Campbell Soup Posts Strong Q3 Earnings, Lifts FY2024 Outlook

Campbell Soup beats expectations in Q3, credits success to Sovos Brands acquisition. Raises fiscal 2024 guidance, stock rises 1.4%.

7939 NW 21st St

Miami, Florida

Campbell Soup beats expectations in Q3, credits success to Sovos Brands acquisition. Raises fiscal 2024 guidance, stock rises 1.4%.

Dell Technologies beats earnings expectations, but stock tumbles in after-hours trading. AI servers segment under scrutiny. Market Domination Overtime for insights.

Salesforce shares fall as company reports revenue miss and slashes forecast. Analyst notes AI investments impacting revenue trajectory. Stock plunge may be overreaction.

Palantir's stock valuation is high and facing tough competition, leading to a 13% drop in early trading. Unrealistic expectations abound.

First Central Savings Bank reports positive earnings despite higher interest rates, with focus on loan growth and asset quality. #Banking #Finance

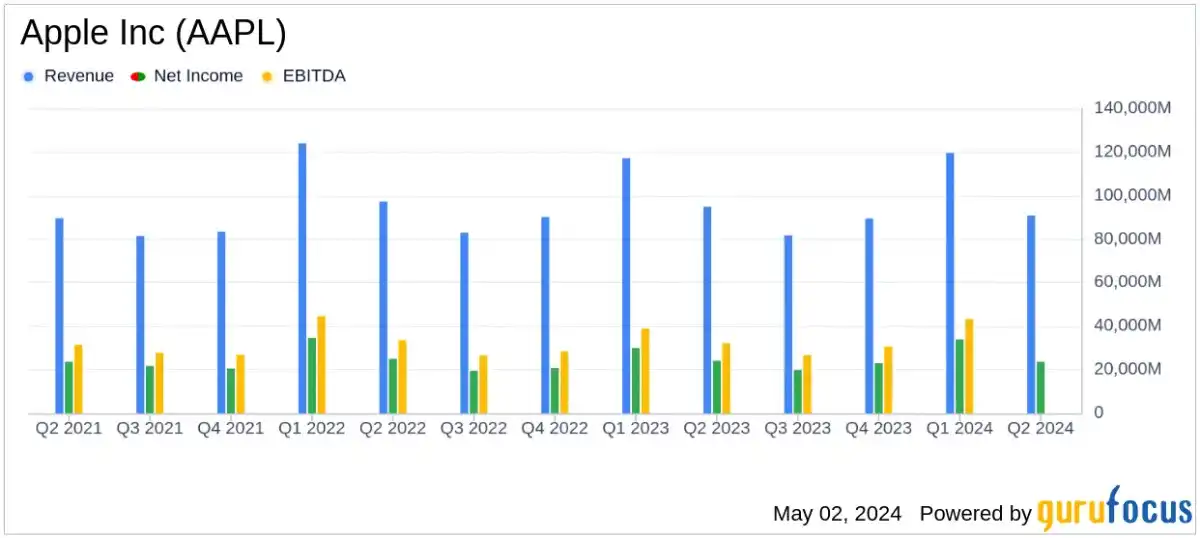

Apple's Q2 earnings: $90.8 billion revenue, $1.53 EPS. iPhone sales lead at $45.96 billion. Services segment hits all-time high.

Investors alarmed as CVS Health's Medicare division struggles, leading to a steep decline in stock price. Is it a buying opportunity?

Exclusive insights from The Quantamental Investor on navigating market volatility. Upgrade to get expert guidance and stay ahead in any climate.

Amazon's quarterly report beats projections, boosted by AI interest. Revenue and net income soar, but revenue outlook disappoints. Advertising revenue spikes.

Join Cash Flow Club for exclusive market tips and guidance. Navigate any climate with expert advice. Learn more for success.

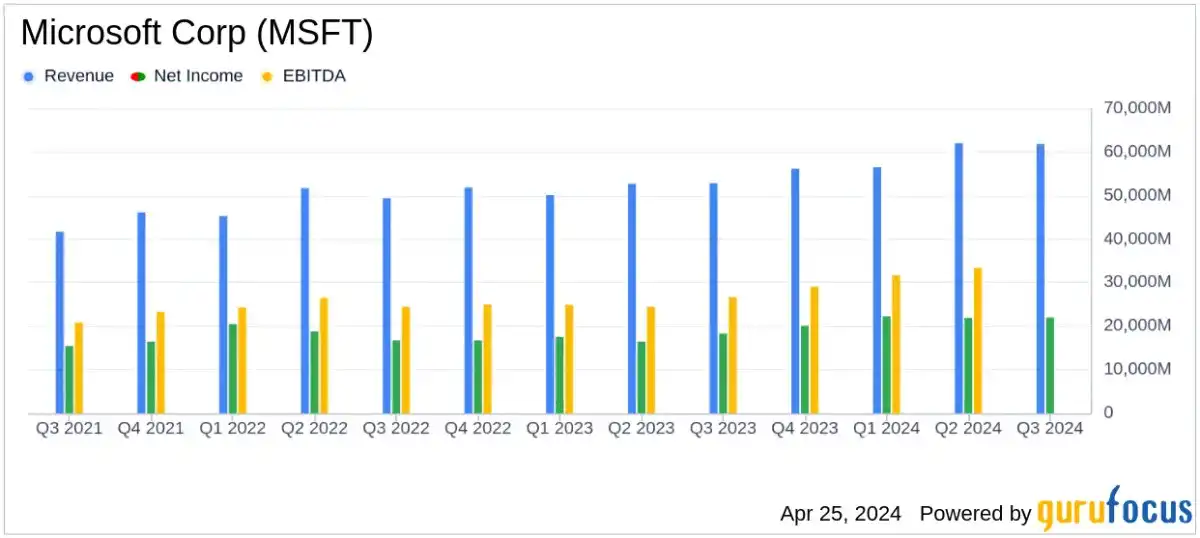

Microsoft returned $8.4 billion to shareholders in Q3, showing strong growth in revenue and net income, exceeding analyst expectations.

Tesla disappoints with Q1 2024 results, missing earnings and revenue estimates. Caution on 2024 vehicle growth. Zacks Rank #5 (Strong Sell).

Palo Alto Networks stock drops as latest earnings report outlook disappoints investors, with Q3 and 2024 estimates falling short.

Walmart's strong earnings report and key announcements, including a dividend increase and acquisition, are driving stock prices higher.

Palantir Technologies may replace Tesla in the Magnificent Seven, as its stock soars, but it faces potential contract issues.

Palantir's stock soars 28.5% after strong Q4 results, highlighting growing demand for AI platform. Revenue, billings, and free cash flow exceed expectations.

SoFi's earnings and revenue outlooks beat estimates, with shares jumping 19%. CEO Noto highlights non-lending segments and membership growth.

Intel's Q4 report beat expectations, but weak forward guidance caused a stock sell-off. AI opportunities may not be as promising as hoped.

Netflix's stock surged 7.9% after beating revenue expectations and strong user growth. Analysts are bullish, but is it a buy?

NVIDIA Corp (NVDA) stock price rose 6.43% to $495.12. Annual sales grew by 25.63% and 267.13% in earnings per share.

S&P 500 lost 1.5% in the first trading week of 2024, ending a nine-week streak. Analysts expect rocky start to 2024.

Members of Value In Corporate Events get exclusive ideas and guidance to navigate the market. Learn More to get ahead!

Nvidia Corporation reported strong quarterly earnings, with revenue up by more than 200%, but shares may not rise further in the near term.

Apple beats expectations for Q4 earnings with $1.46 per share on sales of $89.5bn, but sales fall for fourth consecutive quarter.

Microsoft beats earnings estimates with quarterly earnings of $2.99 per share, representing a surprise of 12.83%.

Tesla's stock drops after disappointing Q3 earnings, but temporary factors are impacting its bottom line. However, its dominant position and competitive advantages could lead to higher stock prices in the future.

Tesla's Q3 production and delivery numbers were lower than expected due to planned factory upgrades. The company's profit margins also fell, leading to concerns about its high valuation. Tesla's stock price may decrease in the future.

Nvidia's Q2 earnings exceeded expectations, with revenue at a record $13.51bn, 101% YoY growth, and a 429% YoY increase in earnings per share.

Disney stock is heading into its Q3 earnings report after a 6% stock price drop in Q2.

Apple is set to release its third-quarter financial results after the market closes. Analysts estimate an EPS of $1.09 on revenues of $74.24 billion.

Amazon's stock price dropped by 2.64% in the last trading session, but analysts still recommend buying the stock.

Apple reports Q3 2023 results with Services offsetting weak iPhone sales, driving total revenue of $81.8 billion.

Amazon.com Inc. saw a decrease in stock price and trading volume, but analysts still recommend buying. Revenue growth is expected.

Amazon's Q3 revenue growth is expected to be strong, beating expectations and leading to a rally in its shares.

Uber's shares fell 5.2% after concerns about slowing growth overshadowed the company's first-ever quarterly operating profit.

Fast food stocks fluctuate after quarterly earnings reports, some exceeding expectations.

Wall Street's winning week continues as inflation eases on economy.

Ever wondered about the financial health of your favorite company? You don't have to be a Wall Street expert to know. It's as simple as understanding "Earnings per share" (EPS).

"What exactly is earnings per share?", you might ask. Well, imagine if the total profits of a company were divided evenly among its shareholders, how much would each person get? That's your EPS! A higher EPS often indicates greater profitability.. neat stuff!

You're probably thinking "Where can I find this kind of news content?" . Financial news platforms are generally overflowing with details on current and forecasted EPS figures for various companies.

Broadly speaking, there are three types of information related to EPS that you'll commonly come across in financial news:

Ultimately though – just like piecing together pieces from a giant jigsaw puzzle – one has got to surmise what best fits into the broader macroeconomic picture when interpreting 'Earnings per Share' trends via ongoing corporate events reported in the media.