Mark Cuban Suggests Powerball Winner Focuses Winnings on a Singular Investment

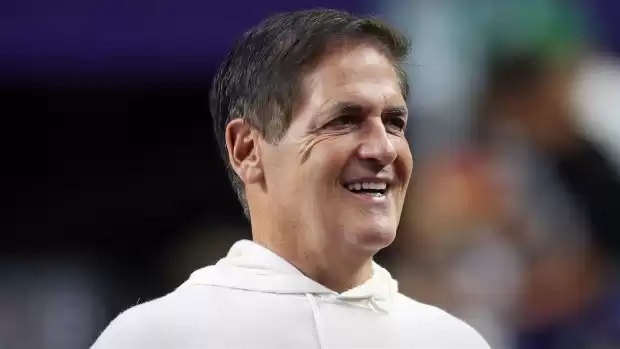

A downtown mini market in Los Angeles has sold a winning Powerball ticket worth $1.08bn. Although the buyer has yet to step forward, many have speculated about how their life is about to change. The majority of winners opt to receive half of the jackpot in an immediate lump sum payment. The National Endowment for Financial Education has previously shown that up to 70% of lottery winners spend all their winnings and go broke within a couple of years. Mark Cuban, billionaire investor and star of ABC's "Shark Tank", advises winners to hire a tax attorney and wealth manager to help them make informed decisions about their newfound wealth.

After an extensive period of anticipation, lottery officials in Los Angeles have finally announced that a small downtown mini market sold the winning ticket for the massive $1.08 billion Powerball jackpot. This staggering amount has left many contemplating just how drastically this lucky individual's life is about to change.

It's important to note that while the media often highlights the larger jackpot number, actually receiving that full amount would require the winner to receive annuity payments spread out over 30 years. However, history has shown that the majority of winners choose to receive half of the winnings as an immediate lump sum payment. In this case, that would amount to $558.1 million, which would also be subject to a 24% withholding rate, as well as later marginal federal and state taxes.

Looking back to January 2016, CNBC recalls a similar situation when a $1.6 billion Powerball drawing produced three winning tickets in California, Florida, and Tennessee. During that time, Mark Cuban, star of ABC's "Shark Tank" and a billionaire investor, advised the winners to avoid taking the lump sum payment. He argued that not only does this option result in a lower overall amount, but it also poses the risk of underestimating what can be achieved with several hundred thousand dollars after taxes.

Cuban's advice is supported by the National Endowment for Financial Education, which has revealed that up to 70% of lottery winners end up squandering their winnings and going broke within a few years. This is often due to overestimating their spending power and lacking the knowledge of how to handle sudden wealth. A prime example is Jack Whitaker, a West Virginia resident who won a $315 million jackpot in 2002 but went bankrupt just four years later. At one point, he was even robbed of $545,000 in cash near a strip club.

Other winners have made poor investment decisions, trusting individuals who promised high returns and ultimately losing their fortunes. Cuban suggests that those without investment experience would be better off securing their future by seeking the guidance of a tax attorney and wealth manager, rather than attempting to maximize their wealth through risky investments. He advises winners to simply put their money in the bank and live comfortably for the rest of their lives.

While the mini-mart owner who sold the winning ticket won't be taking home the full $1.08 billion, they will still experience a significant increase in wealth. Maria Leticia Menjivar, the owner of the Las Palmitas store for the past seven years, will receive a check for $1 million as a prize for selling the winning ticket. However, it's worth noting that this additional income will also place her in the highest-earning tax bracket.

In the midst of this excitement, Menjivar's daughter, Angie, expressed their joy, stating that they are more thrilled for the actual winner than for themselves. This sentiment reflects the understanding that winning such a massive jackpot comes with immense responsibility and challenges.

Comments on Mark Cuban Suggests Powerball Winner Focuses Winnings on a Singular Investment