3 AI Stocks to Buy Post Nvidia Stock Split

InvestorPlace highlights the Nvidia stock split and the best AI stocks to buy in June for explosive growth potential.

7939 NW 21st St

Miami, Florida

InvestorPlace highlights the Nvidia stock split and the best AI stocks to buy in June for explosive growth potential.

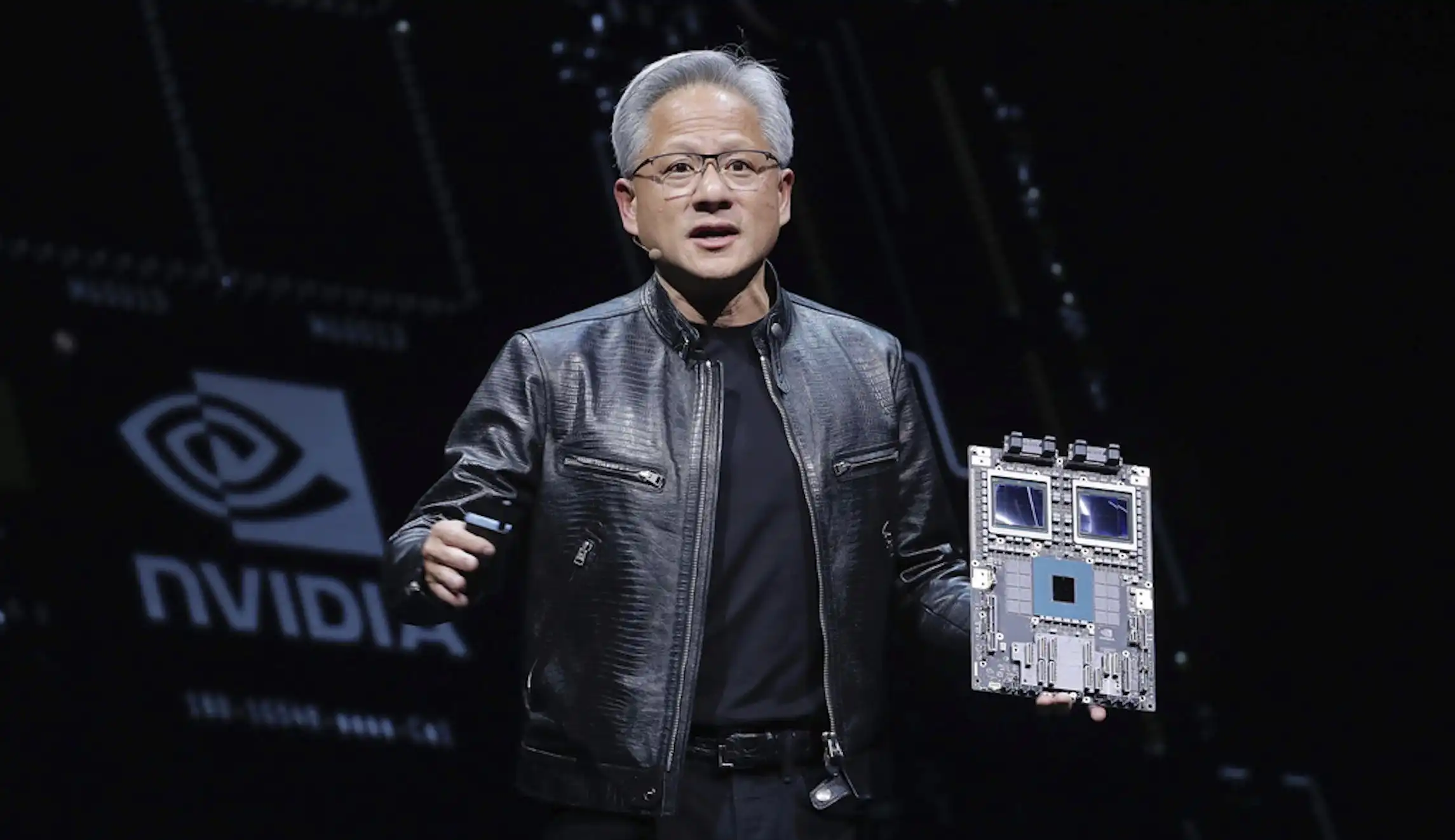

Nvidia stock skyrockets with blowout earnings and stock split, solidifying its AI leadership and exponential growth potential in the market.

Nvidia stock split boosts accessibility for retail investors, reflecting CEO's confidence in company's continued expansion amid surging demand for chips.

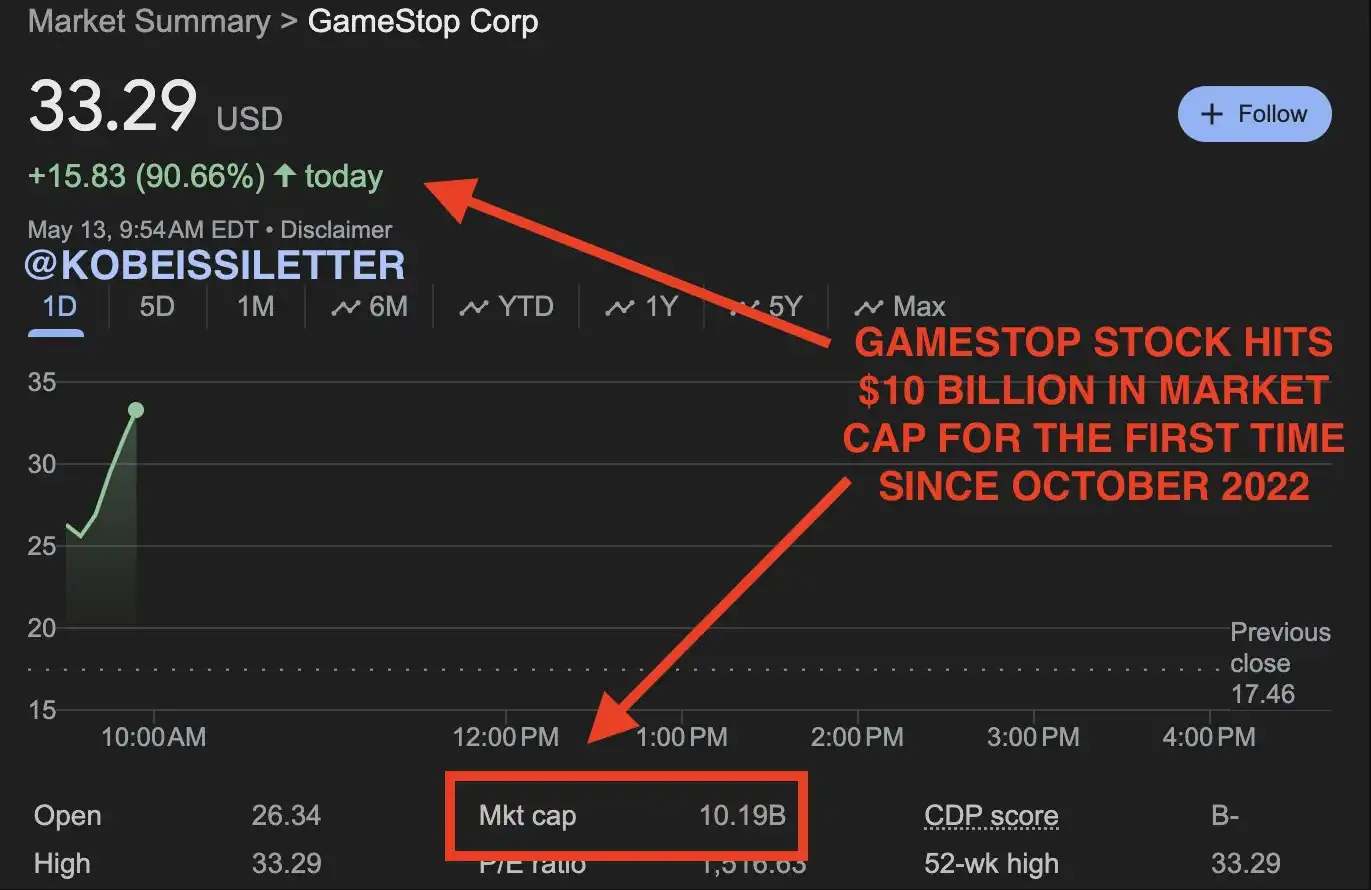

Subscribe to Alpha Reports for exclusive insights on airdrops, NFTs, and more! GameStop (GME) soars as Roaring Kitty plans YouTube livestream.

NVIDIA's stock split may start a trend among high-value tech companies, including Microsoft and Meta Platforms, identified as potential candidates.

Crypto market surges on Ethereum ETF optimism. SEC potentially approving applications, leading to Ether price surge and positive impact on altcoins.

Wall Street insider Ivan Boesky, inspiration for Gordon Gekko, dies at 87. Scandalous life marked by greed, betrayal, and downfall.

GameStop and AMC stocks surge, reigniting meme stock frenzy of 2021. Retail investors scramble to understand the resurgence. Approach with caution.

Economist Peter Schiff warns of potential downfall for Bitcoin ETF investors as digital currency's price surge may lead to reversal.

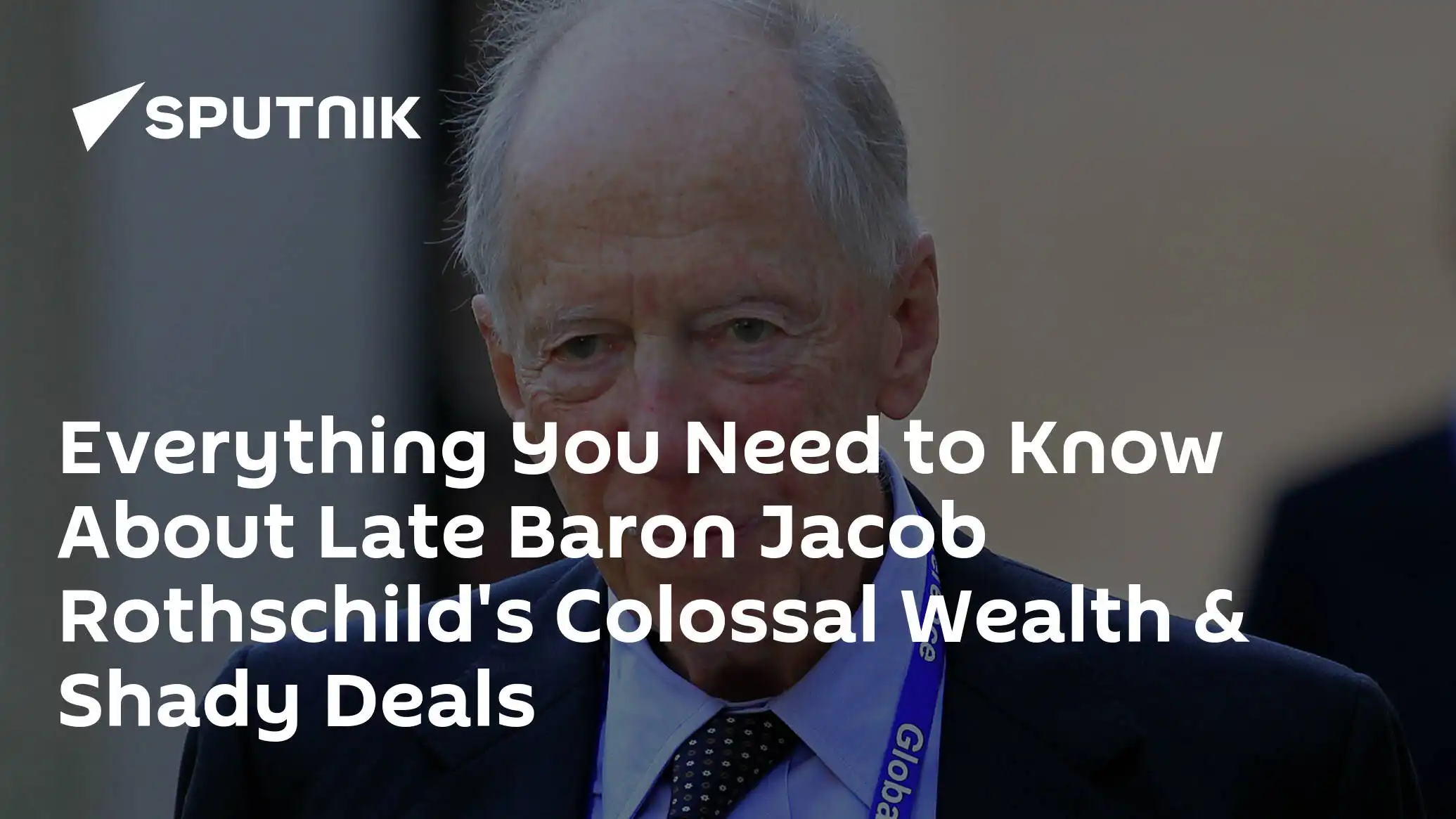

Prominent billionaire financier and philanthropist Lord Jacob Rothschild has died. His family announced the news on February 26.

Jim Cramer discusses Walmart's stock split, Berkshire Hathaway's underperformance, Domino's strong results, and Zealand Pharma's promising drug trial.

Billionaire investors are loading up on Apple stock, prompting retail investors to take a closer look. Apple's iPhone ecosystem is strong, and the company continues to share its success with shareholders. While there are concerns about declining sales and a high valuation, many believe Apple is still a good long-term pick.

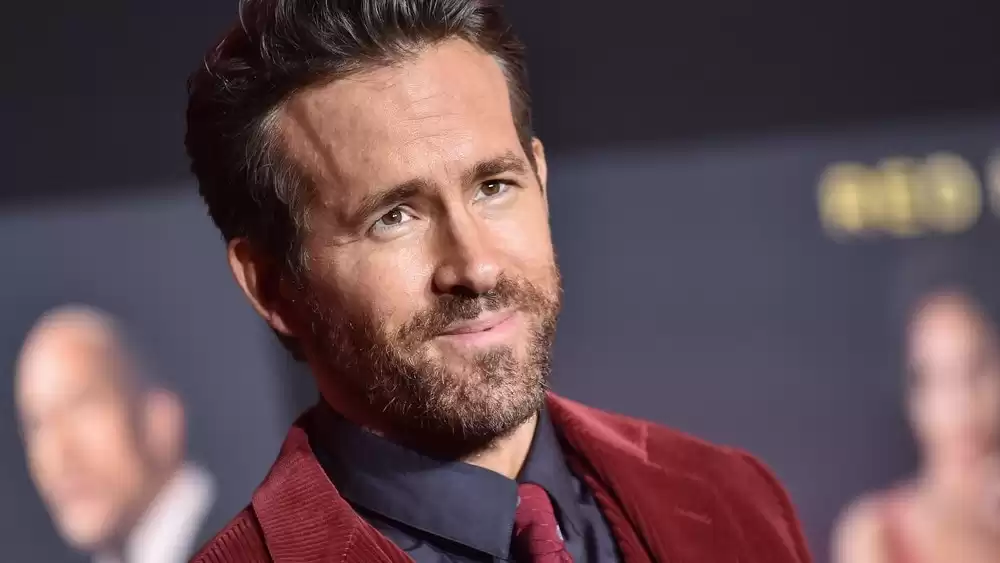

Actor Ryan Reynolds has made over $450 million from brand deals with companies like Aviation Gin and Mint Mobile, despite admitting he's "no wizard" at investing. Reynolds is known for his "valued-added investing" strategy, using his name and face to tell a startup's story and increase its return on investment. This tactic is becoming increasingly popular among venture capitalists and angel investors like Reynolds, as well as retail investors using equity crowdfunding platforms. Despite the risks, Reynolds has had a series of nine-figure exits and continues to invest in startups like Nuvei Corp.

"Goldman Sachs banker found dead after disappearing from Brooklyn nightclub, second death at same venue raises concerns."

"Barbenheimer" double feature boosts AMC attendance, breaks box office records

AMC Entertainment's shares nearly double as court blocks conversion plan.

Meta's Twitter competitor, Threads, has gained 100 million users in a few days, surpassing ChatGPT. Meta's stock has risen over 135% this year, but Fidelity has written down its valuation of Twitter from $44 billion to $15 billion, representing a loss of 65.9%.

You've probably wondered, "What exactly is in the investor news section?" Simply put, it's a treasure trove filled with information regarding anything that can offer insights into investments. Think about it as your guidepost on the labyrinthine journey towards financial freedom and success.

The beauty of this world lies in its vastness - like an ocean laden with opportunities. Let's dive deeper to uncover what gems you may discover within these waters! To start off, investment-related content focuses on topics such as stock market trends, real estate fluctuations, tech startups to watch out for – all facets of a glittering wealth creation diamond.

Ever heard about Initial Public Offerings (IPO)? You’ve hit another nugget right there! The opportunities don't end here though! How about Bond yields? Cryptocurrency updates? They’re akin to twinkling stars guiding investors through their nightly voyage.

A visit to sectors like 'Commodities' holds tales untold - Gold prices soaring or Crude oil pricing plummeting; it’s all waiting to unfold at your fingertips!

Beyond providing data points and statistics galore do you fancy some brain food too because guess what? There are articles dissecting current economic events effect on various industries or extensive interviews featuring thought leaders speaking tempestuously about next big thing in Venture Capital!

Piqued your interest yet?

If "uncertainty" was stand-in for last year shouldn't we be ready for any encounters down our road? Enter ‘Recession Strategies’, ‘Long-term Investment Plans’- Essentially everything that makes one a formidable player amidst economic trials.

In essence, each exploration under 'Investor News', prepares us better for our wealth management journey. A perfect manifestation of the saying: Knowledge Equals Power!