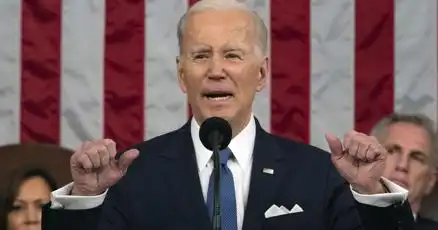

Biden State of the Union: Business Tax Hikes, Middle Class Tax Cuts, Lower Deficits

Biden to unveil plan to raise corporate taxes in State of the Union address, aiming to trim deficits and cut taxes.

President Joe Biden is gearing up for his State of the Union address with a bold plan to raise corporate taxes and use the funds to address budget deficits and provide tax relief for the middle class. This move comes as Biden aims to address voters' concerns about the rising cost of living, especially in an election year with Republican control of the House.

In his upcoming address, Biden will contrast his proposals with Republican plans to extend former President Donald Trump's expiring tax breaks and further reduce corporate tax rates. The key highlights of Biden's plan include eliminating the deduction for employee pay above $1 million, raising the corporate tax rate to 28%, and implementing a minimum tax rate for major companies to prevent tax avoidance.

Additionally, Biden's proposal includes a minimum federal tax rate of 25% for billionaires and higher Medicare taxes for individuals earning over $400,000. These measures aim to generate revenue to expand the Earned Income Tax Credit and Child Tax Credit for lower-income families, as well as make health insurance premiums more affordable for those covered under the Affordable Care Act.

Overall, Biden's economic agenda seeks to reduce the national debt by $3 trillion over the next decade, similar to his previous budget proposal. While it is unlikely to become law due to Republican opposition, Biden's State of the Union address serves as a platform to communicate his vision to the American public and showcase his commitment to addressing economic challenges.

Comments on Biden State of the Union: Business Tax Hikes, Middle Class Tax Cuts, Lower Deficits