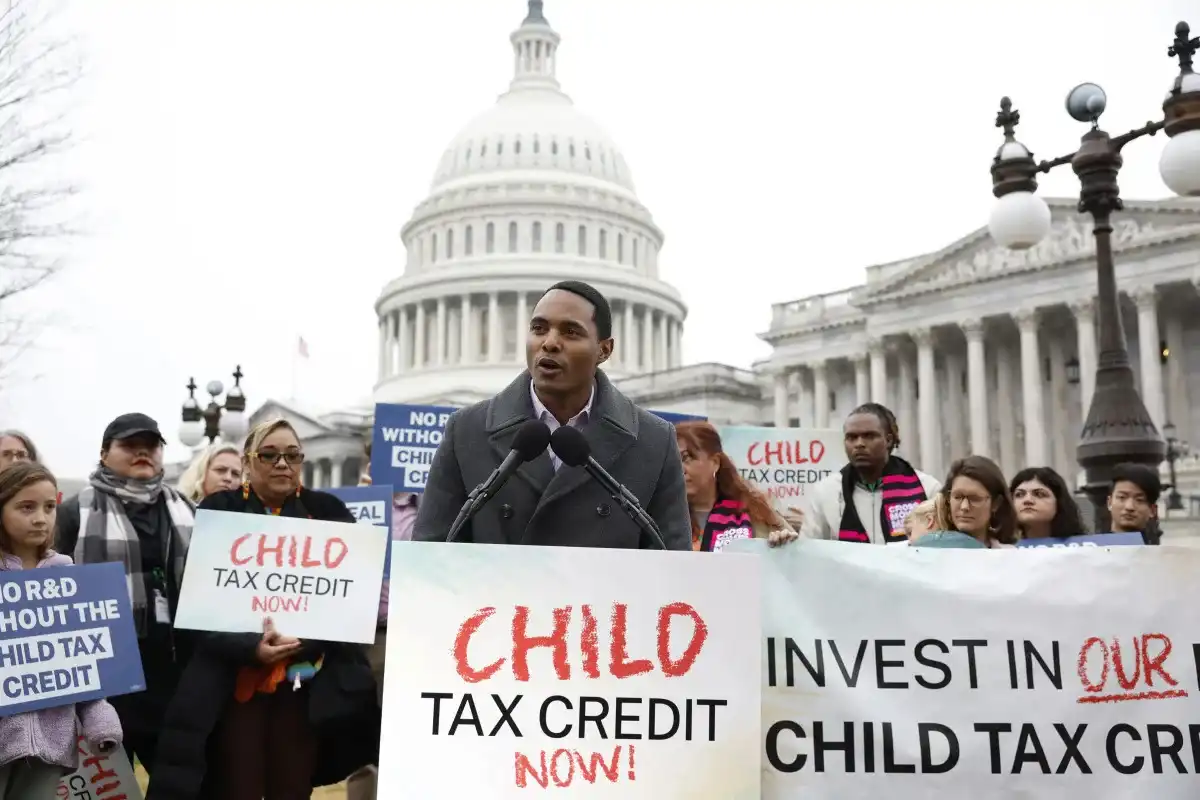

House approves Child Tax Credit expansion: benefits for who

The House has approved a bill that would expand the Child Tax Credit for parents and extend some business tax credits.

The Child Tax Credit is getting closer to an overhaul, with the House approving a bill to expand the credit for parents and extend some business tax credits. The bill, known as the Tax Relief for American Families and Workers Act of 2024, was approved with bipartisan support and is headed to the Senate for a future vote.

The push to expand the tax benefit comes after the expiration of the expanded Child Tax Credit, which increased the credit to $3,600 per child from the current $2,000 per child. Advocates have been urging lawmakers to bolster the CTC again, as evidence shows that its expansion during the pandemic lifted millions of children out of poverty.

The proposed expansion would not bring back the monthly checks to parents, but would make other important changes. The bill would make it easier for more families to qualify for the Child Tax Credit. Taxpayers could use their income from either the current or prior year in calculating the CTC, and the new calculation would multiply the parent's income by 15% as well as by the family's number of children.

If the new tax deal is passed by the Senate, the CTC amount will remain at $2,000 per child. But a third tweak to the credit could mean that more families will get more money back in their tax refund. The maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025.

The bill would also benefit millions of families through an annual adjustment for inflation in 2024 and 2025. Children with a Social Security number and who are under the age of 17 by the end of the calendar year are eligible for the CTC, and parents can claim the credit for each qualifying child if the child has lived with them for more than half the year and can be claimed on their tax return as a dependent.

The income limits for the Child Tax Credit are also part of the bill, with single filers with adjusted gross incomes below $200,000 and joint filers with less than $400,000 eligible for the full credit. The CTC amount is reduced by $50 for every $1,000 above those thresholds.

While there is no vote scheduled yet, Senate majority leader Chuck Schumer has expressed support for the bill and is working with the Finance Committee chair to determine the best way forward.

Comments on House approves Child Tax Credit expansion: benefits for who