Campbell Soup Posts Strong Q3 Earnings, Lifts FY2024 Outlook

Campbell Soup beats expectations in Q3, credits success to Sovos Brands acquisition. Raises fiscal 2024 guidance, stock rises 1.4%.

7939 NW 21st St

Miami, Florida

Campbell Soup beats expectations in Q3, credits success to Sovos Brands acquisition. Raises fiscal 2024 guidance, stock rises 1.4%.

Salesforce CRM shares drop 16% pre-market due to mixed Q1 results and weak Q2 guidance. Investors cautious amid slowing tech spending.

Join Cash Flow Club for exclusive market tips and guidance. Navigate any climate with expert advice. Learn more for success.

Adidas sees strong growth in Europe with retro-style sneakers, while North America struggles with overstock. Company rebounds after split with Ye.

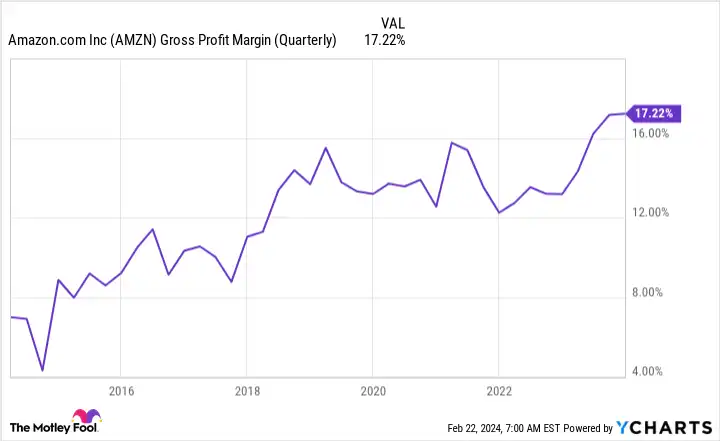

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Walmart's strong earnings report and key announcements, including a dividend increase and acquisition, are driving stock prices higher.

Snap Inc stock plummets after disappointing Q4 revenue due in part to Israel-Hamas conflict, weak future guidance, and planned layoffs.

Palantir's stock soars 28.5% after strong Q4 results, highlighting growing demand for AI platform. Revenue, billings, and free cash flow exceed expectations.

Members of Value In Corporate Events get exclusive ideas and guidance to navigate the market. Learn More to get ahead!

Amazon.com Inc (NASDAQ:AMZN) reports strong Q3 2023 earnings, with increased net sales, operating income, and operating cash flow.

McDonald's is bringing back the McRib sandwich, using scarcity marketing to create consumer urgency and drive sales. The success of the McRib has even sparked competition in the fast-food industry. McDonald's has a positive financial performance and is an attractive investment for income-focused investors.

Amazon's Q3 revenue growth is expected to be strong, beating expectations and leading to a rally in its shares.

Uber's shares fell 5.2% after concerns about slowing growth overshadowed the company's first-ever quarterly operating profit.

Hey there, fellow business enthusiasts! Have you ever found yourself scratching your head when the term Earnings Before Interest and Taxes (EBIT) pops up on your screen while perusing financial news? Well, let's tackle this concept together in a language as smooth as your morning coffee.

"What exactly is stuffed under the broad umbrella of EBIT in the news?", you may wonder. We've all seen those headlines that either make our wallets sing or send a shiver down investors' spines. But what comprises these updates?

Diving into Company Performance ReportsNo stock market drama is complete without earnings reports, right? When companies announce their financial results—usually quarterly and annually—their performances hinge greatly on how well their EBIT numbers stack up against expectations. Higher-than-expected EBIT can lead to stocks soaring faster than a rocket, while lower numbers may see shares dropping like anchors.

The Impact of Market TrendsIn addition to individual company performance, news about general market trends often revolves around collective shifts in EBIT across industries or sectors. From retail to tech giants—any significant collective movement spells out overarching economic narratives contributing to either optimistic forecasts or cautionary tales for stakeholders!

The Role of Tax Reforms and PoliciesLast but not least, let's chat about government influence—a sizzling topic any day! Policy reforms affecting corporate taxes directly impact—you guessed it—EBIT figures within tax-related content pieces. Analysts will dissect how potential legislative changes could shake up future projections for different businesses.

To sum it up: Stay tuned-in if you're playing the game of markets because understanding tweaks and turns in EBIT land would be akin to holding an atlas during road trips full of potentially profitable avenues. Now go ahead; rock those earning reports with fresh insights!