2021. Retail investors scramble to understand the resurgence. Approach with caution.

GameStop and AMC stocks surge after Roaring Kitty returns to social media, sparking retail investor excitement and meme stock rally.

Crypto market sees $900 million in liquidations as Bitcoin drops below $60,660, triggering altcoin losses of up to 35%.

Bitcoin's latest price surge mirrors 2021's bull run, with potential for new all-time high. Institutional adoption and derivatives trading drive momentum.

Soybean and corn futures hit three-year lows due to fund selling and increased U.S. supplies, with markets down 10% this year.

Get all the latest Bitcoin news and expert analysis in our daily newsletter. Sign up now for a comprehensive market recap!

Investors should hold NVDA stock despite valuation concerns. Nvidia's dominance in AI chips and strategies make it a winner.

Hedge funds are exiting their short positions at a rapid pace, signaling a potential market resurgence and a rebalancing of US dollar longs.

Invest in uranium stocks to protect against inflation and capitalize on the new uranium bull market. Don't miss out on explosive gains. #1 Small-Cap Uranium Stock for Ultra-Fast Gains in 2023-24.

Bill Gates and Elon Musk had a confrontational meeting in 2022 over Gates shorting $1.5 billion worth of Tesla stock, according to a new biography. Musk was upset and "super mean" to Gates during the meeting. The book also reveals Gates' criticism of Musk's beliefs on climate change and Mars colonization.

"Barbenheimer" double feature boosts AMC attendance, breaks box office records

AMC CEO emphasizes the need to raise equity capital for the company's survival.

Shares of Carvana surge as online used car seller beats expectations.

Understanding the Intricacies of Short-Selling in Finance

Ever wondered what it means when someone talks about going 'short' in financial discussions? Let's dive into this fascinating terrain. Think of swimming against a tide, and you're right onto the idea of short-selling.

Short-selling, or "shorting", is fundamental to finance news; a controversial strategy shrouded by its perceived complexity. So, how does this audacious tactic work?

In layman terms: Imagine purchasing a novel from your friend today with an agreement to pay them next week. Suddenly, that book's price drops after just two days! You could buy it for less now; so what if instead, you return their book and get one at the reduced rate? Ingenious isn’t it!

This scenario offers some insights into short-selling in finance; however, with stocks versus novels being swapped around. An investor borrows stock they anticipate will drop in value soon and sells these shares promptly at current market prices. If their prediction is correct -and the stock truly falls- they repurchase more stocks at lower cost yet return only what was initially borrowed to their lender.

The twist lies herein: If you have bet wrong –that’s right folks– there's no limit on how much money you might lose as bad calls mean paying hefty amounts when buying back these same shares sold earlier but are way pricier now.

Frequent coverage of shortcuts under finance news usually orbits around risk factors or controversies involving unethical practices like causing deliberate market crashes known as ‘bear raids’. Remember our swimming metaphor? Just like exhausted swimmers may drift away due to incorrect estimation measures or unforeseen tides—equivalent pitfalls lie here too!