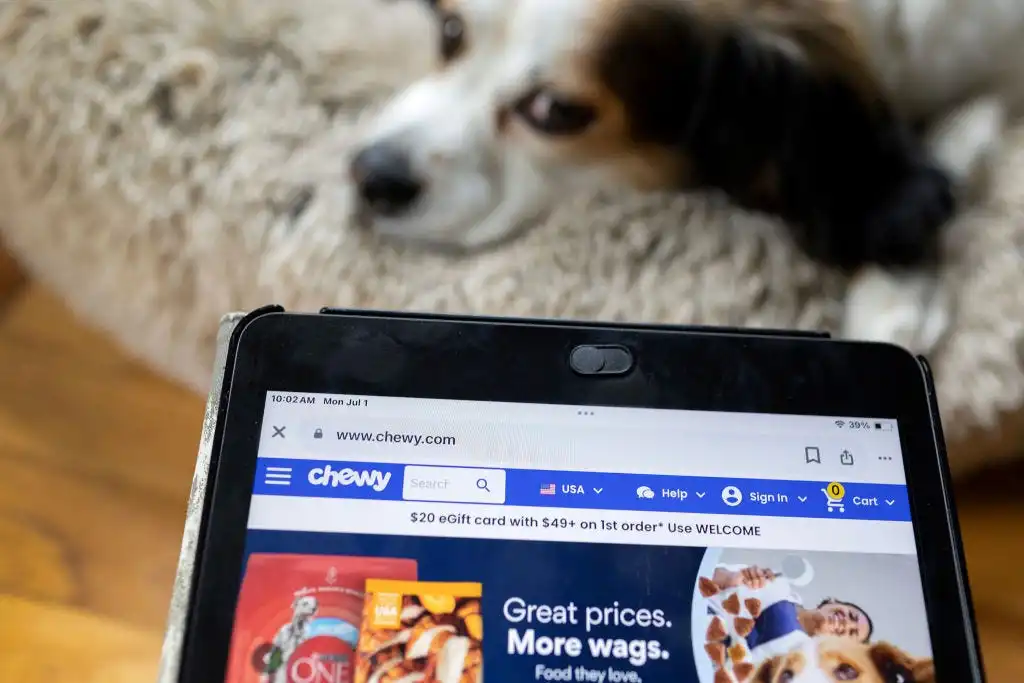

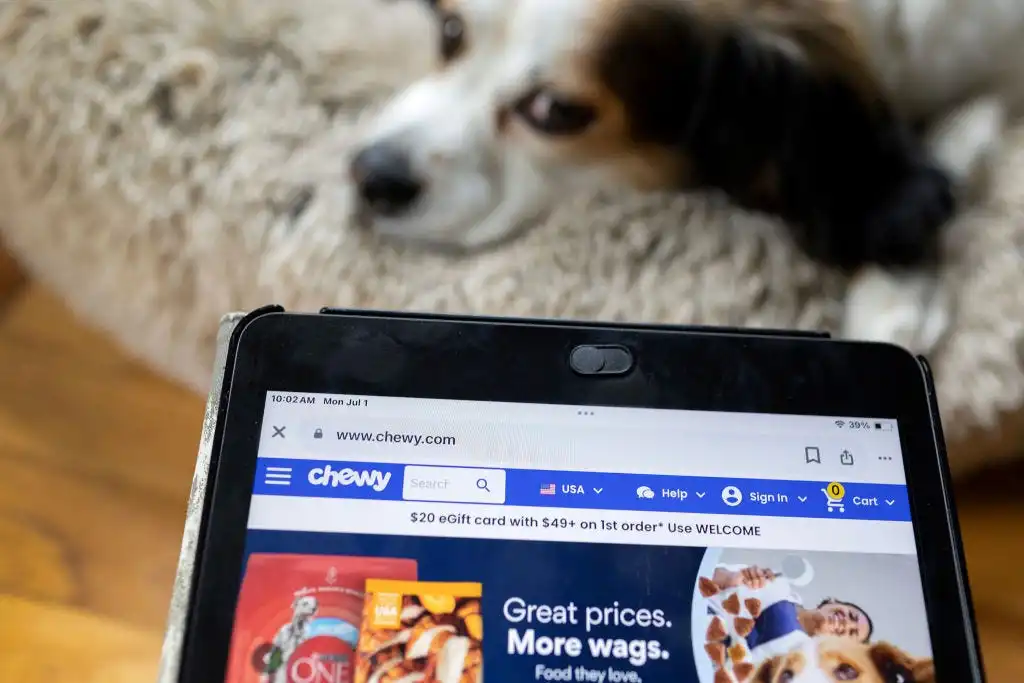

Chewy stock fluctuates as Roaring Kitty reveals $245 million stake

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

7939 NW 21st St

Miami, Florida

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

Cyberattack on CDK Global highlights need for robust contingency plans. Organizations urged to diversify vendors, enhance cybersecurity standards, and collaborate.

DOL's fiduciary rule changes impact on advisors' businesses; compliance deadline in September. Industry execs downplay effects, but changes are significant.

Ethereum ETFs finally approved by SEC, sparking industry celebration. Market response lukewarm, but crypto leaders rejoice in historic moment.

SEC asks leading exchanges to update documents for Ethereum ETFs. Approval could be imminent, with potential positive impact on Ethereum price.

Crypto market surges on Ethereum ETF optimism. SEC potentially approving applications, leading to Ether price surge and positive impact on altcoins.

AMC raises $250 million through equity offering as meme trade boosts GameStop, shares surge 78%. Analysts cautious on long-term outlook.

Regulators investigate Morgan Stanley's wealth management division over potentially risky clients. Stock falls as probe widens. CEO transition adds uncertainty.

Reddit discloses IPO details, aiming for $6.4 billion valuation with plans to offer shares to Redditors. Market debut expected later this month.

Ark Invest and 21Shares boost Bitcoin ETF transparency with Chainlink integration, setting a new standard for secure, transparent asset management.

Labor union accuses Starbucks of failing to disclose costs of anti-union campaigns, estimated at $240 million, ahead of 2024 annual meeting.

Elon Musk's xAI has secured $500 million in new funding. Musk is also in a race with OpenAI to bring generative AI to market.

Ethereum hits all-time high, surpassing $25,000 after SEC's approval of Bitcoin ETFs. Analysts predict potential approval of Ethereum spot ETF.

SEC approves first U.S. bitcoin exchange-traded fund (ETF) after years of rejections. Multiple companies file for spot bitcoin ETFs.

Bitcoin consolidates after a surge past $47,000 as US ETF approval looms. Market expects approval, with Bitcoin up 172% in 12 months.

Standard Chartered bank projects Bitcoin to reach $200,000 by 2025 due to ETF inflows, comparing it to the first gold ETF.

Prominent crypto analysts predict Ethereum could surge to over $3,000, citing its unique advantages and strategic partnerships in the market.

Bitcoin reached a 20-month high of $42,000, signaling fading regulatory scrutiny and potential for a bitcoin exchange fund on the stock market.

Get all the latest Bitcoin news and expert analysis in our daily newsletter. Sign up now for a comprehensive market recap!

SEC meeting with Grayscale, BlackRock, and Nasdaq fuels anticipation for bitcoin ETF approval. Bitcoin rallies to highest price in 20 months.

Dallas Mavericks owner Mark Cuban is selling a majority stake to the family behind the Las Vegas Sands casino.

Dallas Mavericks owner Mark Cuban is in talks to sell a majority stake in the NBA franchise to Las Vegas Sands.

Mark Cuban is working on a deal to sell the Dallas Mavericks to the family that runs the Las Vegas Sands casino.

Bitcoin mining companies have outperformed Bitcoin itself this year, with shares of publicly-traded firms surging over 100%. The rising value of Bitcoin and positive business developments have contributed to the profitability of these companies. Mining companies earn money by mining Bitcoin's next block, and as the value of Bitcoin rises, so does their profit. Additionally, mining companies have made strides in boosting their value proposition to investors through investments in new mining hardware and diversification into other services.

Chelsea Clinton has reportedly earned $9 million since 2011 as a board member of an internet investment company. She also owns a $10 million luxury apartment in Manhattan.

Rep. Eric Swalwell (D-CA) refuses to comment on whether Sen. Bob Menendez (D-NJ) should resign following his indictment, sparking controversy.

The SEC fined Mila Kunis and Ashton Kutcher's NFT-based web series, Stoner Cats, $1 million for unregistered securities.

Bitcoin's price fell by nearly 8% in an hour of frenzied trading, erasing most of its gains since June. The sell-off coincided with news that Elon Musk's SpaceX had written down the value of its bitcoin holdings by $373mn and sold the cryptocurrency. The volatility comes as US regulators crack down on the sector and as expectations of interest rate cuts by the Federal Reserve are reassessed.

Former WWE CEO Vince McMahon was raided by federal agents last month over allegations of paying multiple women "hush money" for sexual misconduct claims. McMahon denies any wrongdoing.

Greta Gerwig's film, starring Margot Robbie as "Stereotypical Barbie," addresses gender stereotypes and Barbie's unrealistic figure. The film also explores the personal struggles of Barbie's creator, Ruth Handler.

Washington Commanders owner Dan Snyder fined $60 million for misconduct.

Washington Commanders owner Dan Snyder fined $60 million for misconduct.

Coinbase argues recent Supreme Court ruling supports fight against SEC charges.

US court rules that XRP is not a security, vindicating Ripple Labs and impacting cryptocurrency regulations.

Ripple wins XRP case against SEC, XRP price surges 35%.

"Passion of the Christ star leads faith-based film funded by crowdfunding."

Bitcoin shows signs of optimism despite SEC lawsuits and stagnant price.

The U.S. Securities and Exchange Commission (SEC): A Buzzing Hive of Financial News

Do you ever wonder about the machinations behind the financial sector, or get curious about how some wayward companies are held accountable? The answer lies with the U.S. Securities and Exchange Commission (SEC). It seems every day there's a new story nestled under this broad topic.

No doubt, when talking about news from SEC, it spans across various sub-topics. For instance, we frequently see discussions around legislations like financial securities laws and sanction mandates that affect both individuals and corporations alike.

'How exactly does SEC regulate?' I hear you ask. Well, one way is through cracking down on firms for fraudulent activities such as insider trading-the buying or selling of stocks based on confidential information not made available to public- akin to having an ace up your sleeve in a poker game!

Apart from these regulatory headlines involving stringent actions, announcements regarding amendments proposed or enforced laws also come under this purview - kind of like painting fresh guiding lines on our economic roadways! These legal changes often carry significant implications for investors and corporate entities following them closely mirrors navigating treacherous terrains with well-managed risk.

Moreover, the inspiring tales of those enterprising protagonists who leverage these regulations to take their businesses onto bigger stages captivate many-a-reader too! Similarly intriguing could be cases wherein certain rules have inadvertently led market players into addled waters- serving as reminders that even strong swimmers must respect tides within oceans vast & varied.

In summary then – stories revolving around everything from company crackdowns right up until legislative proposals can easily find their place under the broad umbrella titled 'U.S Securities And Exchange Commission'. Peek beneath it sometime; fiduciary drama never ceases!