Hedge funds abandon short positions as HSBC turns bullish on global equities

Hedge funds are exiting their short positions at a rapid pace, signaling a potential market resurgence and a rebalancing of US dollar longs.

In February of this year, the market was experiencing the largest short squeeze since the meme stock frenzy of 2021. In fact, it was even bigger, with global hedge funds exiting their short positions at the fastest pace since 2015, surpassing the mass exodus seen in 2021 when activist traders rallied around AMC, Gamestop, and Bed Bath & Beyond, according to Goldman Sachs.

The rapid exits were a response to hedge funds being caught off guard by the sharp rally in equities following the Federal Reserve's 25-basis-point interest rate hike on February 1. Given the latest data, it would be prudent for them to get out of any remaining short positions, which are financial products designed to benefit from large declines in securities prices.

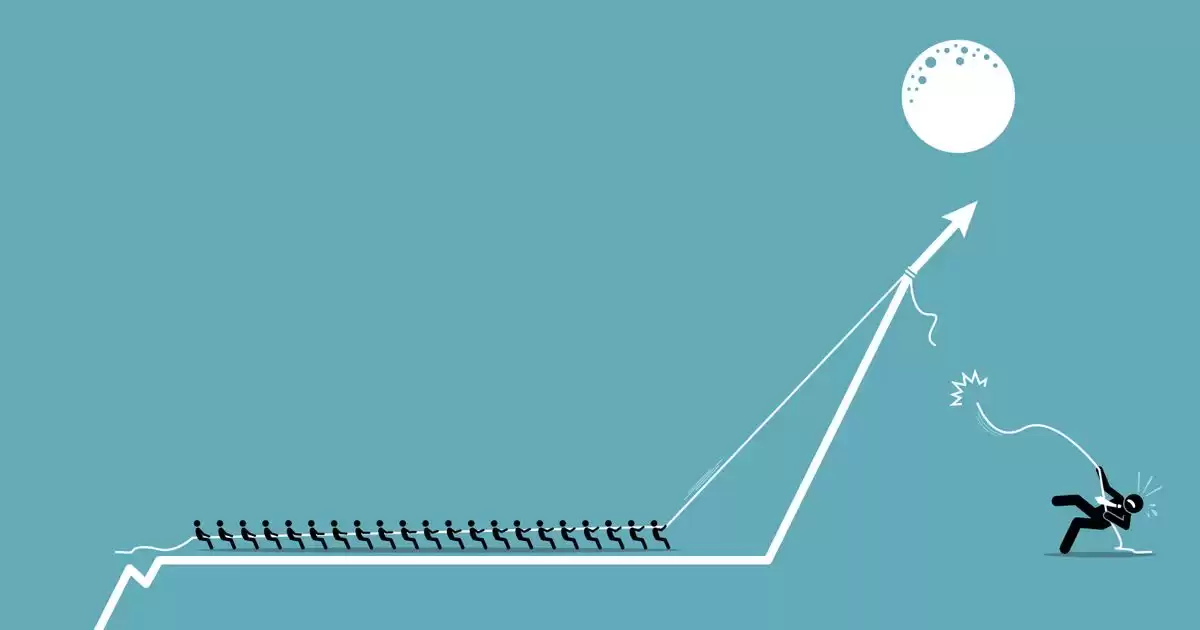

Research published by UBS indicated that CTA funds, which are hedge funds that use managed futures strategies, are expected to unwind up to 60% of their current short positions. UBS predicts that these CTAs will buy back as much as $60 billion worth of global equities in anticipation of a resurgence in the global stock markets, signaling a return to maximal bullishness on the asset class.

HSBC Holdings PLC suggests that the market may be starting to price in interest rate cuts following two years of fiscal tightening implemented by central banks across the West. If the US Federal Reserve can engineer a soft landing, this could imply notable upside for equities, according to HSBC's global equities strategist Alastair Pinder and his team. They believe that the FTSE All-World Index could close 2024 at 480, indicating as much as a 9.5% upside from Wednesday's index price, assuming the US economy avoids a recession.

Historical data suggests that the US benchmark S&P 500 index has rallied an average of 22% in the six months following the end of a Fed hiking cycle. If this collective wisdom holds true, we should expect hedge funds to increase their short exits in the coming weeks and months.

In addition to global equities, UBS data also pointed to a rebalancing of US dollar longs. CTAs sold $20 billion worth of greenbacks last week, and UBS' model expects them to sell a further $90 billion to $100 billion, representing between 40% to 50% of remaining dollar longs, in the following two weeks.

Comments on Hedge funds abandon short positions as HSBC turns bullish on global equities