CPI Services Increase by 5% Year-Over-Year: Is it Real or Inflated?

CPI data shows inflated shelter costs, but bond market will reveal true economic signals. Watch the price for accurate insights.

7939 NW 21st St

Miami, Florida

CPI data shows inflated shelter costs, but bond market will reveal true economic signals. Watch the price for accurate insights.

Ethereum ETFs finally approved by SEC, sparking industry celebration. Market response lukewarm, but crypto leaders rejoice in historic moment.

Economist Peter Schiff warns of potential downfall for Bitcoin ETF investors as digital currency's price surge may lead to reversal.

Ark Invest and 21Shares boost Bitcoin ETF transparency with Chainlink integration, setting a new standard for secure, transparent asset management.

Bitcoin price hits new yearly high at $52,545, up 17% in 7 days. Rising institutional interest suggests bullish trend. Potential $55,000 target.

SEC approves first U.S. bitcoin exchange-traded fund (ETF) after years of rejections. Multiple companies file for spot bitcoin ETFs.

Bitcoin consolidates after a surge past $47,000 as US ETF approval looms. Market expects approval, with Bitcoin up 172% in 12 months.

Standard Chartered bank projects Bitcoin to reach $200,000 by 2025 due to ETF inflows, comparing it to the first gold ETF.

S&P 500 lost 1.5% in the first trading week of 2024, ending a nine-week streak. Analysts expect rocky start to 2024.

Greenlane will use Uber Freight data to build its electric and hydrogen vehicle charging network. The plan is to start in 2024.

SEC meeting with Grayscale, BlackRock, and Nasdaq fuels anticipation for bitcoin ETF approval. Bitcoin rallies to highest price in 20 months.

Walt Disney Co (DIS) has experienced a -1.76% drop in the last session. The company's revenue is expected to grow.

Invest in uranium stocks to protect against inflation and capitalize on the new uranium bull market. Don't miss out on explosive gains. #1 Small-Cap Uranium Stock for Ultra-Fast Gains in 2023-24.

Invest in the small-cap uranium stock set to explode in the new uranium bull market. Get ahead of the herd and grab our FREE report now! #UraniumStocks #ProfitWindfall

Bitcoin mining companies have outperformed Bitcoin itself this year, with shares of publicly-traded firms surging over 100%. The rising value of Bitcoin and positive business developments have contributed to the profitability of these companies. Mining companies earn money by mining Bitcoin's next block, and as the value of Bitcoin rises, so does their profit. Additionally, mining companies have made strides in boosting their value proposition to investors through investments in new mining hardware and diversification into other services.

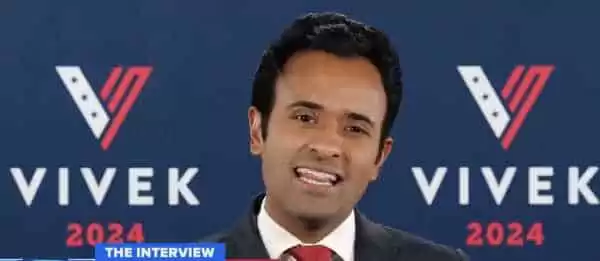

Vivek Ramaswamy, a young presidential candidate, is gaining popularity but faces criticism for his ties to Big Pharma and China.

Hey there, reader! Have you ever wondered what's buzzing in the world of finance and investment? Well, let me paint a picture for you about BlackRock – yeah, that colossal titan of asset management. When scrolling through news on BlackRock, it's like flipping through a novel filled with complex characters and intriguing storylines.

Let's dive into earnings reports first. They're kind of like report cards for adults – showing how well this behemoth performed during the quarter. But it’s not just about numbers; these reports give us insights into economic trends, investor behavior, and maybe even some hints at what could be rocking our financial future!

But hold on! It's more than just cold hard cash. Sustainability initiatives are increasingly grabbing headlines too, illustrating BlackRock’s dance with eco-friendly investments. Are they really going green or simply wearing camouflage? The discussion around this can get pretty lively as debates over corporate responsibility versus profit rage on.

Now throw in some global market analysis because let’s face it - when such a big player speaks up about market conditions or investment strategies, who isn't all ears? Whether you agree with their takeaways or not is one thing; whether they impact your next move is another kettle of fish entirely.

Here comes my favorite part: mergers and acquisitions. Think drama-filled episodes from your beloved soap opera but set in boardrooms with entrepreneurs pondering their fates while nibbling croissants (okay maybe without the pastries). The latest scoop on which company BlackRock might cozy up to next caters to those hungry for business intrigue and strategic plays.

In summary—"What news content can we find under the topic 'BlackRock'?" I hear someone ask rhetorically—the answer pulsates with life: from nerve-wracking numbers to green ambitions all wrapped up in strategical drama—it mirrors a living entity perpetually evolving within our dynamic world economy. So grab your mug of coffee (or tea if that’s your jam) and settle in; exploring what makes headlines beneath BlackRocks’ name promises an enlightening ride!