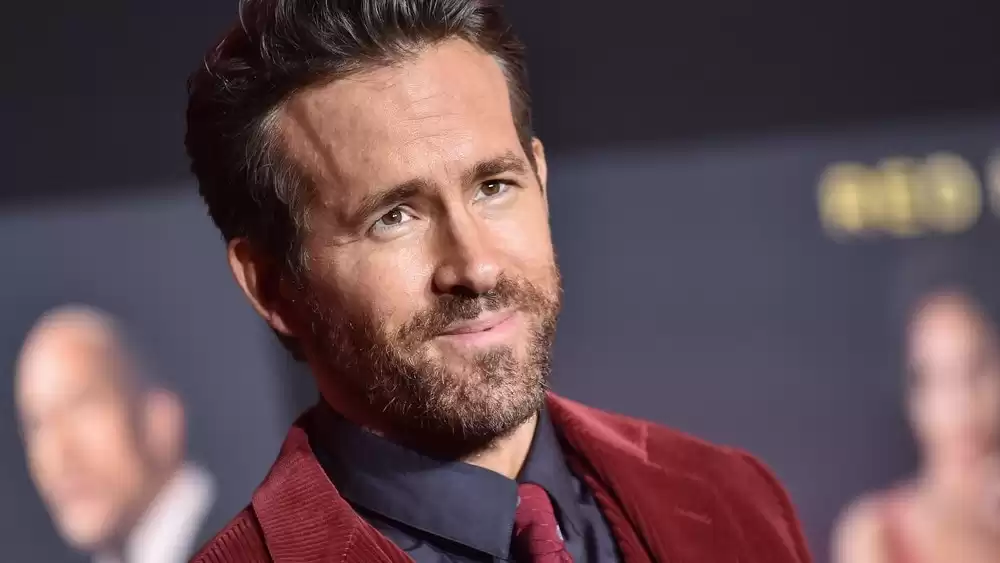

Ryan Reynolds: How he earned $450 million from Aviation Gin and Mint Mobile, despite his admission of not being an investing wizard

Actor Ryan Reynolds has made over $450 million from brand deals with companies like Aviation Gin and Mint Mobile, despite admitting he's "no wizard" at investing. Reynolds is known for his "valued-added investing" strategy, using his name and face to tell a startup's story and increase its return on investment. This tactic is becoming increasingly popular among venture capitalists and angel investors like Reynolds, as well as retail investors using equity crowdfunding platforms. Despite the risks, Reynolds has had a series of nine-figure exits and continues to invest in startups like Nuvei Corp.

Famous athletes and actors have the potential to earn millions of dollars through their careers. However, it is often the brand deals associated with their recognizable names and faces that bring in the most lucrative profits.

Actor Ryan Reynolds, known for his roles in various films, including Deadpool, sees his job as storytelling. While telling a story may not be difficult for someone like Reynolds, capturing the attention of an audience can be a challenge. This is where his fame and popularity come into play. Reynolds' widespread recognition and appeal can attract consumers, giving companies the extra few seconds they need to convey their message.

Reynolds' success extends beyond his acting career. He reportedly owned a 25% stake in Mint Mobile, which was sold to T-Mobile for $1.35 billion, earning him over $330 million. Additionally, Reynolds co-founded Aviation American Gin and sold it for $610 million, pocketing as much as $122 million from the deal.

Many would consider Reynolds a master investor, given his consistent involvement in high-value transactions. However, Reynolds himself humbly denies this label. In an interview with Fortune, he stated that he is "no wizard" when it comes to investing. Instead, he believes that emotional investment in the companies he supports is key.

Reynolds' investment strategy is often referred to as "value-added investing," a tactic commonly employed by venture capitalists and angel investors. These individuals invest substantial amounts of money in startups during their early stages and utilize their expertise to help the businesses grow. Marketing is often a significant hurdle for early-stage companies, and investors like Reynolds can leverage their fame to tell the startup's story, significantly boosting the return on investment for advertising expenses.

This approach is not only popular among venture capitalists and angel investors but also among retail investors who use equity crowdfunding platforms like StartEngine. Equity crowdfunding allows startups to raise capital from their customers and supporters, creating a loyal fan base that can contribute to the company's growth. While the impact of a single retail investor may be limited, the collective efforts of thousands of supporters can have a substantial impact on building a brand.

Reynolds is already eyeing his next investment opportunity with Nuvei Corp. (NASDAQ:NVEI). However, since announcing his stake in the company, its stock has dropped by over 60%, including a recent decline of over 40% due to poor earnings.

In addition to his involvement with Nuvei, Reynolds is an angel investor in several other startups and companies. His portfolio includes 1Password, Wealthsimple Inc., Wrexham Association Football Club, and Alpine F1 Team. He is also attempting to purchase the Ottawa Senators.

Startup investing is a risky yet potentially lucrative endeavor, as demonstrated by Reynolds' nine-figure exits and the recent decline in Nuvei's stock.

In conclusion, Ryan Reynolds has managed to accumulate over $450 million from his investments in Aviation Gin and Mint Mobile, despite his own admission of not being a wizard at investing. His ability to emotionally invest in the companies he supports and leverage his fame as a storyteller has proven to be a successful strategy. Whether it's through traditional venture capitalism or equity crowdfunding, Reynolds has become a prominent figure in the world of startup investing. However, as with any investment, there are risks involved, as seen in the decline of Nuvei's stock. Nonetheless, Reynolds continues to explore new investment opportunities and expand his portfolio, proving that his success goes beyond his acting career.

Comments on Ryan Reynolds: How he earned $450 million from Aviation Gin and Mint Mobile, despite his admission of not being an investing wizard