Tesla stock rises 6%, extends rally with 'Mojo back for Musk' following latest delivery data

Tesla stock surges over 5% after impressive delivery results, gaining 60% since April low. Analysts optimistic about future growth.

7939 NW 21st St

Miami, Florida

Tesla stock surges over 5% after impressive delivery results, gaining 60% since April low. Analysts optimistic about future growth.

BuzzFeed expands stock offering to $150 million, projects revenue decline. Stock volatility and debt burden raise concerns for investors.

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

Tesla is facing challenges including a vehicle recall and CEO controversies. Stock gets a "D" grade, best to avoid investing.

Plaintiffs in major lawsuit against Geico for discrimination join civil rights attorney Ben Crump in press conference, alleging unfair practices.

Elon Musk reacts to Warren Buffett's stock price crash with "hodl" meme, sparking viral crypto community jokes and discussion on AI.

Elon Musk accused of illegally selling $7.5 billion in Tesla stock before disappointing sales data, facing insider trading claims.

Nvidia's stock has more than doubled this year, becoming the third most valuable company in the S&P 500. Eye-popping growth!

GameStop stock soared with Roaring Kitty's return, hitting a 52-week high before dropping 65%. Company raises $933.4 million through offering.

Vistra Corp. surges on S&P 500 debut, Arista Networks beats forecasts, Uber Technologies posts unexpected losses, Match Group revenue guidance disappoints.

Former Boeing whistleblower Joshua Dean dies at 45 after battling sudden illness, raising concerns about manufacturing flaws in 737 MAX planes.

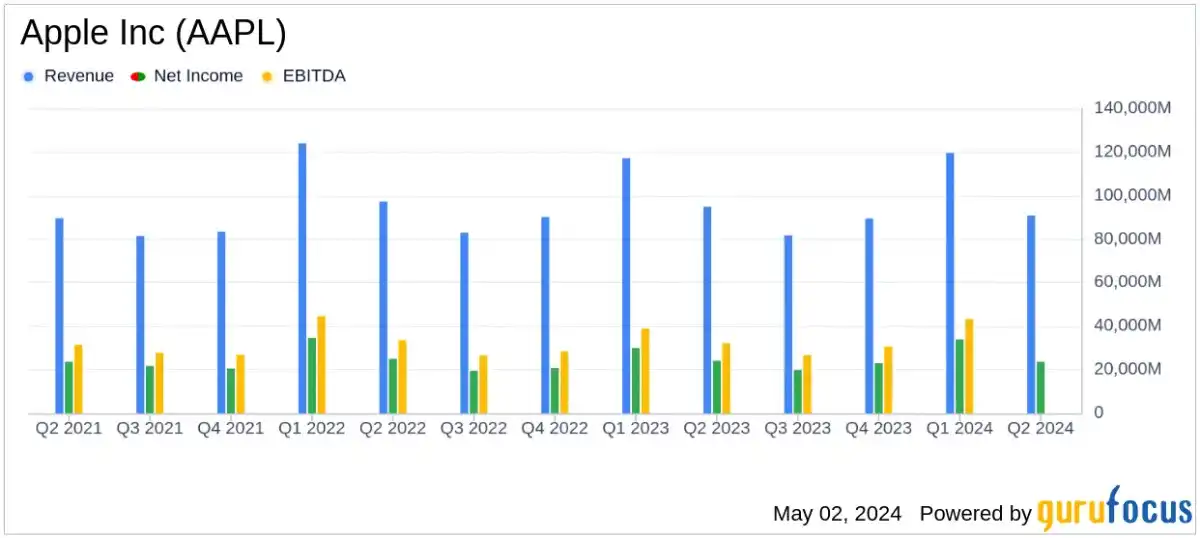

Apple's stock soars despite iPhone sales slump. Company announces dividend increase and stock buyback plan. Pressure to innovate grows.

Apple's Q2 earnings: $90.8 billion revenue, $1.53 EPS. iPhone sales lead at $45.96 billion. Services segment hits all-time high.

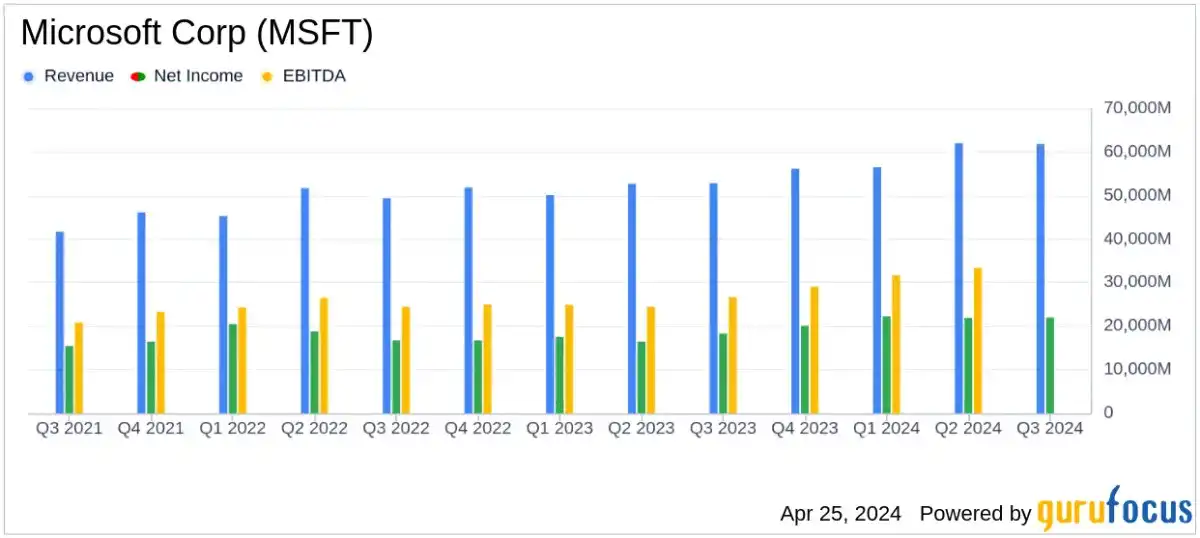

Microsoft returned $8.4 billion to shareholders in Q3, showing strong growth in revenue and net income, exceeding analyst expectations.

Tesla stock surges 11% as Elon Musk accelerates plans for more affordable electric vehicles, despite recent profit decline.

Tesla's first quarter adjusted earnings plunged 48%, but plans for a lower-priced model send shares up 8% in after-market trading.

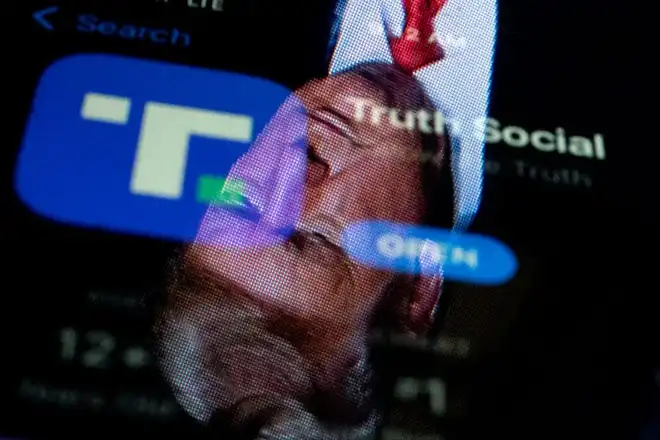

Truth Social's stock price soars over 45% in market debut, Trump's net worth skyrockets, but valuation raises questions. #TruthSocial #TrumpIPO

BLACKBAUD INC Executive VP sells shares, raising questions on valuation. High P/E ratio and revenue growth concerns prompt investor caution.

Reddit discloses IPO details, aiming for $6.4 billion valuation with plans to offer shares to Redditors. Market debut expected later this month.

NYCB stock plummets over 40% amid cash infusion rumors, deposit concerns. Management shakeup adds to uncertainty. Shares near all-time low.

DeeStream (DST) revolutionizes streaming with blockchain technology. Shiba Inu (SHIB), Litecoin (LTC), and Bitcoin (BTC) investors eye potential growth.

Asset managers are increasingly concerned about companies with low tax bills, leading to exclusions and shareholder action amid growing risks.

"Maximize your corporate savings to minimize taxes. Learn how to invest and withdraw strategically to save over 40% in taxes."

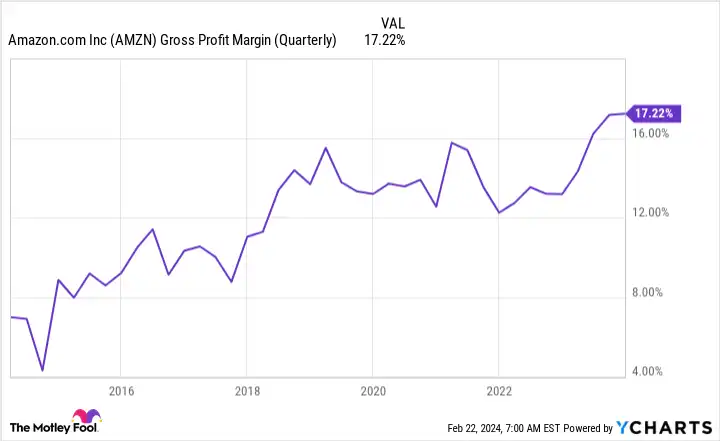

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Capital One, backed by Warren Buffett, acquires Discover Financial Services in a $35.3 billion deal to rival Visa and Mastercard.

Labor union accuses Starbucks of failing to disclose costs of anti-union campaigns, estimated at $240 million, ahead of 2024 annual meeting.

Dating app market growth is slowing, with Match Group reporting a decline in paying customers. AI may be the future.

Disney announced a new sports streaming service with Warner and Fox due in autumn. It also confirmed a tie-up with Fortnite.

Snap Inc stock plummets after disappointing Q4 revenue due in part to Israel-Hamas conflict, weak future guidance, and planned layoffs.

Meta Platforms, Inc. stock surged >20% after announcing a tripling in Q4 profit and its inaugural dividend. It's a long-term 'Buy'.

Meta Platforms (META) stock soars after better than expected earnings and first dividend announcement, leading to a tech futures rally.

Elon Musk's $55.8 billion Tesla payout is at risk after a judge ruled it unfair, potentially reducing his net worth.

Walmart's decision to split its stock has sparked a debate. High-profile tech companies have also split stocks, with positive results.

Microsoft's stock has increased by 21% over the past three months, with a high Return on Equity and expected growth.

Tesla's CEO Elon Musk discussed investor concerns about profitability, AI, humanoid robots, and Cybertruck deliveries in the fourth-quarter earnings call.

Netflix's stock surged 7.9% after beating revenue expectations and strong user growth. Analysts are bullish, but is it a buy?

Troilus Gold to sell Mike Lake project to Prospector Metals, gaining 20% stake and up to $15m milestone payment. Exciting potential ahead!

Nippon Steel clinched a $14.9 billion deal to buy U.S. Steel, outbidding rivals. The acquisition will help Nippon expand in the U.S.

SEC meeting with Grayscale, BlackRock, and Nasdaq fuels anticipation for bitcoin ETF approval. Bitcoin rallies to highest price in 20 months.

Dallas Mavericks owner Mark Cuban is selling a majority stake to the family behind the Las Vegas Sands casino.

Mark Cuban is working on a deal to sell the Dallas Mavericks to the family that runs the Las Vegas Sands casino.

Berkshire Hathaway Vice Chairman Charlie Munger has died at 99. He helped Warren Buffett build the company into an investment powerhouse.

Investors should hold NVDA stock despite valuation concerns. Nvidia's dominance in AI chips and strategies make it a winner.

High-quality company Microsoft (NASDAQ:MSFT) continues to generate strong results. OpenAI CEO Sam Altman has joined Microsoft, strengthening its position.

Walt Disney Co (DIS) has experienced a -1.76% drop in the last session. The company's revenue is expected to grow.

Disney's quarterly revenue grew 5%, but fell short of expectations. The company announced an ambitious $7.5 billion cost-cutting plan.

Invest in the small-cap uranium stock set to explode in the new uranium bull market. Get ahead of the herd and grab our FREE report now! #UraniumStocks #ProfitWindfall

Rivian's announcement of $1.5 billion in convertible notes has caused concern among shareholders, as it implies a continuing cash burn and lack of future revenue. The company also reported a net loss of around $720 million for the fourth quarter. Rivian stock traded down by about 20%.

McDonald's is bringing back the McRib sandwich, using scarcity marketing to create consumer urgency and drive sales. The success of the McRib has even sparked competition in the fast-food industry. McDonald's has a positive financial performance and is an attractive investment for income-focused investors.

Mongolia Growth Group's stock has risen by 14% in the past month. The company's ROE is lower than the industry average, but it has experienced significant net income growth. The company does not pay dividends and reinvests its profits into the business. There are positive factors to consider, but it is important to assess the risks.

Demystifying Shareholder News Content

Ever paused and wondered, what exactly is shareholder news content? It's a captivating adventure we're about to embark on together!

The keyword 'Shareholder' opens up an extensive range of vibrant sub-topics. Picture it like an enormous oak tree with countless branches spreading out. Shareholder news fundamentally comprises insights into the decisions, activities, profits and losses affecting shareholders of various companies. Quite intense? Well yes, but incredibly exciting too!

You see that ray of sunshine after a stormy night? That's how illuminating Investor Updates can be - they provide updated information regarding stock market fluctuations, business performance or corporate governance changes influencing stake value.

Ever fancied yourself as a detective solving cases? This is your chance! Earning reports often yield deep insight into the financial quotient of corporations which in turn portrays both present and potential future scenarios for its stakeholders!

"A good story never fails", isn't that so! Stories make investor profiles more relatable than hard-nosed numbers ever could. These humanized accounts entwined with expert analysis help in predicting trends by dissecting past patterns – two peas-in-a-pod I'd say!

So you see folks; everything under "Shareholder" builds upon numerous intertwining threads resulting in this wonderful tapestry that informs us about multiple aspects shaping company stocks. Wouldn’t you agree now, shareholder news sweeps through broader radii than just simple balance sheets?