judge orders trump and company $354 million ny fraud case

Judge rules that Donald Trump and the Trump Organization must pay $354 million in fines and are barred from seeking loans.

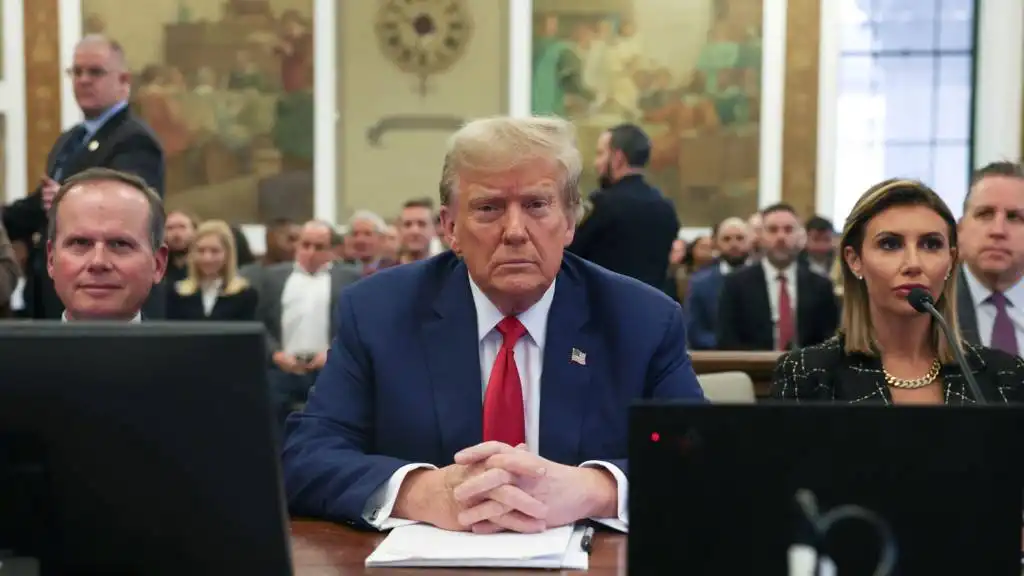

Former President Donald Trump and the Trump Organization have been ordered to pay a $354 million fine and are prohibited from seeking loans from financial institutions in New York for three years, according to a judge's decision issued Friday in the state's civil fraud case. The ruling also includes a three-year ban on Trump serving as an officer or director of any New York corporation.

Judge Arthur Engoron issued his judgment in a 92-page decision on Friday. This ruling represents one of the most significant corporate sanctions in New York history. Trump has stated that he plans to appeal.

The judge's decision also prohibits Trump, Allen Weisselberg, the former chief financial officer of the Trump Organization, and Jeffrey McConney, former corporate controller, from serving as an officer or director of any New York corporation or other legal entity in the state for three years. Weisselberg and McConney are also permanently banned from serving in the "financial control function" of any New York corporation.

According to Engoron's order, "The evidence is overwhelming that Allen Weisselberg and Jeffrey McConney cannot be entrusted with controlling the finances of any business."

Trump and his company are also prohibited from applying for loans from any financial institution registered with the state for three years.

In addition to imposing restrictions on Trump, the order bans his two oldest sons, Eric Trump and Donald Trump, Jr., from serving as an officer or director of any New York corporation or legal entity for two years. The two, who serve as executive vice presidents at the Trump Organization, must also pay more than $4 million apiece, including interest. Weisselberg is ordered to pay a $1 million penalty.

Alina Habba, one of Trump's attorneys who also serves as his spokeswoman, denounced the decision and confirmed the former president will appeal Engoron's judgment.

"This verdict is a manifest injustice -- plain and simple. It is the culmination of a multi-year, politically fueled witch hunt that was designed to 'take down Donald Trump,' before Letitia James ever stepped foot into the Attorney General's office," she said in a statement. "Countless hours of testimony proved that there was no wrongdoing, no crime, and no victim."

She continued: "Let me make one thing perfectly clear: this is not just about Donald Trump -- if this decision stands, it will serve as a signal to every single American that New York is no longer open for business."

A spokesperson for the Trump Organization also defended the company's financial dealings, calling the ruling a "gross miscarriage of justice."

"If the Attorney General is permitted to retroactively insert herself into private commercial transactions between sophisticated parties, no business transaction entered into in the State of New York will be beyond the attorney general's purview," the spokesperson said. "Every member of the New York business community, no matter the industry, should be gravely concerned with this gross overreach and brazen attempt by the attorney general to exert limitless power where no private or public harm has been established."

New York Attorney General Letitia James brought the civil suit in 2022, asked the judge to bar Trump from doing business in the state and sought a penalty of $250 million, a figure her office increased to $370 million by the end of the trial. Trump, the Trump Organization and several executives, including his two eldest sons, Donald Jr. and Eric Trump, were named as co-defendants in the suit.

Trump and his legal team long expected a defeat, with the former president decrying the case as "rigged" and a "sham" and his lawyers laying the groundwork for an appeal before the judgment was even issued.

Even before Friday's ruling, the judge had largely affirmed James' allegations that Trump and others at his company inflated valuations of his properties by hundreds of millions of dollars over the course of a decade, and misrepresented his wealth by billions. The scheme, the state said, was meant to trick banks and insurers into offering more favorable deal terms.

Engoron ruled in September that Trump and the other defendants were liable for fraud, based on the evidence presented through pretrial filings.

The trial, which began in October and wrapped up in January, focused on other aspects of the lawsuit related to alleged falsification of business records, issuing false financial statements, insurance fraud and conspiracy.

The financial penalty James sought, known as disgorgement, is meant to claw back the amount Trump and his company benefited from the scheme. (Under New York law, disgorgement cases are decided by a judge, not a jury.)

Ivanka Trump, the former president's daughter and once an executive at the Trump Organization, was originally named as a defendant in the suit, but an appellate court later dismissed allegations against her, citing the state's statute of limitations.

The lawsuit laid out seven causes of actions -- the claims of illegal conduct that James' office said entitled the state to claw back ill-gotten profits and warranted severe sanctions against the defendants:

- Persistent and Repeated Fraud

- Falsifying Business Records

- Conspiracy to Falsify Business Records

- Issuing False Financial Statements

- Conspiracy to Falsify False Financial Statements

- Insurance Fraud

- Conspiracy to Commit Insurance Fraud

The claims revolve around financial statements given by Trump and his company to banks and insurers. The statements were prepared by accounting firms using spreadsheets of underlying data that included vast inflations of Trump property valuations.

The defendants lost on the first claim, persistent and repeated fraud, before the trial even started.

The Sept. 26 fraud ruling

Engoron agreed in September with James' office that it was beyond dispute, based on evidence presented through pretrial filings, that Trump and his company provided banks with financial statements that misrepresented his wealth by billions.

"The documents here clearly contain fraudulent valuations that defendants used in business," Engoron wrote in the Sept. 26 ruling.

Engoron found as fact in that ruling that Trump and the company overstated the valuations of many properties by hundreds of millions of dollars. He cited the Palm Beach Assessor valuation of Trump's Mar-a-Lago club at between $18 million and $28 million for each year between 2011 and 2021 -- the values for which he paid local property taxes. During those years, Trump valued the property at between $328 million and $714 million on his annual statements of financial conditions.

Trump seized on the Mar-a-Lago valuation, complaining about it frequently during public appearances, in social media posts, and in his own defense at trial.

Donald Trump and three of his children testified during the trial, which began on Oct. 2 and ran for more than three months.

Ivanka Trump and her brothers said they couldn't recall many of the interactions at the center of the case, including deliberations related to efforts to secure financing and insurance for Trump property developments.

Eric and Donald Trump Jr. both sought to pin blame on the company's accountants, claiming they had little involvement in the preparation of financial statements that misrepresented the values of company properties.

In his ruling, Engoron determined that there was "sufficient evidence" that Eric and Donald Trump Jr. "intentionally falsified business records." But he found that Eric Trump "intentionally" gave McConney "knowingly false and inflated valuations" for the Seven Springs estate, a Trump-owned property in Westchester County, New York.

The former president took the stand on Nov. 6, stopping to address the media on his way into court. "It's a very sad situation for our country," he said.

Under oath, he gave long-winded answers, seeming to test the judge's patience. At one point Engoron addressed Trump's lawyers, saying, "We got another speech," and urging them to "control him if you can."

As questioning continued, Trump defended the valuations of various Trump Organization properties said the company's statements of financial condition included a disclaimer that absolved him of responsibility for inaccuracies.

Engoron's order criticized Trump for failing to answer many questions, which the judge said damaged his credibility.

"Overall, Donald Trump rarely responded to the questions asked, and he frequently interjected long, irrelevant speeches on issues far beyond the scope of the trial. His refusal to answer the questions directly, or in some cases, at all, severely compromised his credibility."

Lawyers for the Trumps argued that the financial statements were accurate and well done, and also that valuations are subjective. They said that documents James' lawyers called evidence of fraud were actually evidence of Trump's "genius." Any misrepresentations or breaks with accepted accounting practices were his accountants fault, they said.

The former president himself also blamed his accountants, but maintained that his financial statements actually undervalued his properties and net worth.

Comments on judge orders trump and company $354 million ny fraud case