Jack Dorsey Enters Epic Rap Beef Between Kendrick Lamar and Drake

Kendrick Lamar and Drake's beef heats up with surprising support from Twitter's Jack Dorsey, Uma Thurman, and Al Green.

7939 NW 21st St

Miami, Florida

Kendrick Lamar and Drake's beef heats up with surprising support from Twitter's Jack Dorsey, Uma Thurman, and Al Green.

Senator Sinema of Arizona announces she won't seek reelection, citing political isolation and failed bipartisan efforts, leaving Senate at year's end.

Microsoft stock rises after former OpenAI CEO joins company, despite employees threatening to quit, following a multi-billion-dollar investment in OpenAI.

Hulu's new mystery drama A Murder at the End of the World was originally slated for an Aug. 29 debut.

Instacart's stock opened at $42 a share, 40% higher than anticipated, with a market valuation of roughly $13.9 billion.

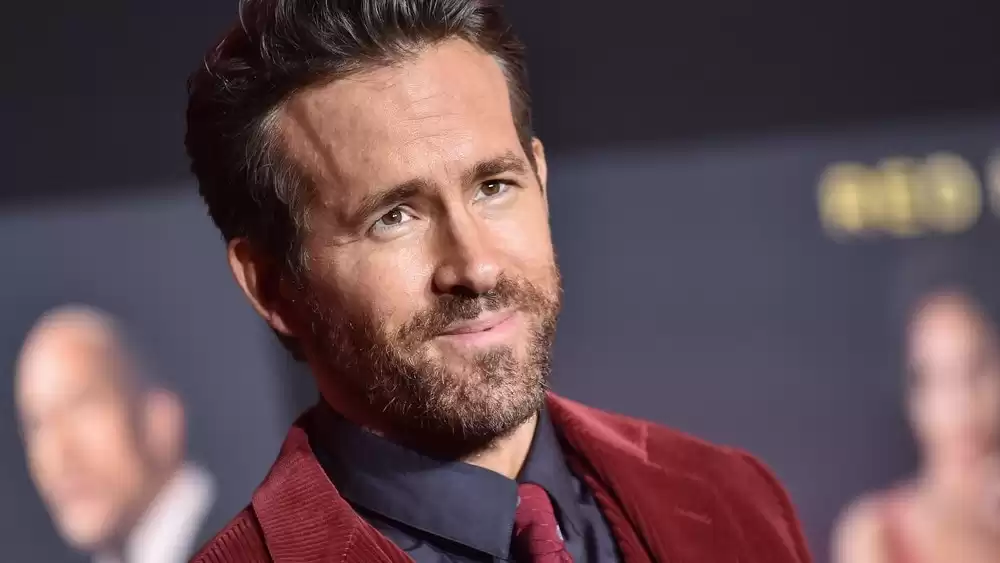

Actor Ryan Reynolds has made over $450 million from brand deals with companies like Aviation Gin and Mint Mobile, despite admitting he's "no wizard" at investing. Reynolds is known for his "valued-added investing" strategy, using his name and face to tell a startup's story and increase its return on investment. This tactic is becoming increasingly popular among venture capitalists and angel investors like Reynolds, as well as retail investors using equity crowdfunding platforms. Despite the risks, Reynolds has had a series of nine-figure exits and continues to invest in startups like Nuvei Corp.

Stanford University President, Marc Tessier-Lavigne, has resigned following allegations of research misconduct. The allegations, first reported by a student newspaper, questioned the integrity of Tessier-Lavigne's research and his failure to address errors. While a report released by the university's board of trustees confirmed some of the allegations, it did not agree with the newspaper's claims of potential research fraud. Tessier-Lavigne, who had a successful career as a neuroscientist and fundraiser, joined Stanford in 2016 and helped raise billions of dollars for the university. Richard Saller, a Stanford classics professor, will serve as interim president.

Meta's Twitter competitor, Threads, has gained 100 million users in a few days, surpassing ChatGPT. Meta's stock has risen over 135% this year, but Fidelity has written down its valuation of Twitter from $44 billion to $15 billion, representing a loss of 65.9%.

Pylon, a startup, has raised $3.2 million in seed funding to help businesses manage and direct customer conversations from communication channels like Slack and Microsoft Teams. The company aims to solve the challenge of tracking and prioritizing messages, and it plans to expand its support to other channels in the future. Pylon currently supports Slack and has already gained customers, including Hightouch. Despite launching during uncertain economic times, the company is already profitable and plans to grow its team. The funding round was led by General Catalyst, with participation from Y Combinator and other investors.

Bitcoin shows signs of optimism despite SEC lawsuits and stagnant price.

One of the most thrilling areas in finance today, Venture Capital (VC), offers a dynamic blend of news topics. Curious to know more about VC? Keep on reading!

Much like an adrenaline-filled rollercoaster ride, venture capital involves high risk and potentially high returns as it mostly revolves around investing in start-ups or young companies with significant growth potential. Whether you're eager to gain insight into innovative startups that just secured milestone funding or established firms indulging their appetite for calculated risk, dive into this captivating world!

The news content surrounding VC is fundamentally diverse and vibrant. But what exactly can we unearth here?

Firstly, we run into stories about newly funded startups so often - exciting, right? Which budding entrepreneur has caught the eye (and opened the wallet) of who's who in VC? It's all there waiting behind those headlines! Funding announcements unconsciously play out dramas featuring human ambition fuelled by monetary injections.

Venture capitalists also regularly grace the dais at conferences and forums sharing their wisdom born from personal experience. They discuss trending sectors poised for disruption or delve deeper into strategic investment philosophies.

A perpetual source arrives via comprehensive rankings where VCs are categorized based on their portfolio performance; these tables fast becoming emblems of entrepreneurial influence within our economy that succinctly adds context to investor profiles.

Besides all this bustling activity, one cannot discount regulation updates regarding fundraising laws which may impact the workings of VC big time! Such broadcasts serve as pivotal reminders how intertwined industry actions remain with national policy frameworks.

So whether you’re pondering your own startup future or simply oblivious about how money makes things tick: Venture Capital inundates us with engaging narratives saturated richly in business acumen coupled with fearlessness toward uncertainty.