Reality Star Julie Chrisley Resentenced Bank Fraud Case

Chrisley couple's bank fraud scheme sentencing recalculated by appeals court. Julie's sentence vacated due to improper calculation. Case sent back for resentencing.

7939 NW 21st St

Miami, Florida

Chrisley couple's bank fraud scheme sentencing recalculated by appeals court. Julie's sentence vacated due to improper calculation. Case sent back for resentencing.

Trump's New York trial nears its end after closing arguments. Charges stem from hush-money payment to Stormy Daniels. Cohen credibility questioned.

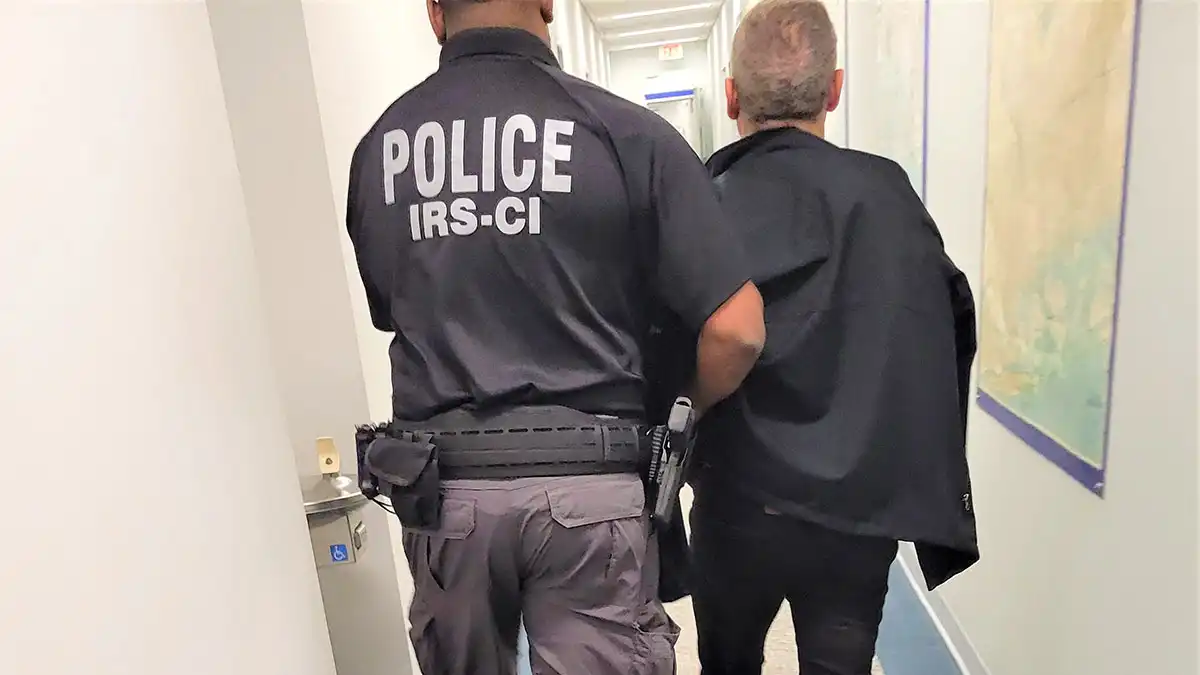

Bronx tax preparer "the Magician" arrested in $100 million tax rip-off scheme, facing federal charges including tax fraud and conspiracy.

Chrisley family settles lawsuit with former Georgia tax official, as Todd and Julie Chrisley serve prison sentences for bank fraud.

Hunter Biden skipped a congressional subpoena to hold a press conference. He painted himself as a victim and denied his father's involvement.

Shakira avoids prison time after striking a deal to settle her tax fraud case in Spain, despite maintaining her innocence.

Shakira has reached a settlement with Spanish authorities to avoid a trial that accused the singer of evading millions of dollars in taxes.

Senator Elizabeth Warren warned of cryptocurrency scams targeting seniors, citing a $2.5 billion loss in 2022 and endorsing new protective legislation.

Hunter Biden, son of US President Joe Biden, is facing three felony federal gun charges, including lying on a federal form. This raises questions about the hypocrisy of the Biden administration's stance on gun control.

Hunter Biden indicted on felony gun charges related to a 2018 revolver purchase while addicted to cocaine. Republicans demand further investigation.

Greta Gerwig's film, starring Margot Robbie as "Stereotypical Barbie," addresses gender stereotypes and Barbie's unrealistic figure. The film also explores the personal struggles of Barbie's creator, Ruth Handler.

Spanish court orders Shakira to stand trial for alleged tax fraud.

Delving into the World of Tax Evasion

Ever wondered what's hidden beneath the surface of white-collar crime? Let’s delve deep into one particular topic we often come across in news content, that's Tax evasion. So, what really lurks behind these two words?

When we arc our lens towards news coverage around tax evasion, we commonly find subjects such as high-profile cases featuring celebrities or multinational corporations. It's like watching an intricate game of hide and seek where billions are at stake. Remember when soccer star Lionel Messi and his father were convicted for tax fraud? Or when Apple Inc was slapped with a €13 billion retrospective tax bill by the European Union? High stakes indeed!

Not just limited to courtrooms and corporate boardrooms, another dimension uncovered within this realm involves changing national and global policies aimed at mitigating tax evasion. For instance, discussions about how legislations like the United States’ Foreign Account Tax Compliance Act (FATCA) influences global finance practices.

"So taxing can taxes be?" Maybe you're pondering over this pun-intended question right now! The truth is that many complexities revolve around tax laws which become breeding grounds for clandestine activities.

These countless stories paint a chilling tableau about those who manipulate complex systems for personal gain through fraudulent methods – quite akin to characters from a gripping thriller novel! But ever considered why they risk getting caught?

While greed could be an obvious driver, sometimes it stems from dissent against perceived unfair taxation or loopholes waiting to be exploited. Whatever their reasons might be, it ultimately leads us down a road questioning on ethics and economic implications - topics frequently surfacing in due course.

Surely makes you think twice before dismissing 'tax' as mere jargon!