Clarence Thomas SCOTUS Opinion Unregulating Bump Stocks Make

Supreme Court Justice Clarence Thomas strikes down regulations on bump stocks, facing scrutiny for ethics and ties to political donor.

In a controversial move, U.S. Supreme Court Justice Clarence Thomas, who is currently under scrutiny for alleged ethical violations, authored a majority opinion striking down regulations on bump stocks, a gun mechanism that allows a semiautomatic rifle to shoot bullets more rapidly. The case, Garland v. Cargill, focused on the legality of bump stocks following a mass shooting in Las Vegas in 2017. Thomas argued that using a bump stock does not fundamentally change the mechanics of firing a gun, as the trigger still needs to be released and reengaged for each shot. He further contended that the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) overstepped its authority by classifying bump stocks as "machineguns."

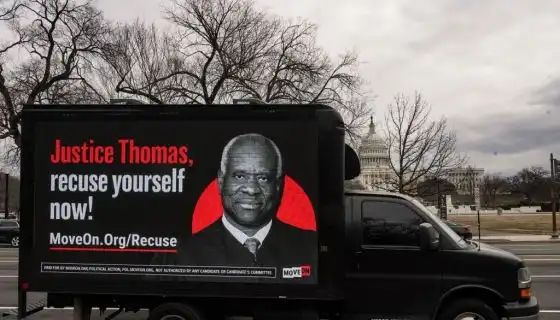

Justice Sonia Sotomayor dissented, pointing to the Las Vegas shooting as evidence of the destructive power of bump stocks. The fact that Thomas, who has faced accusations of corruption and bribery, wrote the majority opinion on a topic favored by Republicans raises concerns about his impartiality. Thomas has come under fire for accepting gifts from conservative billionaire Harlan Crow, leading to questions about the influence of these gifts on his judicial decisions. Critics argue that Thomas' wife, Ginni Thomas, also benefited from Crow's gifts and may have played a role in efforts to overturn the 2020 election.

The controversy surrounding Thomas and his connections to Crow and his wife's involvement in the events leading up to the Capitol insurrection raise questions about the integrity of his Supreme Court decisions. Despite these concerns, Thomas maintains that bump stocks should remain unregulated until Congress passes legislation to address them. The intersection of politics, ethics, and the law in Thomas' decisions highlights the complexities of the American justice system.

Comments on Clarence Thomas SCOTUS Opinion Unregulating Bump Stocks Make