Nvidia stock splits, gains Washington Examiner

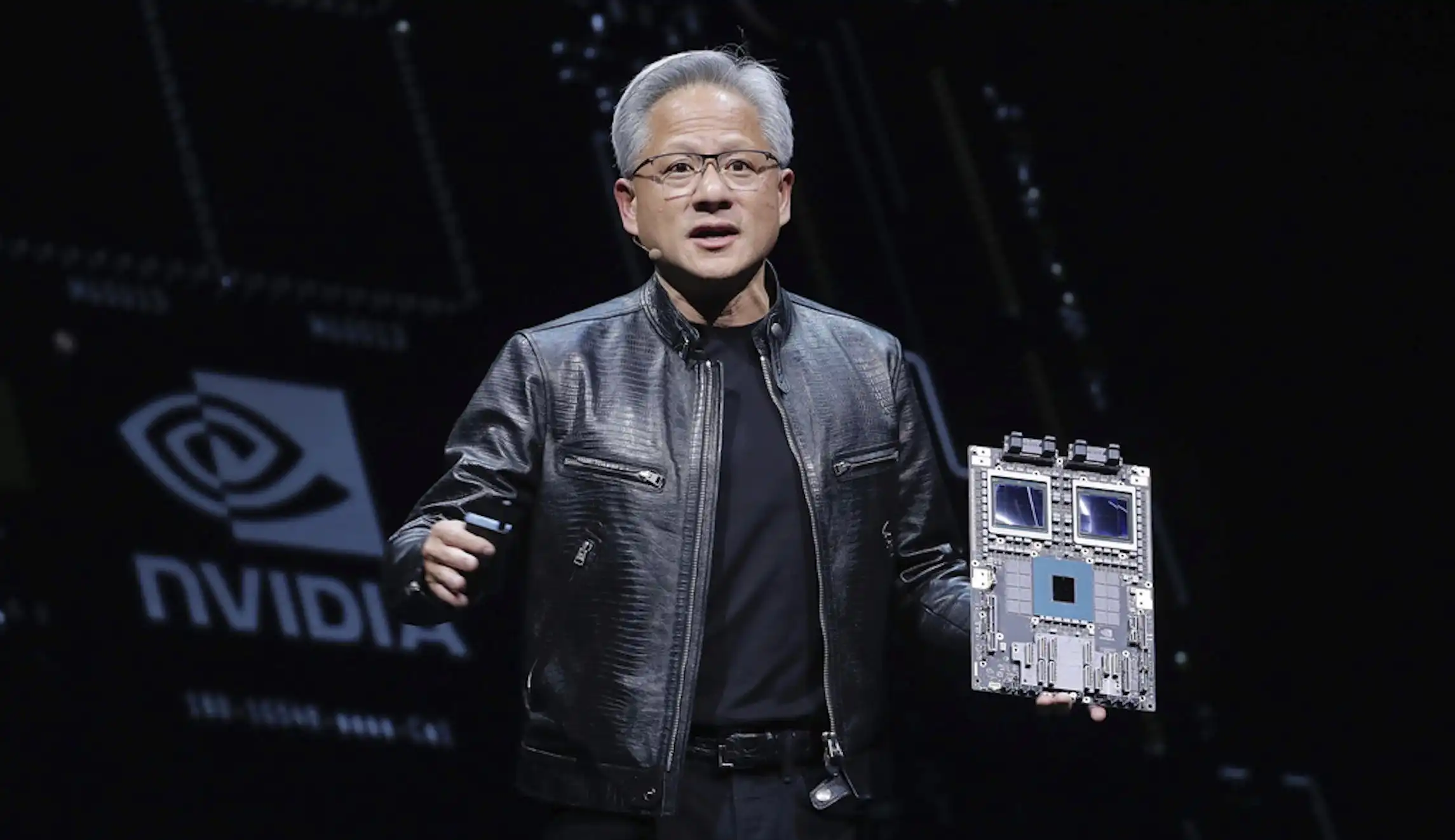

Nvidia stock split boosts accessibility for retail investors, reflecting CEO's confidence in company's continued expansion amid surging demand for chips.

7939 NW 21st St

Miami, Florida

Nvidia stock split boosts accessibility for retail investors, reflecting CEO's confidence in company's continued expansion amid surging demand for chips.

Nvidia's stock price keeps rising, up 174% in a year. Analysts predict continued growth due to AI dominance and tech market position.

Dow Jones up 0.36%, S&P 500 up 0.15%, Nasdaq up 0.17%. Manufacturing data, job openings, and Treasury yields in focus.

NYSE glitch halts trading in 40 stocks, shows 99% drop in Berkshire Hathaway shares. Reversed trades, reviewing stops. Market adjusts to T+1 settlement.

Nvidia's stock has more than doubled this year, becoming the third most valuable company in the S&P 500. Eye-popping growth!

Megacap stocks Apple, Meta, and Alphabet saw gains as Nvidia surged. GameStop soared due to Reddit influence. Market influenced by economic data.

NVIDIA's stock split may start a trend among high-value tech companies, including Microsoft and Meta Platforms, identified as potential candidates.

Stock indices in the US closed lower, but Nvidia's strong earnings boosted the market. Global markets struggled amid inflation concerns.

NVIDIA's record revenue growth and AI dominance propel stock price surge, making it a key player in tech industry.

Wall Street cautious ahead of Fed meeting and Nvidia earnings. Nasdaq up, small caps down. Solar and clean energy industries surge.

Vistra Corp. surges on S&P 500 debut, Arista Networks beats forecasts, Uber Technologies posts unexpected losses, Match Group revenue guidance disappoints.

Fed calms market fears as stocks rise after policy meeting. Interest rates steady, Powell says rate hike unlikely. Inflation remains high.

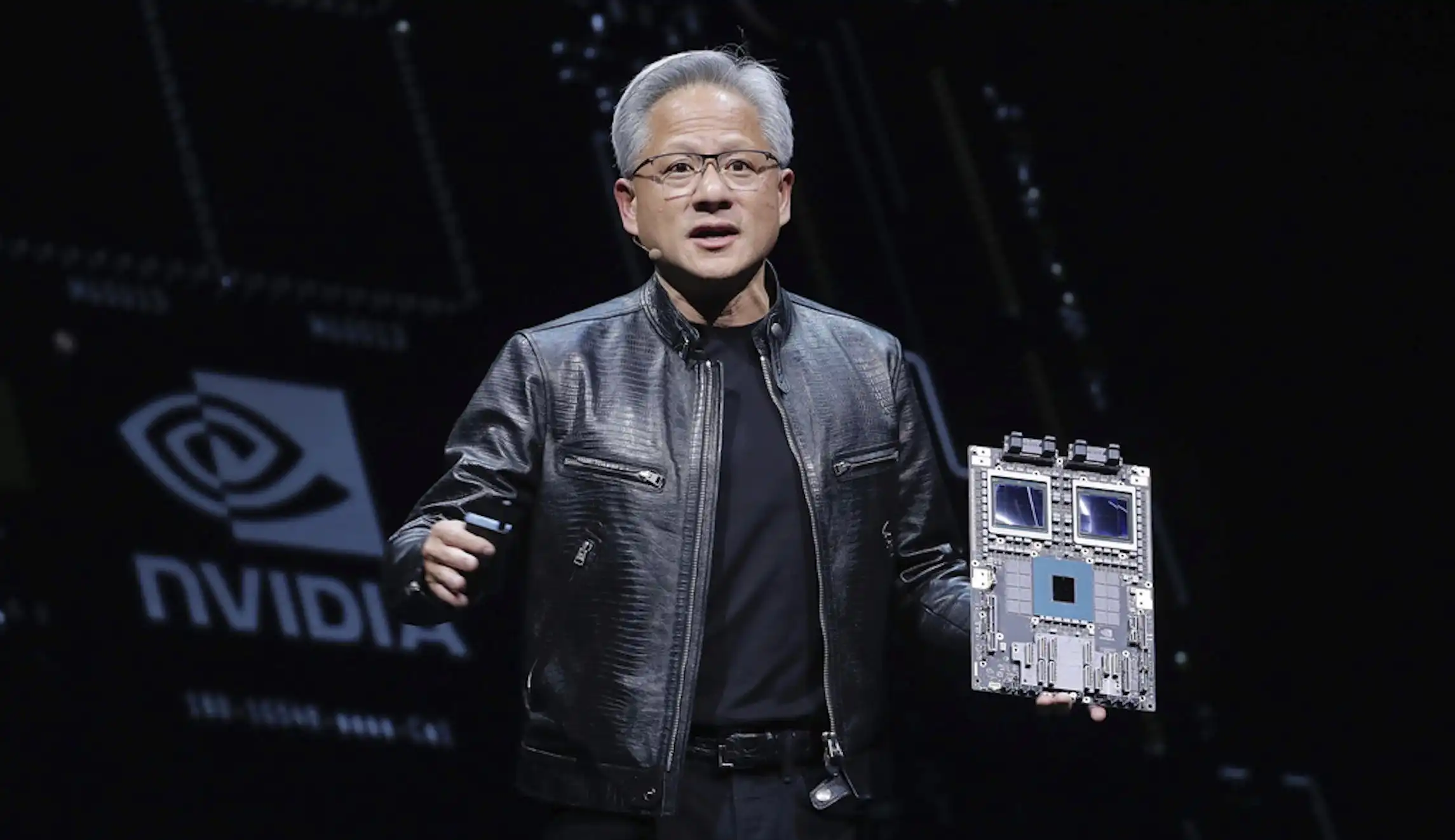

Discover why Advanced Micro Devices (NASDAQ: AMD) stock dropped post-earnings and if it's the right time to invest. Watch now!

SoFi's Q1 earnings report exceeded expectations, surprising investors. Find out why this stock is worth considering for future gains.

Stocks showed strength with Nasdaq, Dow, and S&P 500 gains. Google and Microsoft boosted market after positive earnings. Snap and Skechers surged.

US stocks fell on Monday due to concerns over Israel-Iran conflict escalation. Retail sales surged, but Treasury yield hit highest level of 2024.

Dow drops as Treasury yields spike, retail sales beat expectations. Goldman Sachs shines, Apple falls, Tesla faces layoffs. Geopolitical tensions rise.

Wells Fargo estimates Costco's gold bar sales at $100-200 million/month. Gold prices up 13% this year. Silver coins also available online.

Asian markets fell as US stock indexes closed in the red ahead of key inflation data. Indian GDP data to be released.

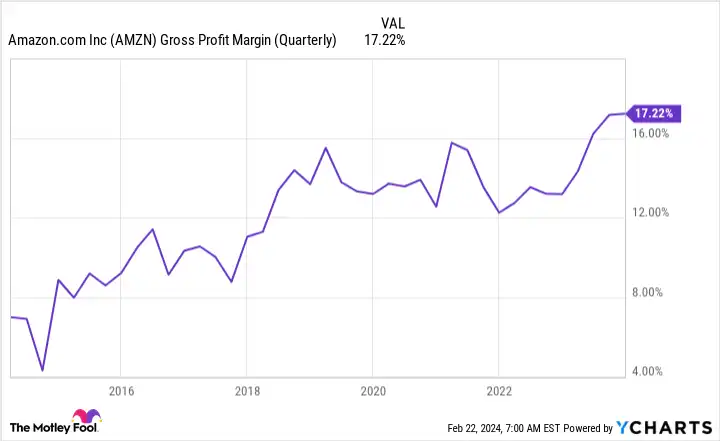

"Amazon (NASDAQ: AMZN) is one of the best buys available with strong 2024 performance. Here are 5 reasons why."

Investors shift focus to tech sector as big tech companies pressure stock market, Nasdaq Composite drops 1%, concerns over Nvidia's earnings.

Stocks fall sharply on disappointing inflation data, raising fears of longer high interest rates. Nearly 90% of S&P 500 stocks fell.

Bitcoin mining stocks were once a sure investment, but with the rise of new ventures like Ocean, things could change.

Meta Platforms, Inc. stock surged >20% after announcing a tripling in Q4 profit and its inaugural dividend. It's a long-term 'Buy'.

Market activity surged today, with the Dow up +369 points and the S&P 500 +1.25%. Big earnings reports coming tomorrow.

"Amazon's fourth-quarter earnings report and new AI announcement show the stock's potential for profitability, despite its expensive appearance."

Walmart's decision to split its stock has sparked a debate. High-profile tech companies have also split stocks, with positive results.

Tesla shares edged higher in early Monday trading after a Wall Street analyst cut his price target on the group.

S&P 500 lost 1.5% in the first trading week of 2024, ending a nine-week streak. Analysts expect rocky start to 2024.

"Breaking: U.S. jobs market adds 216,000 jobs, unemployment rate holds steady at 3.7%. Stocks close losing week. Subscribe to CNBC Daily Open!"

Wall Street is rising after a big rally as investors hope for several interest rate cuts coming next year.

World equity markets end November with biggest monthly rally in three years. Optimism for 2024 challenged by declining liquidity and inflation.

"Stock futures slip ahead of economic data, but Wall Street hopes for rate cuts. U.S. markets back to 12-month highs."

Hedge funds are exiting their short positions at a rapid pace, signaling a potential market resurgence and a rebalancing of US dollar longs.

Global equities rise and Treasury yields rebound as hopes of interest rate cuts fade, but uncertainty remains over growth and inflation.

Markets rally for a second day, with weekly totals up on the Dow and Nasdaq. Apple's earnings disappoint.

Meta (META) beats earnings expectations in Q3, with advertising revenue of $33.64 billion and a 31% increase in ad impressions. Shares rise 4% in after-hours trading.

The tech sector has made a remarkable comeback in 2023, driven by the AI industry surge and the performance of top tech companies like Nvidia, Meta Platforms, and Alphabet. Despite adverse external factors, the US stock market has shown resilience, indicating a promising signal for the Q4 stock market rally. Google's stock has reached a new 52-week high and faces resistance at $143.65.

Wall Street experienced a sharp decline as U.S. interest rates are expected to remain high, causing stocks to fall worldwide.

Wall Street indexes gain as data suggests the Federal Reserve may keep interest rates unchanged in September.

Tesla, CVS Health, and Qualcomm were the top performers on the S&P 500, while Rtx Corp, JM Smucker Company, and Newell Brands were the worst performers. Rising stocks outnumbered declining ones on the NYSE and Nasdaq. Shares in Rtx Corp, JM Smucker Company, Walgreens Boots Alliance, Intel Corporation, Tenon Medical, Crinetics Pharmaceuticals, and Solowin Holdings either reached 52-week lows or all-time lows. The CBOE Volatility Index was down, while gold futures and crude oil prices fluctuated.

Global shares and the dollar rise after US consumer price inflation moderates, boosting hopes of the Fed's rate-hiking cycle nearing its end.

Rivian's stock drops despite better-than-expected quarterly results, analysts cautious about the company's future and stock direction.

Amazon's shares surged nearly 8% after the company reported a net profit of $6.7 billion in Q2, compared to a loss of $2 billion last year. The company's revenue increased 11% to $134.4 billion.

US stocks slumped as Fitch Ratings downgraded the credit rating of the US government, causing European equities to tumble as well.

AMD shares surge after Q2 results beat Wall Street estimates. Data-center revenue and PC sales slightly below expectations.

ECB expected to raise rates as Fed raises interest rates.

Facebook's parent company Meta sees strong earnings, stock up 7%.

Wall Street sees gains, but mixed results from Netflix and Tesla.

Shares of Carvana surge as online used car seller beats expectations.

Ever wondered what makes the financial world tick? Let's dip our toes into the intriguing landscape of economic indices, primarily focusing on a star player - S&P 500 Index.

"What even is that?", you might ask. Well, it's one of the most important barometers for gauging the health and trends of large-cap U.S. equities.

When tuning into news under this topic, one can expect to be greeted by data about a range of interesting subjects. First off, there will be updates on its overall performance or "score." These numerical markers convey how well (or poorly) companies listed within this index are faring.

You know when your sport team scores a point and changes its ranking? The market functions similarly; impressive company performance gives rise to an increase in stock prices thus increasing their score too!

In addition to performance markers, we often stumble upon pieces relating to additions or deletions from this list – much like musical chairs! Companies must meet specific criteria in terms of size, liquidity and industry representation for them swaying around in this powerful dance music.

Besides these observable activities happening directly within S&P 500’s realm, external factors can also impact it significantly: Hot talk button topics ranging from political decisions affecting nuclear energy industries to rising coffee bean prices impacting Starbucks’ shares could all make comebacks while scrolling through news items tagged under ‘S&P 500.’

All sounds quite energetic and lively right? Just remember dear reader that following developments related stately standing giants like S&P doesn’t merely serve as trivia fodder - clinging closely onto every update may greatly inform your understanding about global economy’s pulse which makes being financially savvy truly within reach!