Mortgage rates update: May 29 rates should stay high

Fixed mortgage rates are down for the third week, but may not drop much lower in 2024. Consider buying now.

7939 NW 21st St

Miami, Florida

Fixed mortgage rates are down for the third week, but may not drop much lower in 2024. Consider buying now.

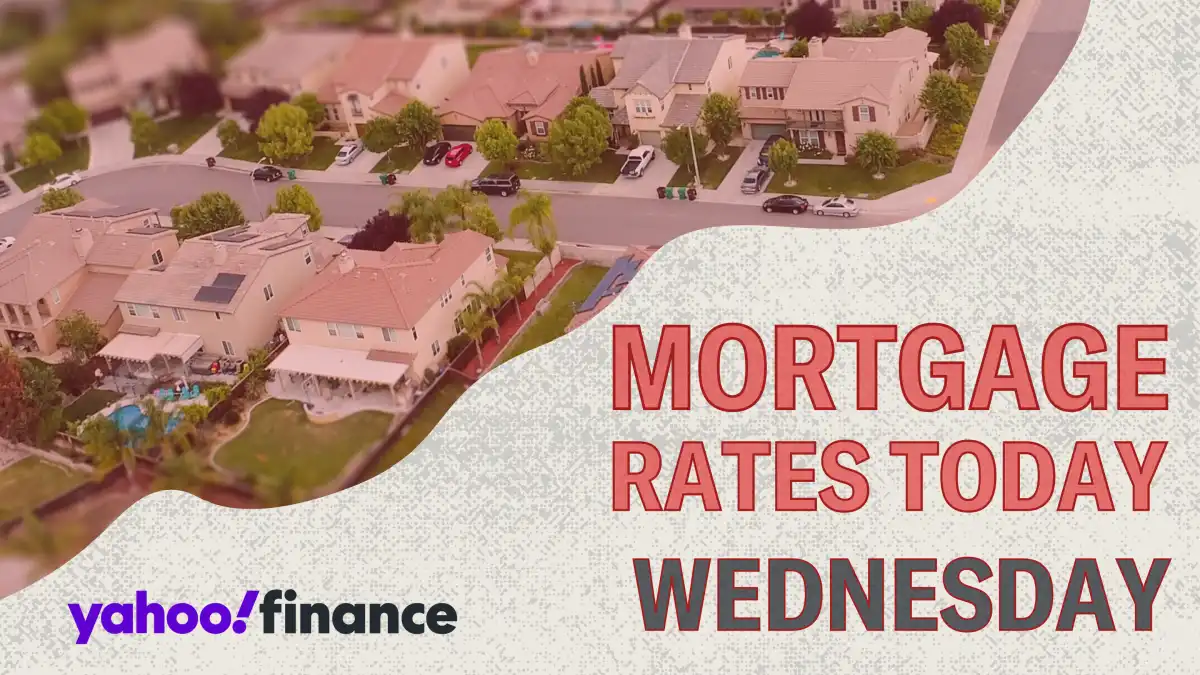

"Teachers deserve more pay to cover living costs. Let's value their work with action, not just appreciation. Invest in education."

Anthony Noto's fear of failure has driven him to success, leading SoFi to strong earnings and a promising future.

Republic First Bank seized by regulators after pulling out of import funding discussions, leading to takeover by Fulton Bank. Market impact significant.

Consumer prices rose in February, casting doubt on inflation hitting the 2% target, impacting mortgage rates and rental prices.

Couple transforms rundown bungalow into stunning home; saves money by doing renovations themselves, creating dream space. #HomeTransformation #DIY #DreamHome

Progressives celebrate Biden's $1.2 billion student loan forgiveness, but push for more and criticize conservatives who argue the cancellation is unfair.

Marilyn Mosby, former Baltimore State's Attorney, found guilty of making false statements to mortgage lender in federal court. Jury acquitted fraud.

Former Baltimore State's Attorney Marilyn Mosby found guilty of making false statements to a mortgage lender in federal court.

SoFi's earnings and revenue outlooks beat estimates, with shares jumping 19%. CEO Noto highlights non-lending segments and membership growth.

Michigan's Unemployment Insurance Agency (UIA) gave millions to ineligible people, leaving others without benefits. Audit found $250M improperly disbursed.

Get the latest on mortgage rates and find out how to save money on your mortgage in the long run.

Small Business Saturday is approaching, and small business owners are finding ways to survive and thrive despite economic uncertainties. #smallbusiness

Inflation has led to an increase in mortgage rates, with the Federal Reserve raising its federal funds rate. Experts predict rates will remain high.

AMC stock plunges as judge approves APE shares conversion plan. Find out why investors are concerned. #AMC #stockmarket

Properties are being sold before they hit the market in California, with some agents double-ending deals.

SoFi Technologies may benefit from easing inflation and is gaining favor among investors. It aims to disrupt traditional banking and appeals to a younger demographic. Despite some analysts' pessimism, the unique fintech firm has potential for a longer-term rally.

SoFi Technologies, a fintech firm aiming to disrupt traditional banking, may see a longer-term rally as inflation eases.

Mortgage rates remain steady for home purchases, rise for refinancing.

Experts predict mortgage interest rates will drop in late 2023.

If you've been keeping up to date with financial news, odds are you've come across plenty about mortgage loans, right? But what's the real deal with all these news and why should we be interested?

News surrounding mortgage loans often focus on two main areas: interest rates and regulatory changes. Ever heard that expression 'lower than a snake’s belly in a wagon rut’? That comes pretty close to summing up current mortgage loan interest rates! Articles touch upon ways consumers can take advantage of this golden opportunity. While others caution readers regarding negative impacts these enticing low-interest rates may have on inflation, or the potential housing market bubbles they could inflate.

Moving onto our second key player in our game - regulatory changes. Rules and regulations in the lending industry seem to evolve as fast as Usain Bolt ran his 100m record (9.58 seconds if anyone asks). New policies influence how easy or hard it is for consumers to secure mortgages like one sec your finances meet all criteria; then bam some new law tosses everything into disarray! And whatever happens at home doesn't stay at home; international tweaks too ripple down affecting us locally.

To wrap it up: Topics under 'Mortgage Loan', serve up a rich menu ranging from altering interest rates and shifting regulations both domestic and global ultimately impacting buyers' abilities to secure property financing.

It makes navigating through them feel like trying to steer Fred Flintstone’s car with those comically huge rollers instead of wheels. Alarming? Perhaps but also provides compelling reasons for staying informed about events shaping this sector regardless if planning buying homes soon or not because guess what?! Its effects resonate throughout various segments of society beyond just prospective homeowners!