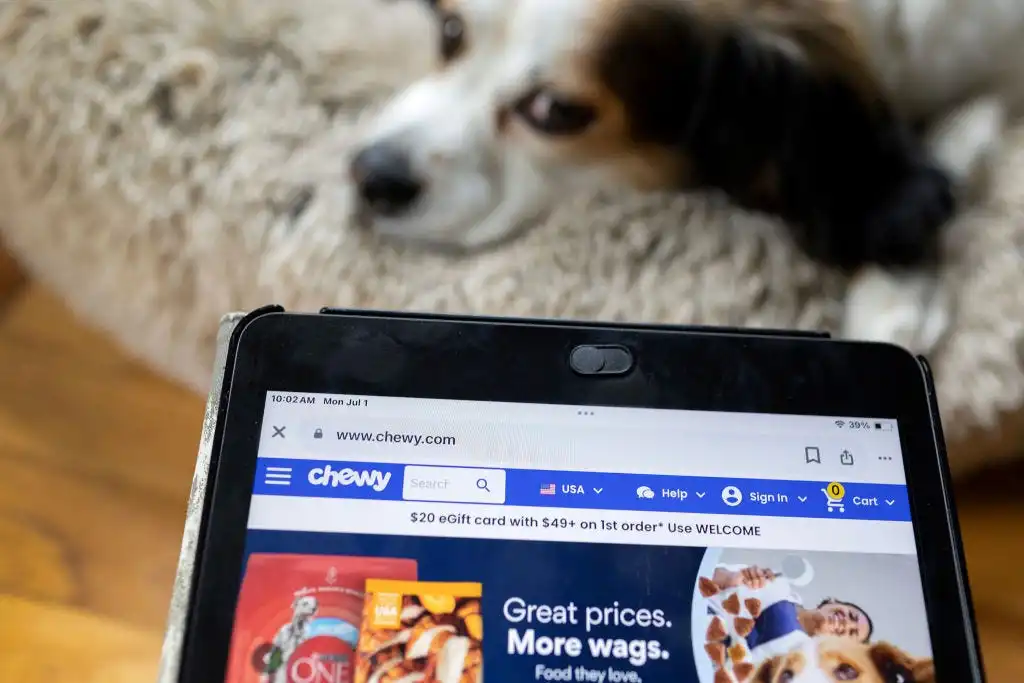

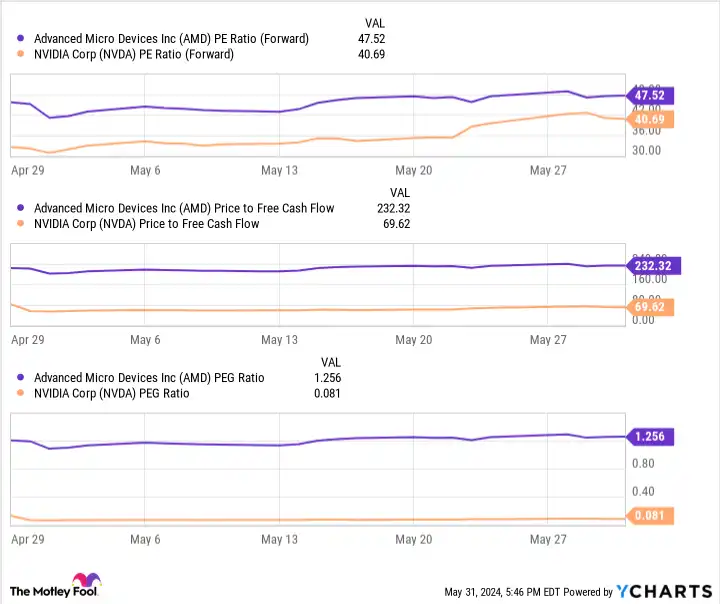

Chewy stock fluctuates as Roaring Kitty reveals $245 million stake

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

7939 NW 21st St

Miami, Florida

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

Argentina is making economic reforms to reduce imbalances and control inflation, while Chile is seeing growth driven by copper demand.

Tech giants Apple, Microsoft, and Nvidia are racing to a $4 trillion valuation driven by AI technologies, predicts Wedbush analyst Dan Ives.

Nvidia stock skyrockets with blowout earnings and stock split, solidifying its AI leadership and exponential growth potential in the market.

Nvidia's stock price keeps rising, up 174% in a year. Analysts predict continued growth due to AI dominance and tech market position.

Salesforce shares fall as company reports revenue miss and slashes forecast. Analyst notes AI investments impacting revenue trajectory. Stock plunge may be overreaction.

NVIDIA's stock split may start a trend among high-value tech companies, including Microsoft and Meta Platforms, identified as potential candidates.

Dogecoin (DOGE) surges with whale transactions, Shiba Inu (SHIB) faces crucial moment, Furrever Token (FURR) charms investors with unique offerings.

Palantir's stock valuation is high and facing tough competition, leading to a 13% drop in early trading. Unrealistic expectations abound.

Carvana's Q1 earnings beat expectations, with a surprise profit and higher sales. Investors excited as stock soars, but profitability uncertain.

Investors alarmed as CVS Health's Medicare division struggles, leading to a steep decline in stock price. Is it a buying opportunity?

Join Cash Flow Club for exclusive market tips and guidance. Navigate any climate with expert advice. Learn more for success.

Stripe announces decoupling payments from its stack, allowing companies with existing processors to use their products, targeting large enterprises.

Truth Social's stock price soars over 45% in market debut, Trump's net worth skyrockets, but valuation raises questions. #TruthSocial #TrumpIPO

BLACKBAUD INC Executive VP sells shares, raising questions on valuation. High P/E ratio and revenue growth concerns prompt investor caution.

Reddit discloses IPO details, aiming for $6.4 billion valuation with plans to offer shares to Redditors. Market debut expected later this month.

Asset managers are increasingly concerned about companies with low tax bills, leading to exclusions and shareholder action amid growing risks.

Palo Alto Networks' fair value is 18% higher than its analyst price target, suggesting it may be undervalued. Check out the analysis!

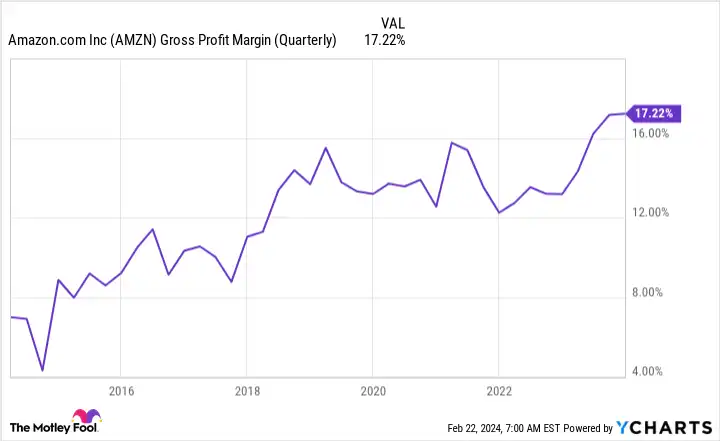

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Investors shift focus to tech sector as big tech companies pressure stock market, Nasdaq Composite drops 1%, concerns over Nvidia's earnings.

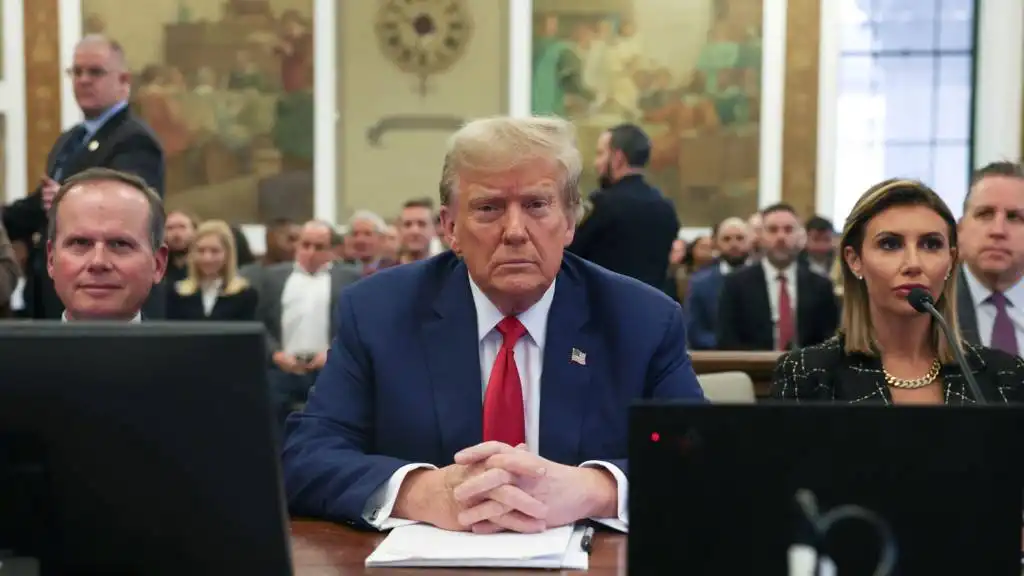

Judge rules that Donald Trump and the Trump Organization must pay $354 million in fines and are barred from seeking loans.

Arm Holdings stock surges 30% in heavy trading, outpacing Nvidia and AMD, prompting investor interest and caution. Potential market capitalization boost.

Palantir Technologies may replace Tesla in the Magnificent Seven, as its stock soars, but it faces potential contract issues.

"Ferrari's Revs Up After Signing Lewis Hamilton and Impressive Earnings Report, RACE Stock Surges with Ambitious Growth Targets"

Microsoft's stock has increased by 21% over the past three months, with a high Return on Equity and expected growth.

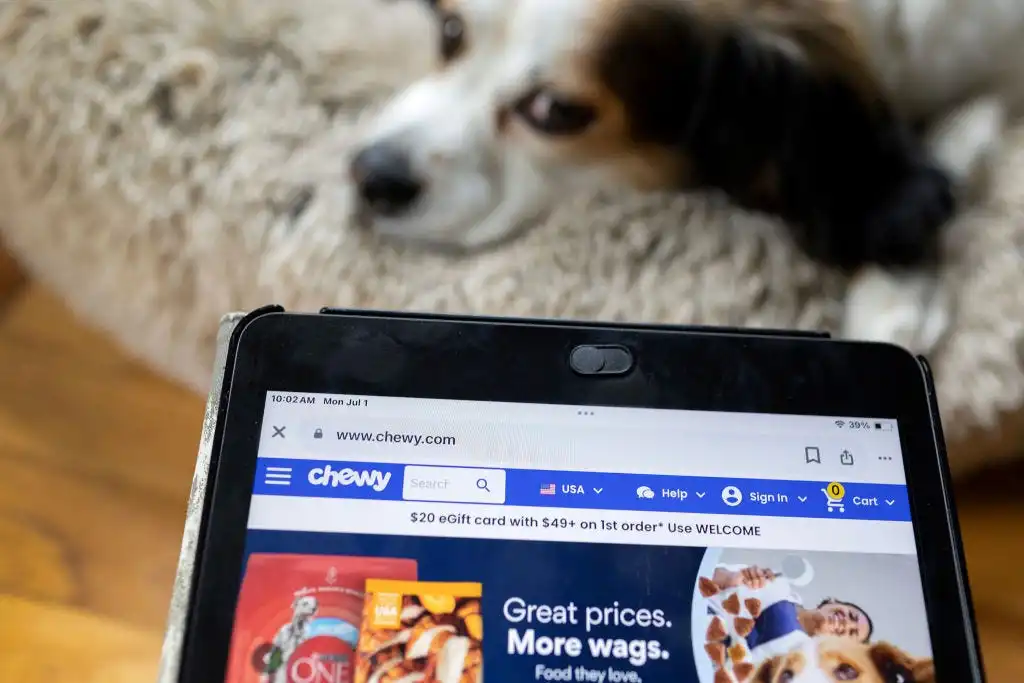

Analyst downgrades AMD due to overinflated expectations for AI chip growth, citing distorted demand signals and uncertainty about the company's future.

Federal judge blocked JetBlue's $3.6 billion acquisition of Spirit. Spirit stock fell while JetBlue's rose. Airlines to 'evaluate next steps.'

S&P 500 lost 1.5% in the first trading week of 2024, ending a nine-week streak. Analysts expect rocky start to 2024.

Members of Value In Corporate Events get exclusive ideas and guidance to navigate the market. Learn More to get ahead!

Alphabet's stock surges with the release of its latest AI model, Gemini, easing concerns about its competitive position in the AI sector.

World equity markets end November with biggest monthly rally in three years. Optimism for 2024 challenged by declining liquidity and inflation.

Investors should hold NVDA stock despite valuation concerns. Nvidia's dominance in AI chips and strategies make it a winner.

Nvidia Corporation reported strong quarterly earnings, with revenue up by more than 200%, but shares may not rise further in the near term.

High-quality company Microsoft (NASDAQ:MSFT) continues to generate strong results. OpenAI CEO Sam Altman has joined Microsoft, strengthening its position.

Sam Bankman-Fried, founder of cryptocurrency exchange FTX, has been convicted of one of the biggest financial frauds in US history. Bankman-Fried, who amassed a net worth of $26 billion before turning 30, used his wealth to gain political influence and hired celebrities to promote FTX as safe. However, prosecutors claim that his responsible image was a cover for embezzling customer funds. Bankman-Fried has pleaded not guilty to seven counts of fraud and conspiracy.

Tesla's Q3 production and delivery numbers were lower than expected due to planned factory upgrades. The company's profit margins also fell, leading to concerns about its high valuation. Tesla's stock price may decrease in the future.

Mongolia Growth Group's stock has risen by 14% in the past month. The company's ROE is lower than the industry average, but it has experienced significant net income growth. The company does not pay dividends and reinvests its profits into the business. There are positive factors to consider, but it is important to assess the risks.

Instacart's stock opened at $42 a share, 40% higher than anticipated, with a market valuation of roughly $13.9 billion.

British chipmaker Arm debuted on the public markets, with shares jumping 10% and climbing over 20% in the first 30 minutes of trading.

Arm's oversubscribed IPO could have been priced at $52 per share, above the indicated range of $47 to $51.

Billionaire investors are loading up on Apple stock, prompting retail investors to take a closer look. Apple's iPhone ecosystem is strong, and the company continues to share its success with shareholders. While there are concerns about declining sales and a high valuation, many believe Apple is still a good long-term pick.

IBEX Technologies' peers are trading at a higher premium to fair value, suggesting the company may be undervalued.

WeWork's potential failure poses a significant threat to the US commercial real estate sector, with experts warning of a "systematic shock."

Amazon's shares surged nearly 8% after the company reported a net profit of $6.7 billion in Q2, compared to a loss of $2 billion last year. The company's revenue increased 11% to $134.4 billion.

Elon Musk explains why he rebranded Twitter to X, citing the need for freedom of speech and to accelerate the release of the X app. The official Twitter account has been changed to X, along with other renamed accounts. Musk believes X will become the most valuable brand on Earth.

Shares of Carvana surge as online used car seller beats expectations.

June CPI rises by 0.2% and 3.0% over the last year, with shelter accounting for 70% of the increase; food prices also increase.

Meta's Twitter competitor, Threads, has gained 100 million users in a few days, surpassing ChatGPT. Meta's stock has risen over 135% this year, but Fidelity has written down its valuation of Twitter from $44 billion to $15 billion, representing a loss of 65.9%.

Ever wonder about the perplexing industry known as finance and what it means to 'value' something within that world? Well, let's take a peek behind the curtains. In simple terms, valuation refers to the monetary worth placed on companies, investments, or assets. You know how you'd inspect a used car and consider factors like mileage, rust distribution (if any!), and whether the heater works before you make an offer? That's similar to financial valuation!

The realm of news content under this category is vast – from investor policies affecting company valuations to real estate market assessments; there's always a buzz! Ever noticed how share prices fluctuate daily? It isn't because people just can't seem to decide! These shifts reflect perception changes regarding companies’ values based on numerous complex factors including earnings insights, economic indicators, and geopolitical events.

A significant part of financial valuation considerations may delve into sector-specific issues such as technology innovations altering perceptions toward IT enterprise worth or oil price variations affecting fossil fuel-linked sectors. Like monitoring an intricate game of chess with countless players - each move matters!

You’ll find articles debating whether new tax regulations are inflating e-commerce giants’ valuations while dampening enthusiasm for brick-and-mortar traditionalists. There's rarely a shortage of speculative discussions either: Will XYZ Company’s new invention elevate its value beyond belief—or might their legal scandals topple their stock entirely?

Valuation keeps us all guessing—and constantly absorbed—it truly encapsulates why finance never fails to ignite intrigue!