Nvidia stock splits, gains Washington Examiner

Nvidia stock split boosts accessibility for retail investors, reflecting CEO's confidence in company's continued expansion amid surging demand for chips.

Shares of Nvidia, a prominent tech company, began trading on a 10-to-1 split on Monday, making the stock more accessible to retail investors. The company's value has surged in the past year due to high demand for its chips, leading to its status as a sought-after equity on Wall Street.

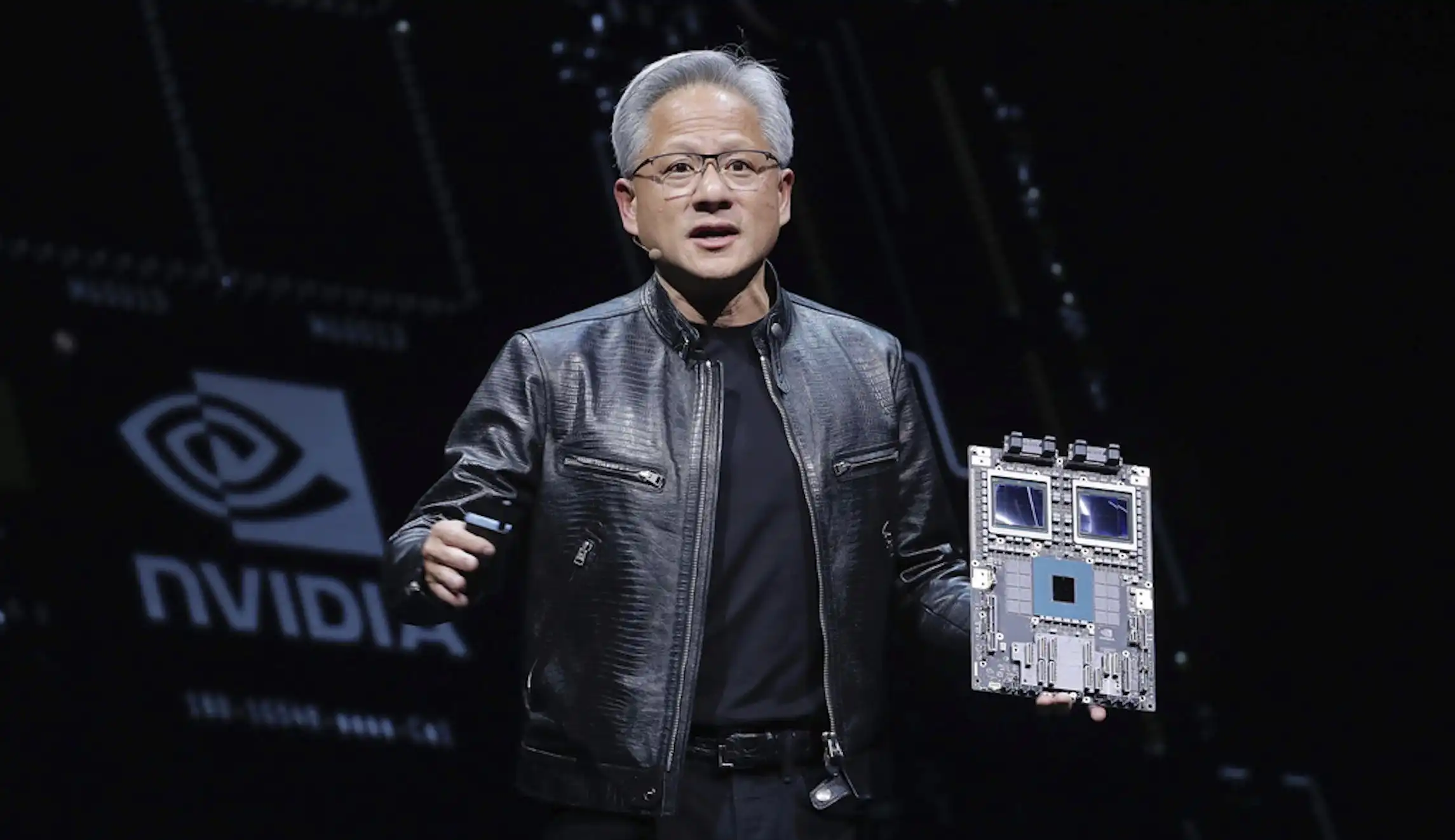

The split reduced the price of Nvidia shares to a tenth of their previous value, reflecting CEO Jensen Huang's confidence in the company's ability to expand in response to the growing market demand for high-level tech and artificial intelligence chips. While the split lowers the cost of shares, it does not alter the company's overall value, as evidenced by the market capitalization remaining near $3 trillion.

This move is a significant one for Nvidia, signaling its belief in future growth and expansion. The stock split, while uncommon for large companies, indicates management's confidence in the stock's performance going forward. Such splits often lead to positive outcomes for investors, with stocks typically outperforming the market in the following year.

Nvidia's remarkable growth over the past year has outpaced competitors and market indices, with investors reaping substantial returns. The company's focus on AI technology has positioned it as a key player in the industry, with powerful chips essential for advancements in artificial intelligence.

Looking ahead, Nvidia anticipates continued growth as AI becomes increasingly integral to various sectors. The company's record revenue in the first quarter of the year reflects its strong performance and potential for further expansion in the coming years. With the stock split making shares more accessible to retail investors, Nvidia is poised for continued success in the evolving tech landscape.

Comments on Nvidia stock splits, gains Washington Examiner