Nvidia Stock NASDAQ NVDA Cheaper after Stock Split Priceless

Nvidia stock skyrockets with blowout earnings and stock split, solidifying its AI leadership and exponential growth potential in the market.

7939 NW 21st St

Miami, Florida

Nvidia stock skyrockets with blowout earnings and stock split, solidifying its AI leadership and exponential growth potential in the market.

Salesforce CRM shares drop 16% pre-market due to mixed Q1 results and weak Q2 guidance. Investors cautious amid slowing tech spending.

Exclusive insights from The Quantamental Investor on navigating market volatility. Upgrade to get expert guidance and stay ahead in any climate.

Adidas sees strong growth in Europe with retro-style sneakers, while North America struggles with overstock. Company rebounds after split with Ye.

Tesla disappoints with Q1 2024 results, missing earnings and revenue estimates. Caution on 2024 vehicle growth. Zacks Rank #5 (Strong Sell).

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Walmart's strong earnings report and key announcements, including a dividend increase and acquisition, are driving stock prices higher.

Palantir's stock soars 28.5% after strong Q4 results, highlighting growing demand for AI platform. Revenue, billings, and free cash flow exceed expectations.

Apple's stock falls despite beating earnings, with China sales dropping 13% and services business falling short of expectations.

Tesla shares edged higher in early Monday trading after a Wall Street analyst cut his price target on the group.

NVIDIA Corp (NVDA) stock price rose 6.43% to $495.12. Annual sales grew by 25.63% and 267.13% in earnings per share.

Nvidia Corporation reported strong quarterly earnings, with revenue up by more than 200%, but shares may not rise further in the near term.

Tesla's Q3 production and delivery numbers were lower than expected due to planned factory upgrades. The company's profit margins also fell, leading to concerns about its high valuation. Tesla's stock price may decrease in the future.

McDonald's is bringing back the McRib sandwich, using scarcity marketing to create consumer urgency and drive sales. The success of the McRib has even sparked competition in the fast-food industry. McDonald's has a positive financial performance and is an attractive investment for income-focused investors.

Nvidia's Q2 earnings exceeded expectations, with revenue at a record $13.51bn, 101% YoY growth, and a 429% YoY increase in earnings per share.

AMD shares surge after Q2 results beat Wall Street estimates. Data-center revenue and PC sales slightly below expectations.

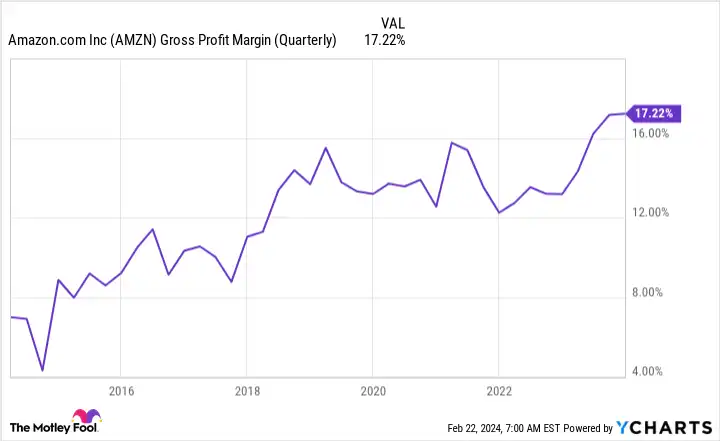

Have you ever heard the term Gross Margin tossed around in financial meetings or seen it headlining business articles and wondered what all the fuss is about? Well, let’s wade into this vital metric like a shark prowling through the deep blue—keenly aware that there's more to it than just numbers.

First off, why should we care about gross margin? It's like your car's fuel gauge; it tells you how efficiently your business is running. Simply put, Gross Margin represents a company’s sales revenue after subtracting the cost of goods sold (COGS). But hold on a second—why does this matter to us as readers of financial news?

When perusing through pages brimming with economic details, one could stumble upon news content under 'Gross Margin' shedding light on different businesses’ financial health. You might find comparisons between titans of industry showing who can squeeze out more profit from their revenues. Or perhaps discover which scrappy startups are revving up competition by claiming larger slices of profitability despite smaller sales volumes. Discussions around gross margins might even spiral into strategic insights where mature companies strive to improve their efficiencies or new players shake up traditional processes with innovative solutions.

Honestly speaking, isn’t it exciting to see how these figures narrate stories beyond mere percentages? They speak volumes about pricing strategies, cost management and reveal subtle aspects of market dynamics—all at once! Can you imagine catching wind of an article analyzing trends over time and predicting possible futures based on changes in gross margin patterns? There lies the intersection between critical analysis and prophetic forecasting!

So next time you come across 'Gross margin' while sifting through today’s barrage of news content, don't scroll past too fast! Remember: these aren't just sterile statistics but rather essential embers that spark discussions which illuminate our understanding of various industries—and knowing how they fire up can truly keep those business-savvy brains bustling!