BuzzFeed Expands ATM Program to $150 Million Amid Revenue Dip

BuzzFeed expands stock offering to $150 million, projects revenue decline. Stock volatility and debt burden raise concerns for investors.

7939 NW 21st St

Miami, Florida

BuzzFeed expands stock offering to $150 million, projects revenue decline. Stock volatility and debt burden raise concerns for investors.

Discover the top 10 consumer cyclical stocks to buy now, including Tesla. Learn how to maximize returns in economic cycles.

Chewy shares surge then drop as Keith Gill reveals big stake, making him third-largest shareholder. Meme stock frenzy continues.

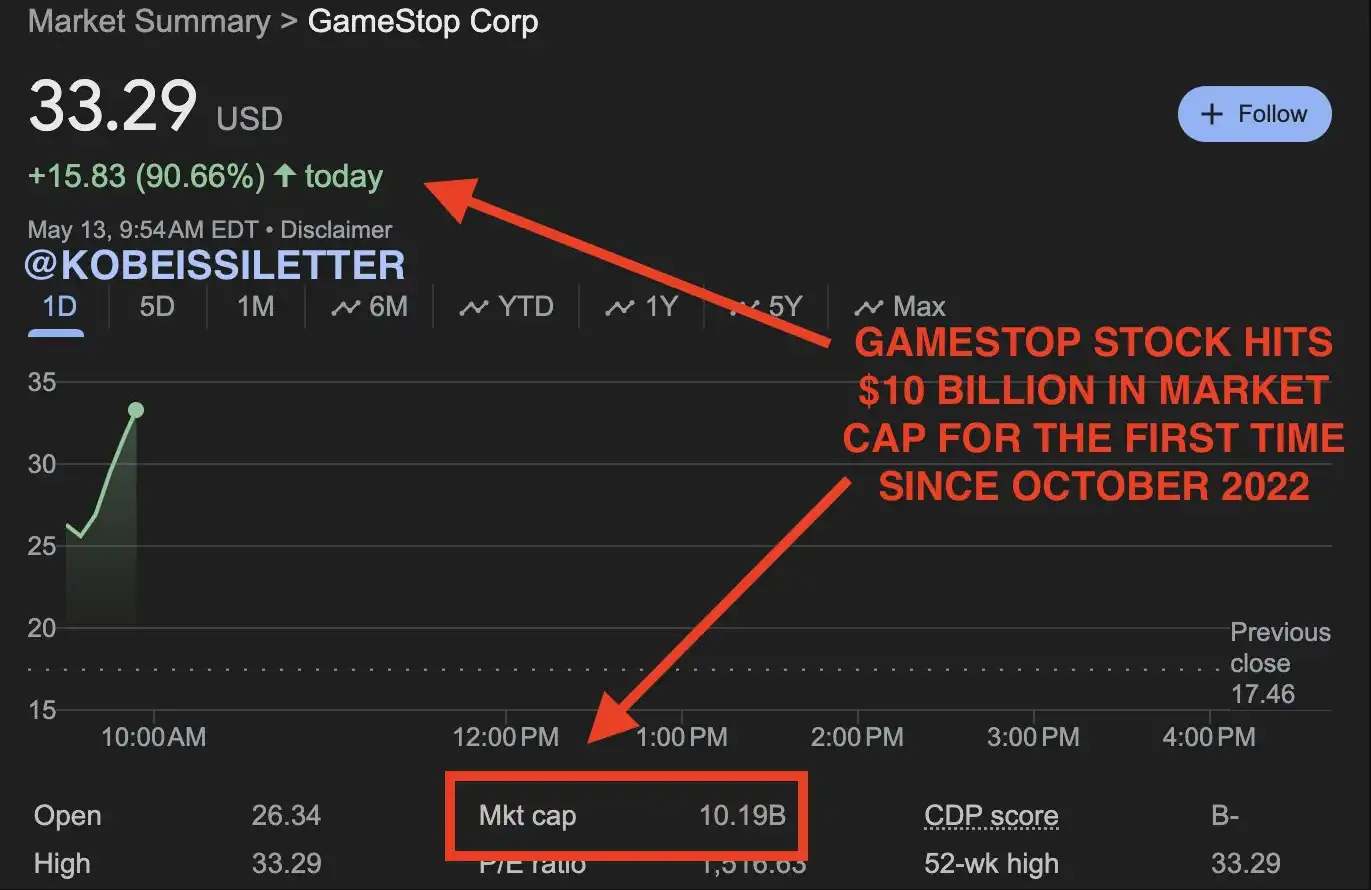

GameStop reports disappointing earnings, plans to sell more stock. Roaring Kitty's livestream aims to boost GME shares amid volatility.

NYSE glitch halts trading in 40 stocks, shows 99% drop in Berkshire Hathaway shares. Reversed trades, reviewing stops. Market adjusts to T+1 settlement.

Megacap stocks Apple, Meta, and Alphabet saw gains as Nvidia surged. GameStop soared due to Reddit influence. Market influenced by economic data.

NYSE glitch causes massive swings in Berkshire Hathaway and Barrick Gold shares, trading halts in dozens of companies before issue fixed.

Stifel lowers Tellurian price target to $0.25, maintains sell rating after deal to sell Haynesville assets for $260 million.

Dogecoin (DOGE) surges with whale transactions, Shiba Inu (SHIB) faces crucial moment, Furrever Token (FURR) charms investors with unique offerings.

Consumer prices rose less than expected in April, giving shoppers relief. President Biden vows to fight inflation and lower costs.

GameStop stock surges 118% in premarket trading, fueled by "Roaring Kitty" and meme stock rally. AMC also sees significant gains.

GameStop and AMC stocks surge, reigniting meme stock frenzy of 2021. Retail investors scramble to understand the resurgence. Approach with caution.

Inflation remains high despite avoiding recession post-pandemic. Experts predict gradual decrease in prices, uncertainty over interest rate cuts in 2024.

Bitcoin aims for $70,000 as bullish trend continues. Shiba Inu surges, XRP eyes $0.64 resistance for potential bullish phase.

Asian markets fell as US stock indexes closed in the red ahead of key inflation data. Indian GDP data to be released.

Palo Alto Networks' fair value is 18% higher than its analyst price target, suggesting it may be undervalued. Check out the analysis!

Top meme coins like DOGE, SHIB, and BONK are set for a bull run, signaling potential breakout opportunities and sharp jumps.

BTC seeks new highs, altcoins recover. What will SOL, ADA, AVAX, and DOGE be worth in a new surge? Predictions included.

Palantir's stock soars 28.5% after strong Q4 results, highlighting growing demand for AI platform. Revenue, billings, and free cash flow exceed expectations.

Hippo completes 2024 reinsurance renewal, retains more risk, and expands excess-of-loss protection, showing growing confidence in profitability and predictability.

Netflix's stock surged 7.9% after beating revenue expectations and strong user growth. Analysts are bullish, but is it a buy?

NVIDIA Corp (NVDA) stock price rose 6.43% to $495.12. Annual sales grew by 25.63% and 267.13% in earnings per share.

Bitcoin consolidates after a surge past $47,000 as US ETF approval looms. Market expects approval, with Bitcoin up 172% in 12 months.

Bitcoin reached a 20-month high of $42,000, signaling fading regulatory scrutiny and potential for a bitcoin exchange fund on the stock market.

Bitcoin price falls after US CPI data, but support at $36,000 could launch gains above $38,000 and $40,000, making it bullish.

Bitcoin mining companies have outperformed Bitcoin itself this year, with shares of publicly-traded firms surging over 100%. The rising value of Bitcoin and positive business developments have contributed to the profitability of these companies. Mining companies earn money by mining Bitcoin's next block, and as the value of Bitcoin rises, so does their profit. Additionally, mining companies have made strides in boosting their value proposition to investors through investments in new mining hardware and diversification into other services.

Tesla's stock drops after disappointing Q3 earnings, but temporary factors are impacting its bottom line. However, its dominant position and competitive advantages could lead to higher stock prices in the future.

Instacart's stock opened at $42 a share, 40% higher than anticipated, with a market valuation of roughly $13.9 billion.

Tesla, CVS Health, and Qualcomm were the top performers on the S&P 500, while Rtx Corp, JM Smucker Company, and Newell Brands were the worst performers. Rising stocks outnumbered declining ones on the NYSE and Nasdaq. Shares in Rtx Corp, JM Smucker Company, Walgreens Boots Alliance, Intel Corporation, Tenon Medical, Crinetics Pharmaceuticals, and Solowin Holdings either reached 52-week lows or all-time lows. The CBOE Volatility Index was down, while gold futures and crude oil prices fluctuated.

IBEX Technologies' peers are trading at a higher premium to fair value, suggesting the company may be undervalued.

Bitcoin's price has declined due to Tether's decision to stop supporting USDT on the Bitcoin blockchain, potentially impacting market volatility and deterring businesses from accepting Bitcoin. Elon Musk's sale of BTC holdings is also a contributing factor.

Bitcoin's price fell by nearly 8% in an hour of frenzied trading, erasing most of its gains since June. The sell-off coincided with news that Elon Musk's SpaceX had written down the value of its bitcoin holdings by $373mn and sold the cryptocurrency. The volatility comes as US regulators crack down on the sector and as expectations of interest rate cuts by the Federal Reserve are reassessed.

Inflation has led to an increase in mortgage rates, with the Federal Reserve raising its federal funds rate. Experts predict rates will remain high.

Global shares and the dollar rise after US consumer price inflation moderates, boosting hopes of the Fed's rate-hiking cycle nearing its end.

WeWork's potential failure poses a significant threat to the US commercial real estate sector, with experts warning of a "systematic shock."

U.S. stocks rise as inflation eases, tech sector leads gains.

Delving into the Volatility Rollercoaster in Finance

Ever felt the intense rush from a roller coaster's sudden drops and dramatic ascents? Now, imagine that thrill - or perhaps dread for some - transplanted to your finances. That, my dear reader, is what we label as volatility.

In finance-speak, volatility measures fluctuations in price value of various assets - stocks, commodities or foreign exchange markets.

We've all seen financial headlines screaming about massive market movements. Remember those mornings with your hot brew witnessing Wall Street having an absolute meltdown? Perhaps you've even had nail-biting suspense witnessing currency prices skyrocketing overnight. This unpredictability, my friends are classic examples of financial volatility.

The news under this topic often entails complex algorithms—sounds scary right? But let me simplify it; these mathematical predictions help us brace ourselves for impending storms in the economic seascape.

You might wonder why so much emphasis on this one little word: 'Volatilty'. Isn't investing all about risks and rewards anyway?

Surely it is! But here's an analogy to chew on. Suppose your shiny new car didn't come with brakes; wouldn’t that ride be perilously unpredictable (and not precisely in an adrenaline-pumping way)? Similarly understanding volatility helps put brakes on our exposure to risk. It allows us buckle up before embarking upon rickety rides within fluctuating financial markets.

A glance at the ‘volatility-related’ news equips investors with forecasts akin to weather updates ahead of a stormy season – insights which could make all difference between capsizing & cruising through their financial voyages!

So next time when someone asks you "What’s brewing in finance?” You'd know exactly where to look! Turn towards 'volatility', ladies and gentlemen — the pulsating heartbeat nested amidst the labyrinthian murmurs echoing down Wall-Street corridors!